Xiangxing International Holding Limited's (HKG:1732) Share Price Boosted 52% But Its Business Prospects Need A Lift Too

Xiangxing International Holding Limited (HKG:1732) shares have had a really impressive month, gaining 52% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 35% over that time.

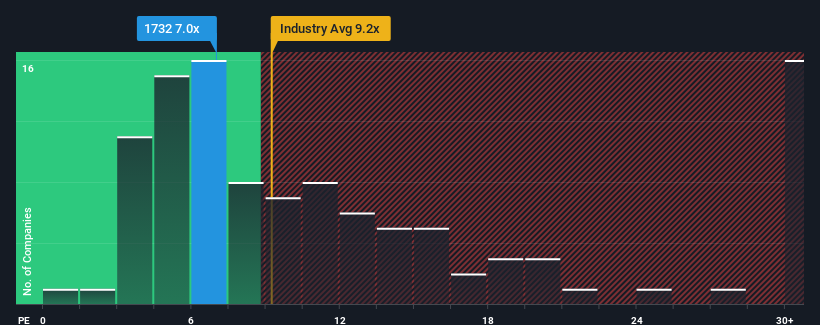

Although its price has surged higher, Xiangxing International Holding's price-to-earnings (or "P/E") ratio of 7x might still make it look like a buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 11x and even P/E's above 21x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's exceedingly strong of late, Xiangxing International Holding has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Xiangxing International Holding

How Is Xiangxing International Holding's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Xiangxing International Holding's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 245% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 37% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 21% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that Xiangxing International Holding's P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Xiangxing International Holding's P/E?

The latest share price surge wasn't enough to lift Xiangxing International Holding's P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Xiangxing International Holding revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Xiangxing International Holding (2 are potentially serious!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Xiangxing International Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English