Shareholders Will Likely Find Eminence Enterprise Limited's (HKG:616) CEO Compensation Acceptable

Key Insights

- Eminence Enterprise's Annual General Meeting to take place on 21st of August

- Total pay for CEO Law Kau Lai includes HK$480.0k salary

- The overall pay is 69% below the industry average

- Eminence Enterprise's EPS declined by 90% over the past three years while total shareholder loss over the past three years was 98%

Performance at Eminence Enterprise Limited (HKG:616) has been rather uninspiring recently and shareholders may be wondering how CEO Law Kau Lai plans to fix this. At the next AGM coming up on 21st of August, they can influence managerial decision making through voting on resolutions, including executive remuneration. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We think CEO compensation looks appropriate given the data we have put together.

Check out our latest analysis for Eminence Enterprise

Comparing Eminence Enterprise Limited's CEO Compensation With The Industry

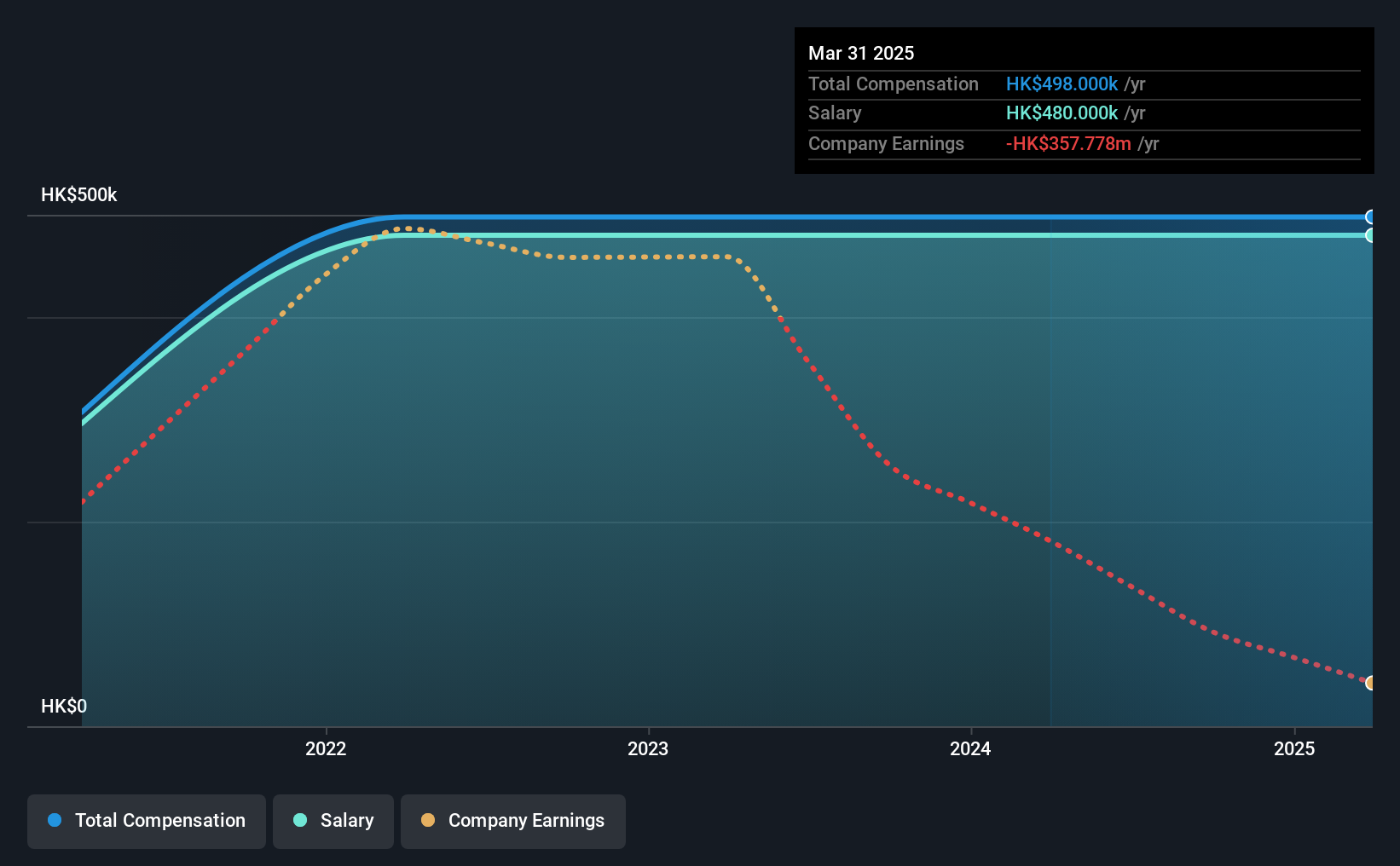

Our data indicates that Eminence Enterprise Limited has a market capitalization of HK$74m, and total annual CEO compensation was reported as HK$498k for the year to March 2025. This was the same as last year. We note that the salary portion, which stands at HK$480.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the Hong Kong Real Estate industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$1.6m. In other words, Eminence Enterprise pays its CEO lower than the industry median.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | HK$480k | HK$480k | 96% |

| Other | HK$18k | HK$18k | 4% |

| Total Compensation | HK$498k | HK$498k | 100% |

Talking in terms of the industry, salary represented approximately 84% of total compensation out of all the companies we analyzed, while other remuneration made up 16% of the pie. Eminence Enterprise has gone down a largely traditional route, paying Law Kau Lai a high salary, giving it preference over non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Eminence Enterprise Limited's Growth

Over the last three years, Eminence Enterprise Limited has shrunk its earnings per share by 90% per year. In the last year, its revenue is up 47%.

Investors would be a bit wary of companies that have lower EPS But in contrast the revenue growth is strong, suggesting future potential for EPS growth. It's hard to reach a conclusion about business performance right now. This may be one to watch. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Eminence Enterprise Limited Been A Good Investment?

The return of -98% over three years would not have pleased Eminence Enterprise Limited shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Law Kau receives almost all of their compensation through a salary. The fact that shareholders are sitting on a loss is certainly disheartening. The downward trend in share price performance may be attributable to the the fact that earnings growth has gone backwards. In the upcoming AGM, shareholders will get the opportunity to discuss these concerns with the board and assess if the board's plan is likely to improve company performance.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 5 warning signs for Eminence Enterprise (4 make us uncomfortable!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English