Exploring Undiscovered Gems And 2 Other Small Caps With Strong Potential

In the current global market landscape, small-cap stocks have been experiencing notable fluctuations, as seen in the S&P 600 index's performance amidst broader economic uncertainties and policy changes. With inflation data impacting interest rate expectations and sector-specific developments influencing stock movements, investors are increasingly on the lookout for promising opportunities within this dynamic segment. Identifying a good stock often involves assessing its potential for growth in light of prevailing market conditions, making small caps with strong fundamentals particularly appealing to those seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tait Marketing & Distribution | NA | 7.36% | 18.40% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Savior Lifetec | NA | -7.74% | -0.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Vivo Energy Mauritius | NA | 13.58% | 14.34% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Pasifik Eurasia Lojistik Dis Ticaret (IBSE:PASEU)

Simply Wall St Value Rating: ★★★★★☆

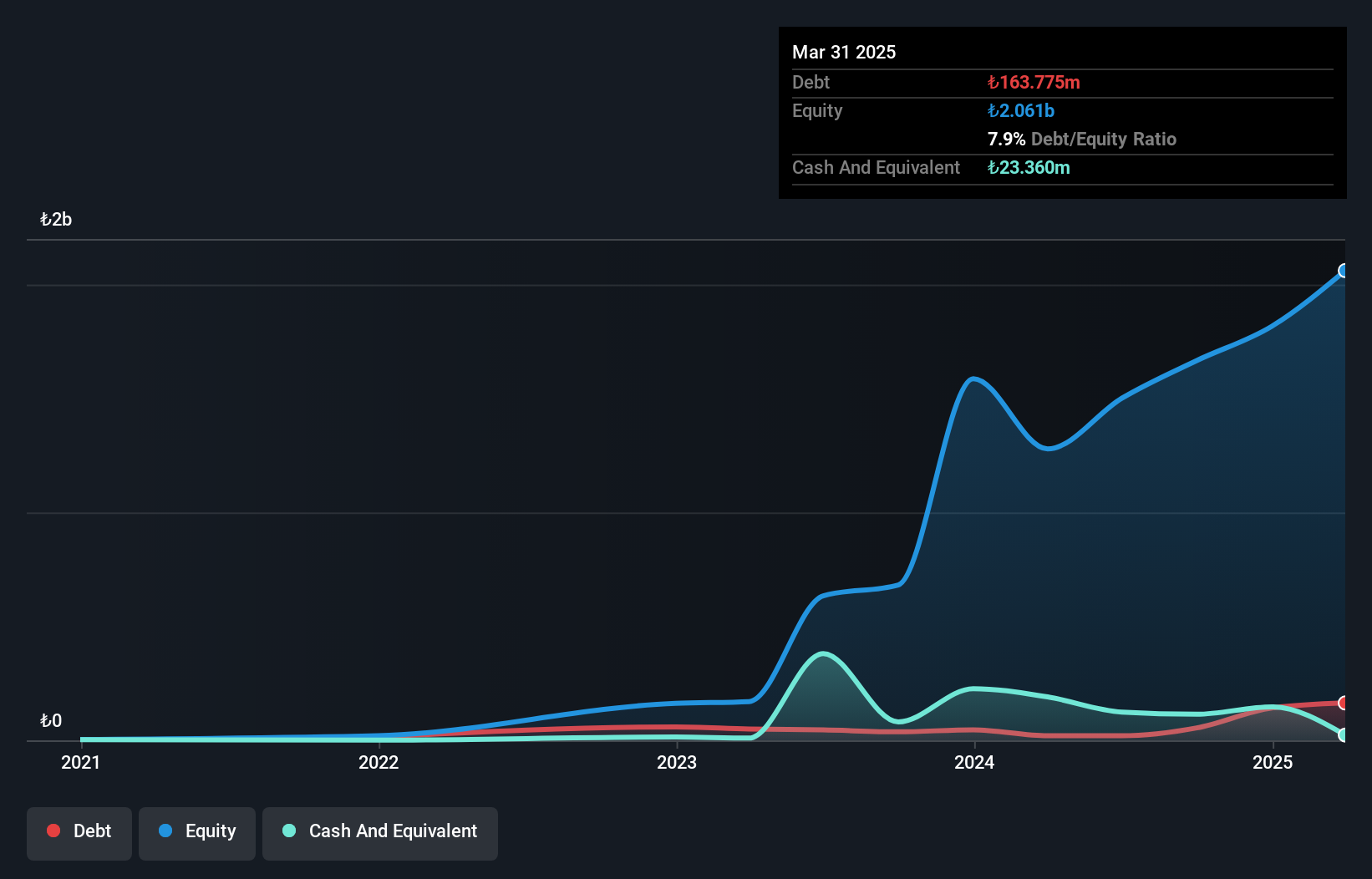

Overview: Pasifik Eurasia Lojistik Dis Ticaret A.S. operates in the logistics sector with a focus on railroad transportation, and has a market capitalization of TRY17.08 billion.

