The Market Lifts Xiangxing International Holding Limited (HKG:1732) Shares 44% But It Can Do More

The Xiangxing International Holding Limited (HKG:1732) share price has done very well over the last month, posting an excellent gain of 44%. Taking a wider view, although not as strong as the last month, the full year gain of 24% is also fairly reasonable.

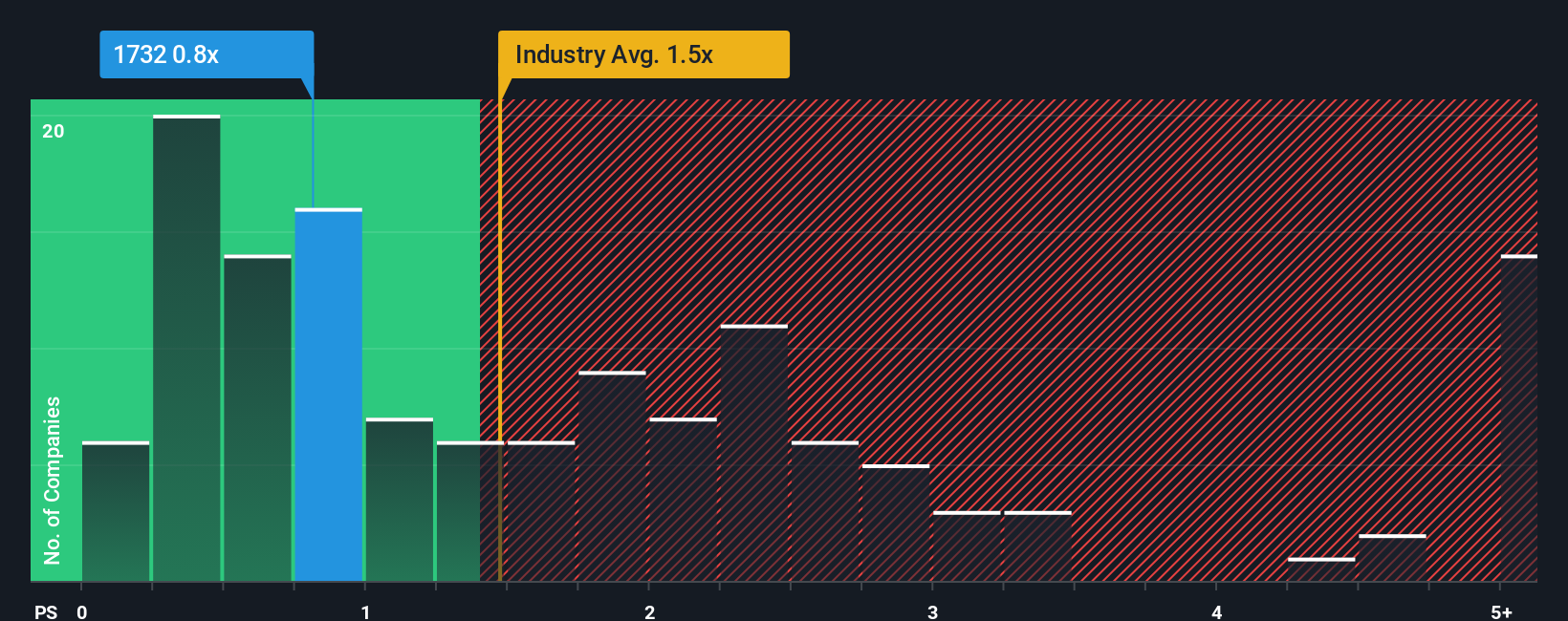

Although its price has surged higher, you could still be forgiven for feeling indifferent about Xiangxing International Holding's P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Shipping industry in Hong Kong is also close to 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Xiangxing International Holding

How Xiangxing International Holding Has Been Performing

Recent times have been quite advantageous for Xiangxing International Holding as its revenue has been rising very briskly. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Xiangxing International Holding's earnings, revenue and cash flow.How Is Xiangxing International Holding's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Xiangxing International Holding's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 33% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 19% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for a contraction of 9.3% shows the industry is even less attractive on an annualised basis.

With this information, it's perhaps curious but not a major surprise that Xiangxing International Holding is trading at a fairly similar P/S in comparison. There's no guarantee the P/S has found a floor yet with recent revenue going backwards, despite the industry heading down even harder. It's conceivable that the P/S falls to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Final Word

Its shares have lifted substantially and now Xiangxing International Holding's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Xiangxing International Holding currently trades on a slightly lower than expected P/S if you consider its recent three-year revenues aren't as bad as the forecasts for a struggling industry. The fact that the company's P/S is on par with the industry despite the fact that it outperformed it could be an indication of some unobserved threats to future revenues. One major risk is whether the company can prevent revenue performance from slipping further into decline under these tough industry conditions. It appears some are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Xiangxing International Holding (1 is a bit unpleasant!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English