Undiscovered Gems In Hong Kong To Watch August 2024

As global markets react to anticipated interest rate cuts by the Federal Reserve, small-cap stocks have been outperforming their larger counterparts, with indices like the S&P 600 showing notable gains. Amid this favorable environment for smaller companies, Hong Kong's market presents intriguing opportunities for investors seeking undiscovered gems. In this context, identifying promising stocks involves looking at companies with solid fundamentals and growth potential that may benefit from current economic conditions and broader market sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.50% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| Chongqing Machinery & Electric | 28.07% | 8.82% | 11.12% | ★★★★★☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Xin Point Holdings (SEHK:1571)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xin Point Holdings Limited, an investment holding company, manufactures and sells automotive and electronic components in China, North America, Europe, and internationally with a market cap of HK$3.39 billion.

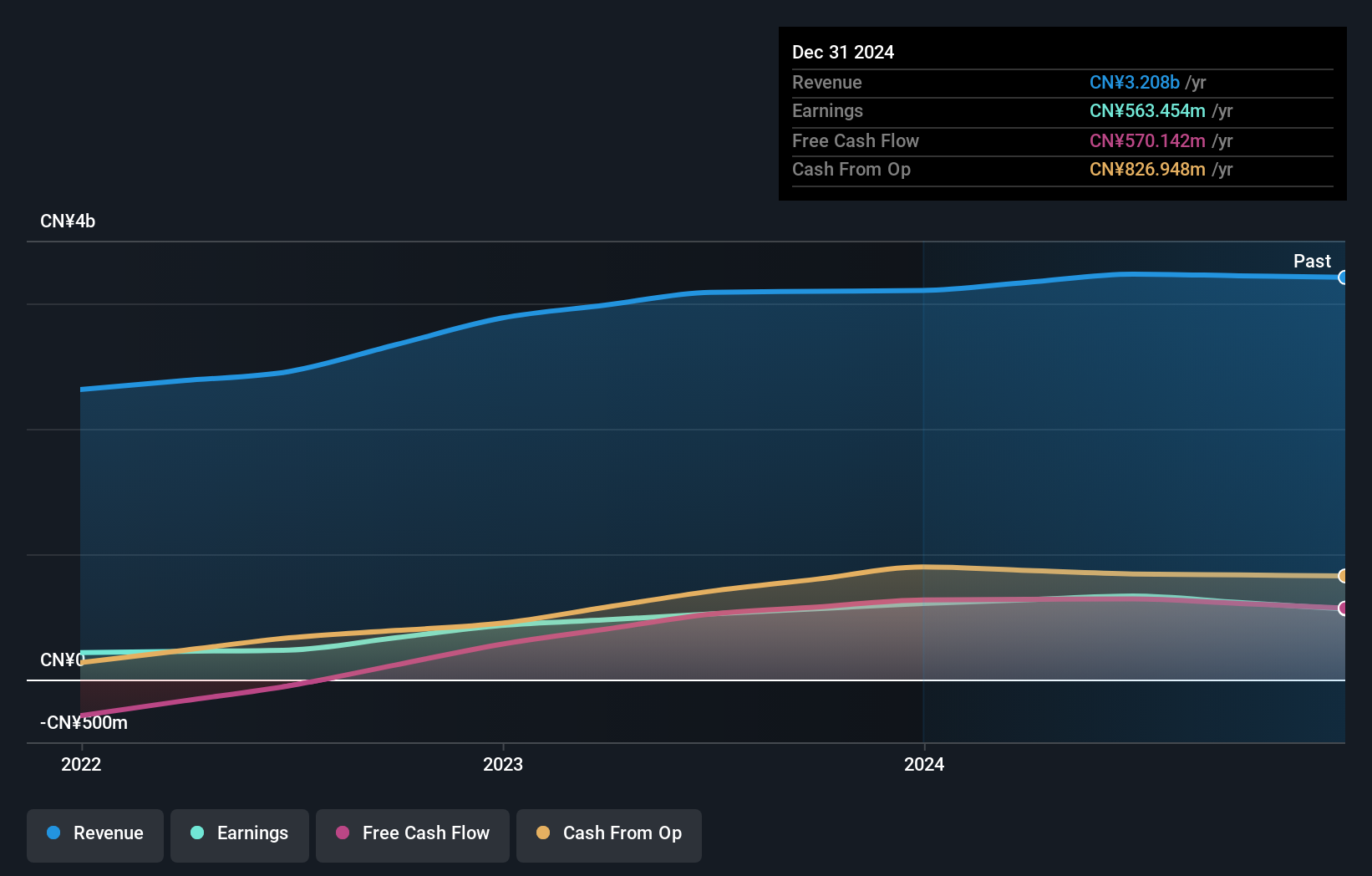

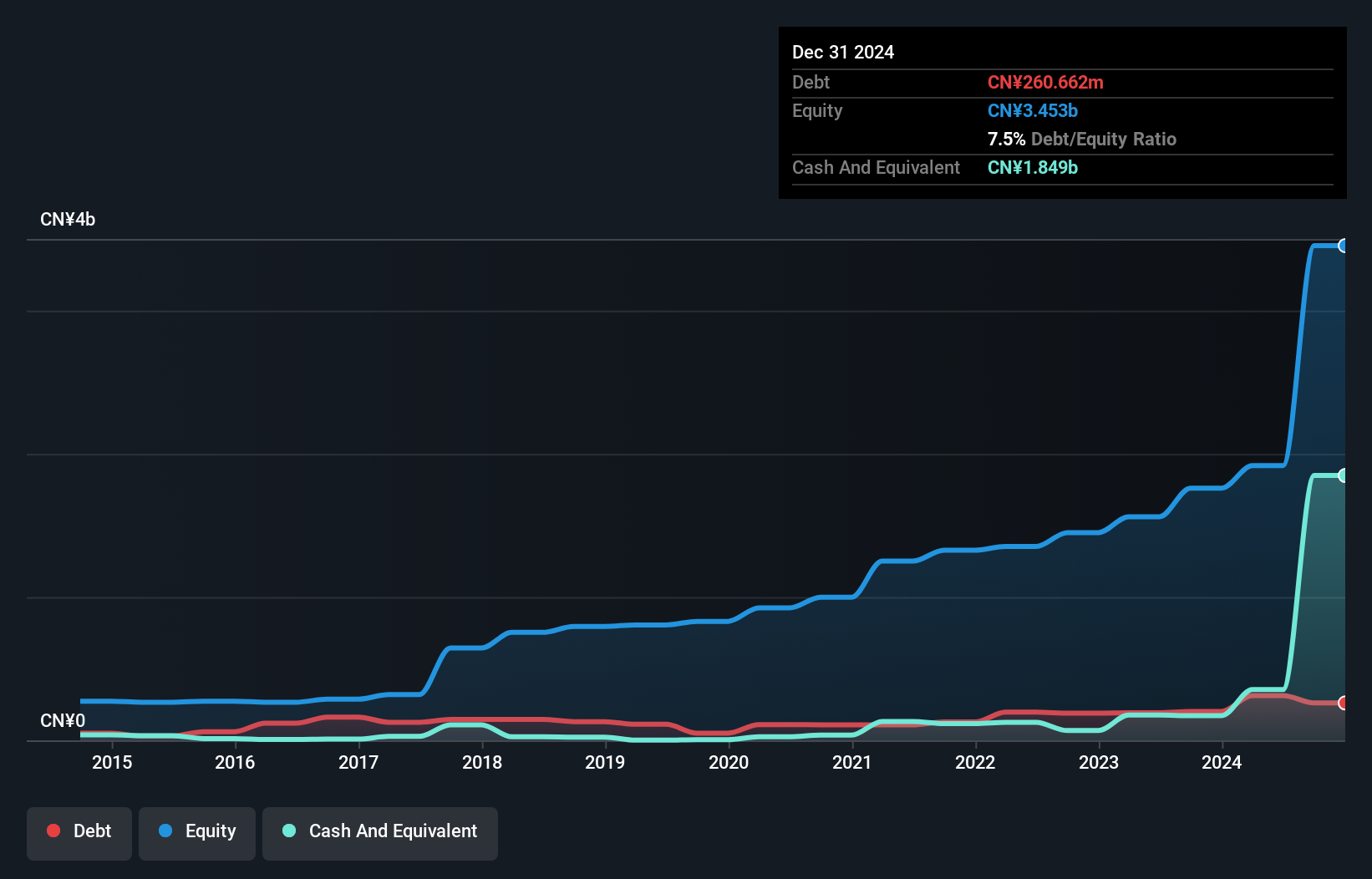

Operations: Xin Point Holdings generates revenue primarily from the manufacture and sale of automotive and electronic components, amounting to CN¥3.23 billion. The company operates internationally, including markets in China, North America, and Europe.