Operations: The primary revenue stream for Pasifik Eurasia Lojistik Dis Ticaret comes from its railroad transportation segment, generating TRY665.02 million. The company's financial performance can be further assessed by examining its net profit margin trends over time.

Pasifik Eurasia Lojistik Dis Ticaret has shown impressive financial performance, with earnings growing by 259% over the past year, outpacing the Transportation industry's growth of 85.1%. The company's net income for the third quarter reached TRY 26.19 million, a significant turnaround from a net loss of TRY 103.17 million in the previous year. Additionally, their nine-month net income rose to TRY 154.71 million from TRY 28.96 million last year, reflecting solid profitability and high-quality earnings. Despite challenges in sales figures for the nine months at TRY 808 million compared to last year's TRY 853 million, Pasifik Eurasia remains profitable with more cash than total debt and positive free cash flow indicators suggesting robust financial health moving forward.

Xi'an Kingfar Property Services (SEHK:1354)

Simply Wall St Value Rating: ★★★★★★

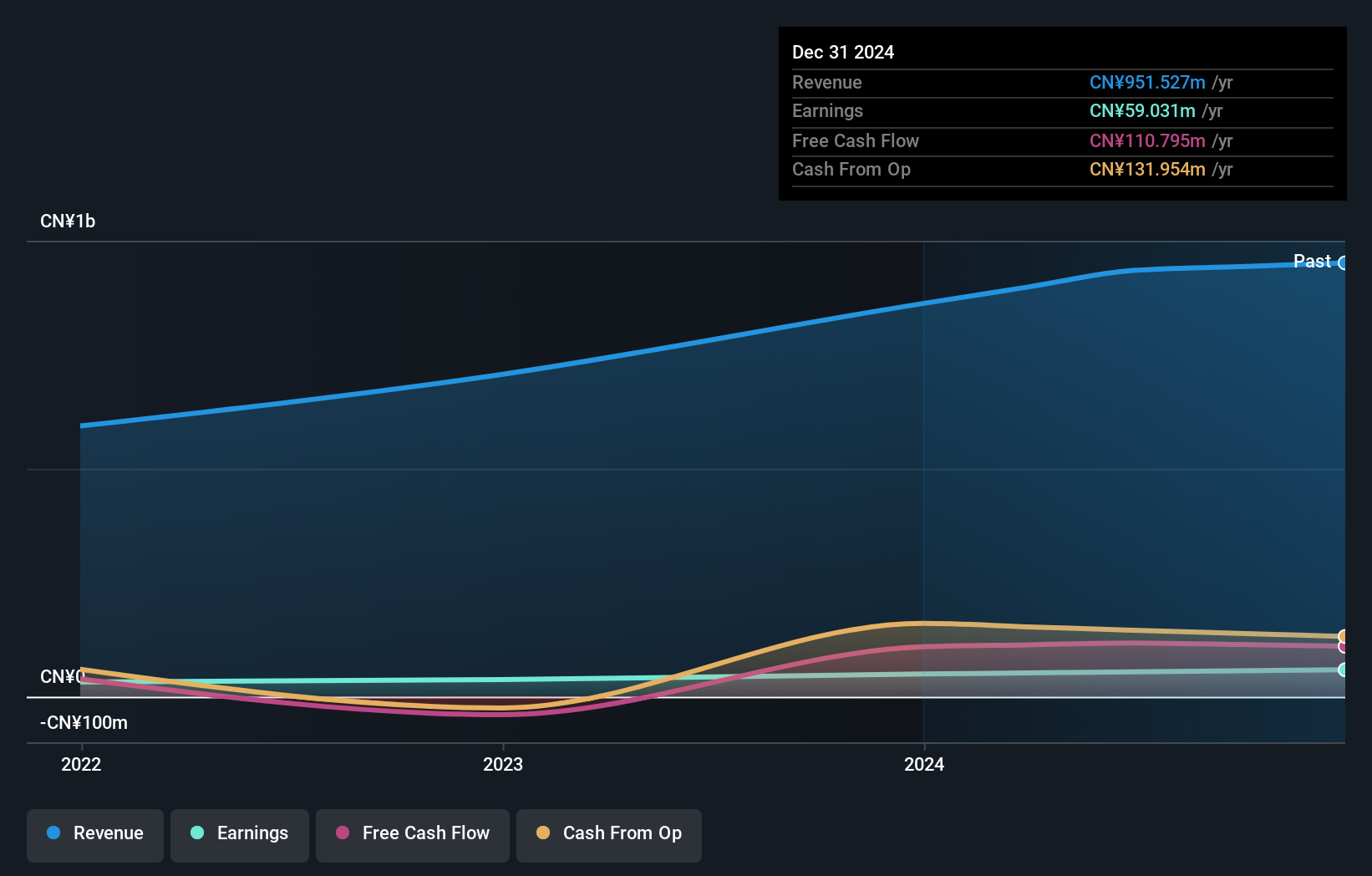

Overview: Xi'an Kingfar Property Services Co., Ltd. operates in the property management industry and has a market capitalization of HK$2.52 billion.

