China Tower (SEHK:788) Reports Strong Earnings Growth, Presents Compelling Investment Opportunity

China Tower (SEHK:788) recently reported a strong financial performance for the first nine months of 2024, with sales reaching CNY 72,452 million and net income climbing to CNY 8,153 million, reflecting its competitive edge in the telecom sector. Despite these gains, challenges such as a modest Return on Equity of 5.4% and high net debt to equity ratio persist. As the company navigates these hurdles, investors should watch for strategic developments, including recent board changes, which may influence future growth and governance.

See the full analysis report here for a deeper understanding of China Tower.

Competitive Advantages That Elevate China Tower

With earnings projected to grow at an impressive 24.21% annually, the company showcases strong financial health. The past year's earnings growth of 8.4% surpasses the telecom industry average, highlighting its competitive edge. The management's strategic acumen is evident in the improved net profit margin of 11%, up from 10.4% last year, and the absence of shareholder dilution further enhances investor confidence. Moreover, trading at HK$1.06, significantly below the SWS fair ratio of HK$3.19, suggests a potential undervaluation, offering an attractive entry point for investors.

To dive deeper into how China Tower's valuation metrics are shaping its market position, check out our detailed analysis of China Tower's Valuation.Internal Limitations Hindering China Tower's Growth

However, the company's Return on Equity stands at a modest 5.4%, falling short of the desired 20% benchmark. This is compounded by a forecasted revenue growth rate of 4.1% per year, lagging behind the Hong Kong market average of 7.7%. The volatility in dividend payments over the past six years raises concerns about income stability for investors. Additionally, the board's relatively short average tenure of 2.3 years may limit strategic continuity, while a high net debt to equity ratio of 41% poses financial constraints.

Learn about China Tower's dividend strategy and how it impacts shareholder returns and financial stability.Future Prospects for China Tower in the Market

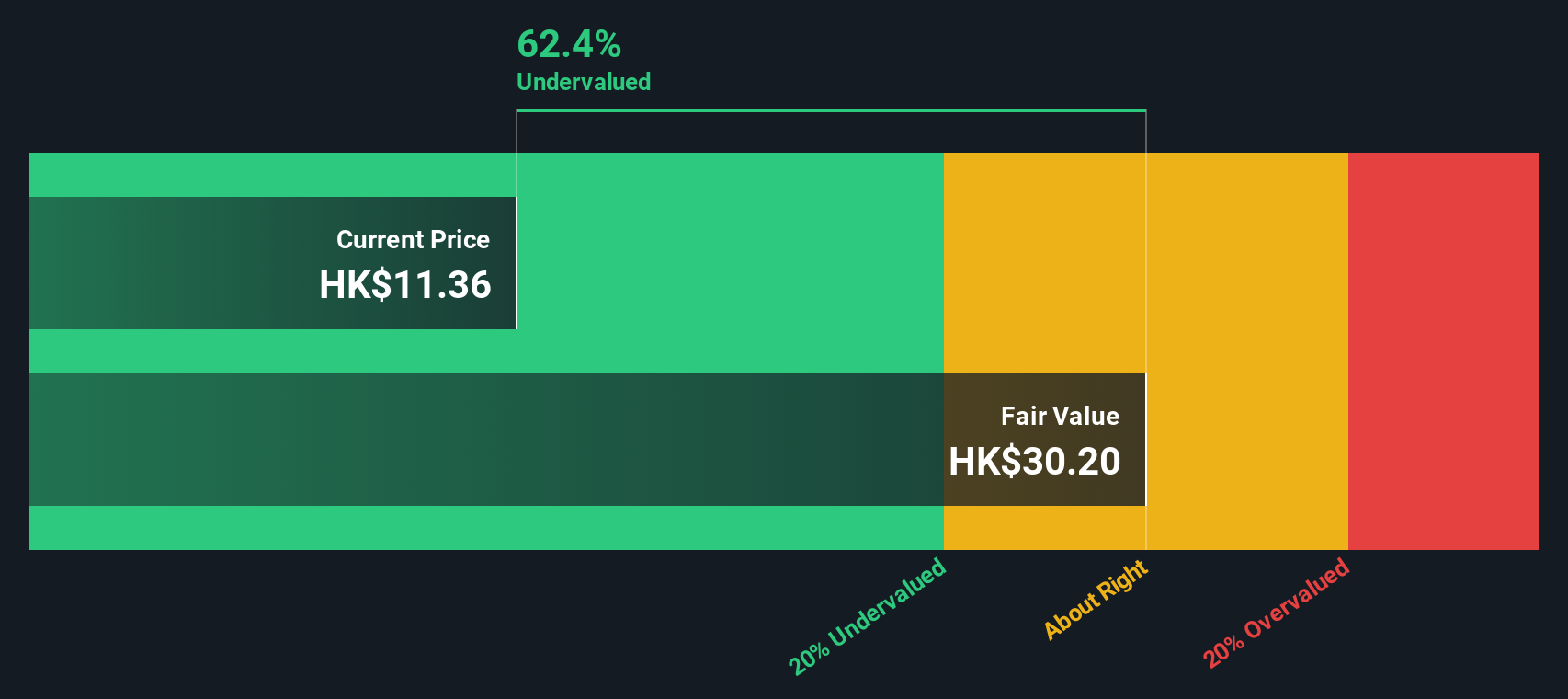

Looking ahead, the anticipated significant earnings growth over the next three years presents a promising opportunity to enhance profitability. The company's undervaluation, trading at 66.7% below its estimated fair value, indicates substantial room for price appreciation. Recent board adjustments, including the appointment of Ms. Zhang Wei as chairman of the audit committee, signal a strategic reorganization aimed at strengthening governance and oversight.

See what the latest analyst reports say about China Tower's future prospects and potential market movements.Key Risks and Challenges That Could Impact China Tower's Success

Despite these opportunities, high levels of debt remain a pressing concern, introducing financial risk. The company's revenue growth, forecasted to remain below 20% per year, may limit its expansion capabilities. Furthermore, competitive pressures from new entrants with aggressive pricing strategies could erode market share, necessitating a robust response to maintain its competitive position.

To gain deeper insights into China Tower's historical performance, explore our detailed analysis of past performance.Conclusion

China Tower's impressive projected earnings growth of 24.21% annually and its improved net profit margin highlight its strong financial health and strategic management, offering a solid foundation for future profitability. However, challenges such as a modest Return on Equity of 5.4% and a high net debt to equity ratio of 41% pose significant hurdles, potentially constraining growth and financial flexibility. Despite these challenges, the company's current trading price of HK$1.06, significantly below its estimated fair value of HK$3.19, presents a compelling investment opportunity, suggesting potential for substantial price appreciation. Investors should weigh these factors carefully, considering both the promising growth prospects and the financial risks, to make informed decisions about China Tower's future performance.

Taking Advantage

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English