SmarTone Telecommunications Holdings (HKG:315) Has Announced A Dividend Of HK$0.175

The board of SmarTone Telecommunications Holdings Limited (HKG:315) has announced that it will pay a dividend of HK$0.175 per share on the 22nd of November. The dividend yield will be 7.4% based on this payment which is still above the industry average.

Check out our latest analysis for SmarTone Telecommunications Holdings

SmarTone Telecommunications Holdings' Projected Earnings Seem Likely To Cover Future Distributions

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Before this announcement, SmarTone Telecommunications Holdings was paying out 75% of earnings, but a comparatively small 26% of free cash flows. In general, cash flows are more important than earnings, so we are comfortable that the dividend will be sustainable going forward, especially with so much cash left over for reinvestment.

Over the next year, EPS is forecast to expand by 24.5%. If the dividend continues along recent trends, we estimate the payout ratio will be 57%, which would make us comfortable with the sustainability of the dividend, despite the levels currently being quite high.

Dividend Volatility

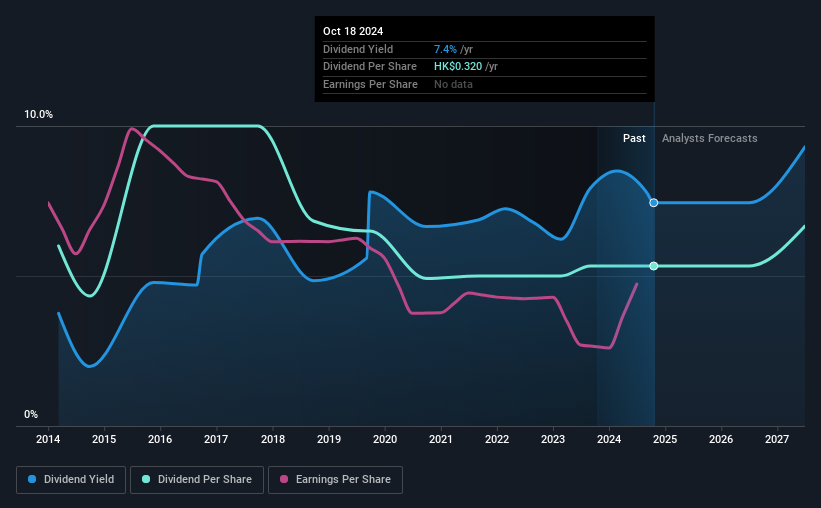

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2014, the dividend has gone from HK$0.36 total annually to HK$0.32. The dividend has shrunk at around 1.2% a year during that period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Dividend Growth May Be Hard To Come By

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. SmarTone Telecommunications Holdings has seen earnings per share falling at 5.4% per year over the last five years. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth. Earnings are predicted to grow over the next year, but we would remain cautious until a track record of earnings growth is established.

In Summary

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about SmarTone Telecommunications Holdings' payments, as there could be some issues with sustaining them into the future. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 2 warning signs for SmarTone Telecommunications Holdings you should be aware of, and 1 of them shouldn't be ignored. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English