Xin Point Holdings, a small cap in the auto components sector, recently reported half-year sales of CNY 1.65 billion and net income of CNY 322.16 million, showing solid growth from last year’s figures. The company is trading at 75% below its estimated fair value and has been growing earnings faster than the industry at 27%. With a debt-to-equity ratio increase from 0.3 to 1.8 over five years, Xin Point still maintains high-quality earnings and positive free cash flow.

- Delve into the full analysis health report here for a deeper understanding of Xin Point Holdings.

Understand Xin Point Holdings' track record by examining our Past report.

Wanguo International Mining Group (SEHK:3939)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wanguo International Mining Group Limited is an investment holding company involved in mining, ore processing, and the sale of concentrate products in China and the Solomon Islands, with a market cap of HK$7.09 billion.

Operations: The company's revenue streams primarily come from the Yifeng Project (CN¥749.25 million) and the Solomon Project (CN¥912.63 million).

Wanguo Gold Group, previously Wanguo International Mining Group, has seen notable improvements in its financial performance. For the half-year ended June 2024, sales reached CNY 927.86 million from CNY 581.19 million a year ago, with net income rising to CNY 254.27 million from CNY 147.11 million. The company declared an interim dividend of HKD 0.12 per share and reported basic earnings per share of CNY 0.307 compared to last year's CNY 0.178, reflecting robust growth and shareholder returns.

