AEON Credit Service (Asia) (HKG:900) Will Pay A Dividend Of HK$0.24

The board of AEON Credit Service (Asia) Company Limited (HKG:900) has announced that it will pay a dividend of HK$0.24 per share on the 31st of October. Based on this payment, the dividend yield will be 8.2%, which is fairly typical for the industry.

See our latest analysis for AEON Credit Service (Asia)

AEON Credit Service (Asia)'s Future Dividend Projections Appear Well Covered By Earnings

Solid dividend yields are great, but they only really help us if the payment is sustainable. Prior to this announcement, AEON Credit Service (Asia)'s earnings easily covered the dividend, but free cash flows were negative. In general, we consider cash flow to be more important than earnings, so we would be cautious about relying on the sustainability of this dividend.

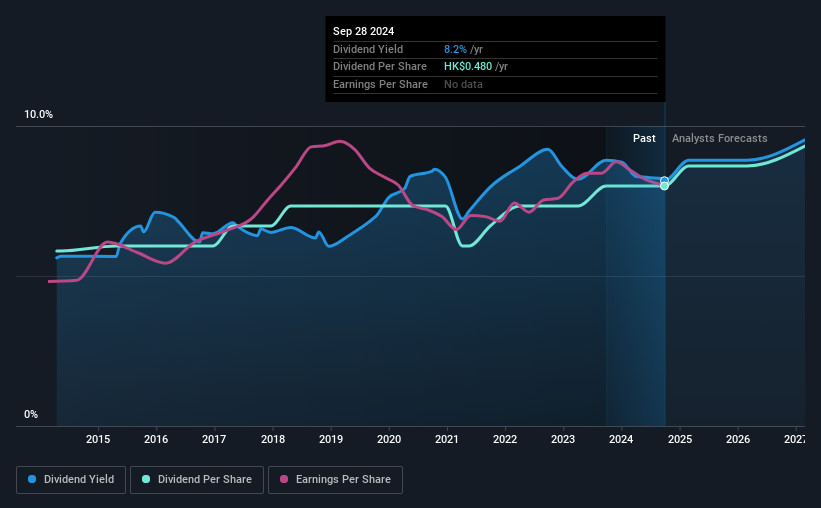

Looking forward, earnings per share is forecast to rise by 60.2% over the next year. Assuming the dividend continues along recent trends, we think the payout ratio could be 35% by next year, which is in a pretty sustainable range.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The annual payment during the last 10 years was HK$0.35 in 2014, and the most recent fiscal year payment was HK$0.48. This means that it has been growing its distributions at 3.2% per annum over that time. The dividend has seen some fluctuations in the past, so even though the dividend was raised this year, we should remember that it has been cut in the past.

AEON Credit Service (Asia) May Find It Hard To Grow The Dividend

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Unfortunately, AEON Credit Service (Asia)'s earnings per share has been essentially flat over the past five years, which means the dividend may not be increased each year.

AEON Credit Service (Asia)'s Dividend Doesn't Look Sustainable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. While AEON Credit Service (Asia) is earning enough to cover the payments, the cash flows are lacking. We would probably look elsewhere for an income investment.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, AEON Credit Service (Asia) has 2 warning signs (and 1 which can't be ignored) we think you should know about. Is AEON Credit Service (Asia) not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English