Market Still Lacking Some Conviction On MV Oil Trust (NYSE:MVO)

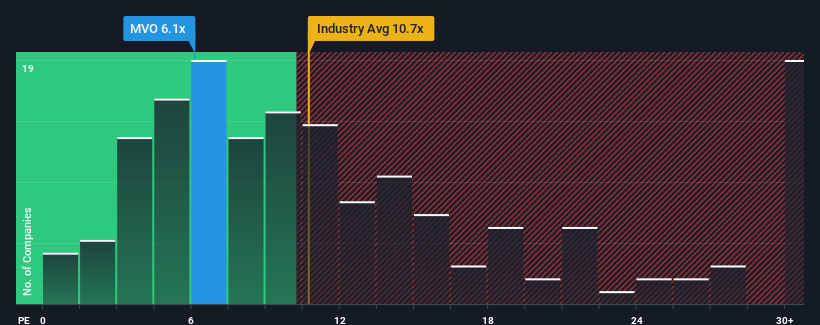

MV Oil Trust's (NYSE:MVO) price-to-earnings (or "P/E") ratio of 6.1x might make it look like a strong buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 19x and even P/E's above 35x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

As an illustration, earnings have deteriorated at MV Oil Trust over the last year, which is not ideal at all. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for MV Oil Trust

Is There Any Growth For MV Oil Trust?

In order to justify its P/E ratio, MV Oil Trust would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 30%. Even so, admirably EPS has lifted 261% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Comparing that to the market, which is only predicted to deliver 15% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it odd that MV Oil Trust is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that MV Oil Trust currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It is also worth noting that we have found 1 warning sign for MV Oil Trust that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English