Lucid Group (LCID) Advances Tech Roadmap With Major DreamDrive Pro ADAS Update

Lucid Group (LCID) recently announced significant updates to its DreamDrive Pro system, showcasing its commitment to advancing its autonomous driving capabilities. During the past month, Lucid's stock price rose by 8% amid these announcements. This upward movement comes as the company unveiled enhancements like hands-free drive and lane change assist features, which were received positively by the market. Meanwhile, broader market trends showed mixed performance; the Nasdaq rose slightly while other major indexes remained flat. Lucid’s product enhancements likely supported the stock's gain, countering the market's overall stagnation during this period.

Lucid Group's recent advancements with their DreamDrive Pro system could further cement their position in the electric vehicle market, especially with their strategic push into autonomous features like hands-free driving and lane change assist. Over the longer term, however, the company's shares have faced challenges, with a total return decline of 37.12% over the past year. Over this time, Lucid underperformed compared to the US Auto industry, which had a return of 18.5% over one year, and the broader US market with an 11.4% return during the same period.

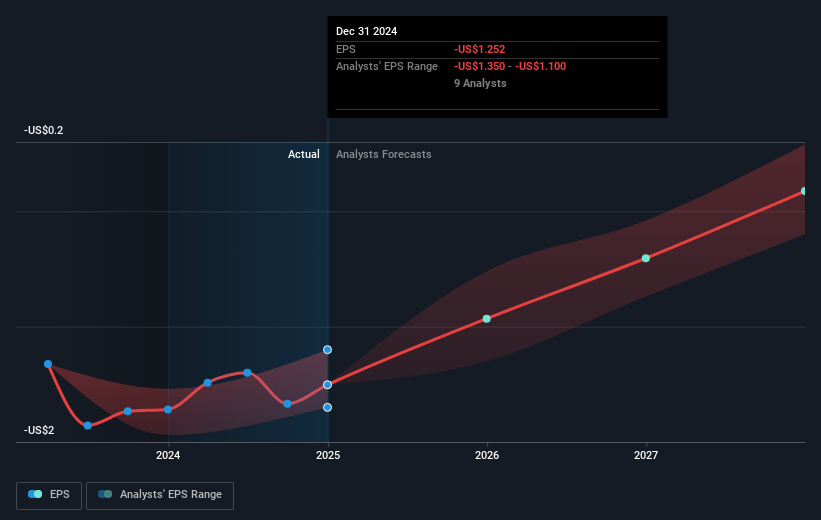

The reception of these technological enhancements might positively influence Lucid’s revenue and earnings projections. Yet, analysts maintain that the company will remain unprofitable for the next three years, despite forecasting significant revenue growth. The current share price of US$2.27 positions it just above the analyst consensus price target of US$2.53, reflecting a close alignment with market expectations. This suggests that any upward revisions to earnings forecasts from these advancements may be necessary to support longer-term price appreciation and to achieve or exceed the price target.

Dive into the specifics of Lucid Group here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English