COSCO SHIPPING International (Hong Kong) (SEHK:517)

Simply Wall St Value Rating: ★★★★★★

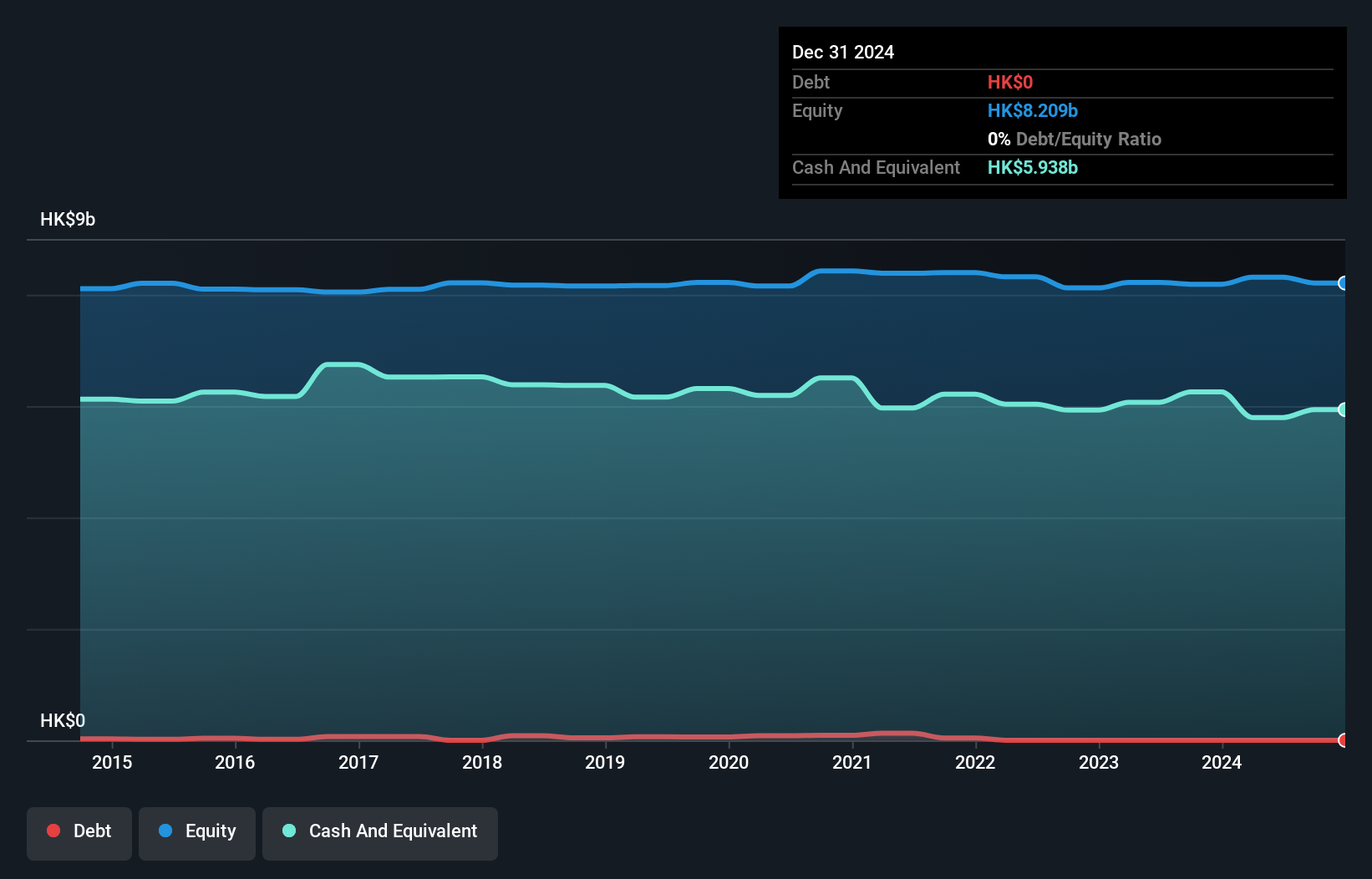

Overview: COSCO SHIPPING International (Hong Kong) Co., Ltd. is an investment holding company that provides shipping services in the People’s Republic of China and internationally, with a market cap of HK$6.39 billion.

Operations: The company's revenue streams primarily include Marine Equipment and Spare Parts (HK$1.73 billion), Coatings (HK$992.94 million), and Insurance Brokerage (HK$175.51 million). Ship Trading Agency contributes HK$99.97 million, while General Trading adds HK$478.19 million to the total revenue.

COSCO SHIPPING International (Hong Kong) has shown notable performance with earnings growth of 24.8% over the past year, outpacing the infrastructure industry’s 9.3%. The company reported sales of HK$1.75 billion for the first half of 2024, up from HK$1.62 billion a year ago, and net income rose to HK$388 million from HK$336 million. Additionally, it announced an interim dividend of HK$0.265 per share for the six months ended June 30, 2024, reflecting its robust financial health and shareholder-friendly approach.

Next Steps

- Dive into all 169 of the SEHK Undiscovered Gems With Strong Fundamentals we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English