Here's Why We Think Kiu Hung International Holdings (HKG:381) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Kiu Hung International Holdings (HKG:381). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Kiu Hung International Holdings with the means to add long-term value to shareholders.

Check out our latest analysis for Kiu Hung International Holdings

Kiu Hung International Holdings' Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. Which is why EPS growth is looked upon so favourably. It is awe-striking that Kiu Hung International Holdings' EPS went from HK$0.0042 to HK$0.023 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While Kiu Hung International Holdings' EBIT margins are down, it's not all bad news as revenues are at least stable. While some people may not be too phased, this could be a sticking point for some investors.

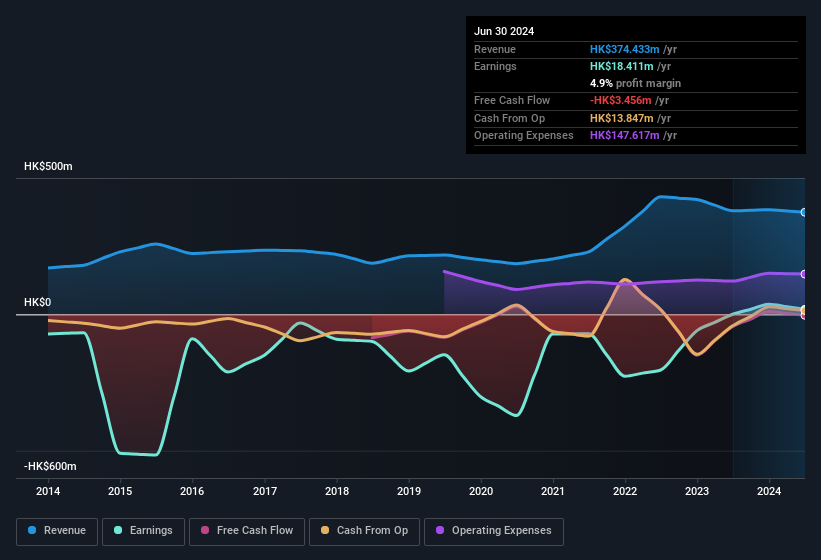

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Kiu Hung International Holdings is no giant, with a market capitalisation of HK$1.6b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Kiu Hung International Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One gleaming positive for Kiu Hung International Holdings, in the last year, is that a certain insider has buying shares with ample enthusiasm. Indeed, company insider Zhu Ou has accumulated shares over the last year, paying a total of HK$8.0m at an average price of about HK$0.15. Big insider buys like that are a rarity and should prompt discussion on the merits of the business.

On top of the insider buying, it's good to see that Kiu Hung International Holdings insiders have a valuable investment in the business. Indeed, they hold HK$144m worth of its stock. That's a lot of money, and no small incentive to work hard. That amounts to 9.2% of the company, demonstrating a degree of high-level alignment with shareholders.

Is Kiu Hung International Holdings Worth Keeping An Eye On?

Kiu Hung International Holdings' earnings per share growth have been climbing higher at an appreciable rate. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Kiu Hung International Holdings deserves timely attention. It's still necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Kiu Hung International Holdings (at least 3 which are a bit concerning) , and understanding them should be part of your investment process.

Keen growth investors love to see insider activity. Thankfully, Kiu Hung International Holdings isn't the only one. You can see a a curated list of Hong Kong companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English