Operations: Xi'an Kingfar Property Services generates revenue primarily through its property management services. The company's financial performance is highlighted by a notable trend in its net profit margin, which has shown variability across different periods.

Xi'an Kingfar Property Services, a relatively small player in its industry, has shown impressive financial growth with earnings surging by 26% over the past year. The company is debt-free, which alleviates concerns about interest payments and enhances its financial stability. Trading at nearly 80% below estimated fair value suggests potential undervaluation. Despite a volatile share price recently, Xi'an Kingfar's high-quality earnings and robust free cash flow position it well for future opportunities. Recent board changes saw Ms. Leung Shui Bing appointed as joint company secretary, bringing over two decades of experience to strengthen governance practices.

Acter Group (TPEX:5536)

Simply Wall St Value Rating: ★★★★★☆

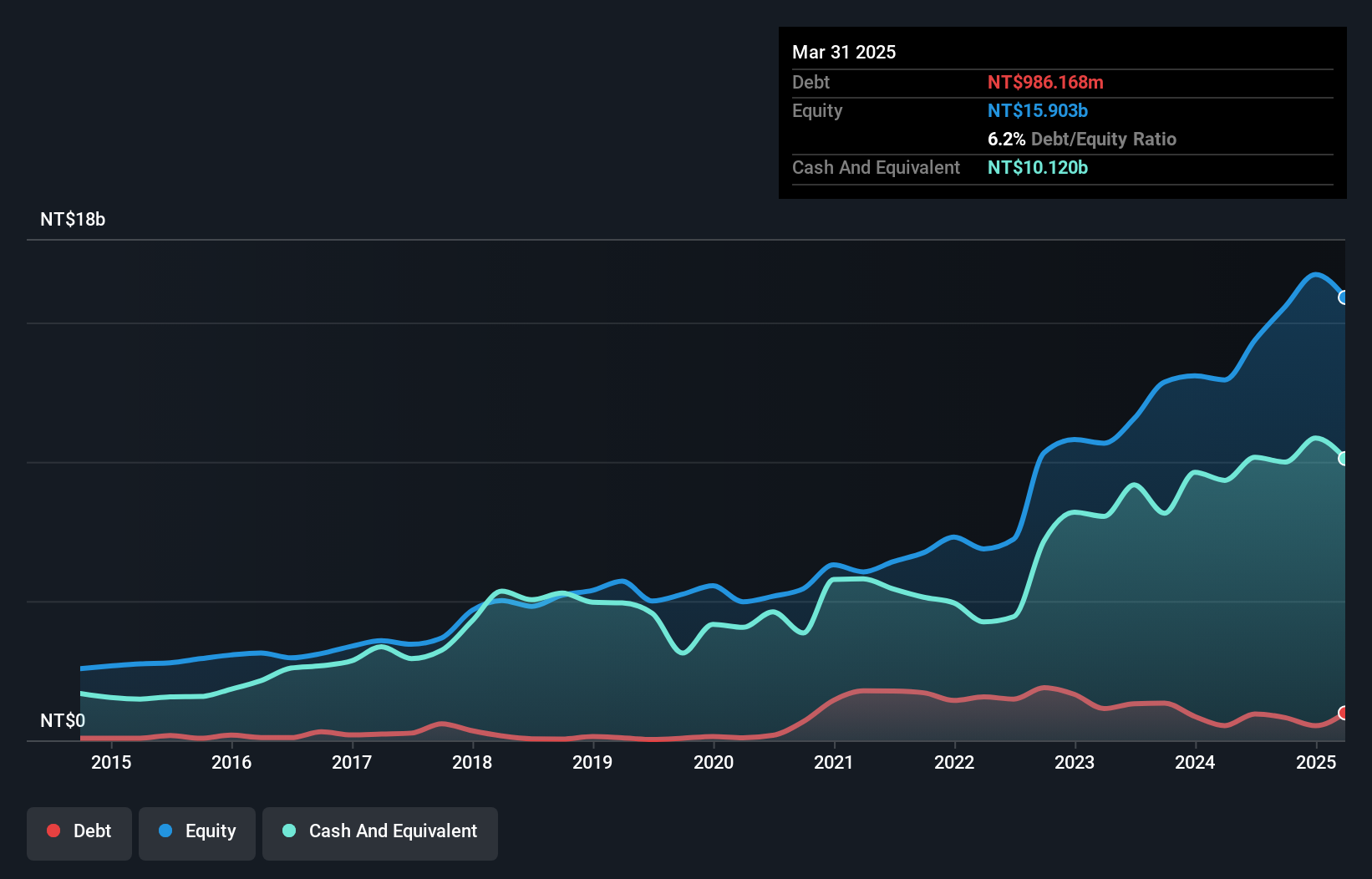

Overview: Acter Group Corporation Limited offers engineering services across Taiwan, Mainland China, and other Asian countries with a market capitalization of NT$39.27 billion.

Operations: Acter Group generates revenue primarily from engineering services in Taiwan (NT$11.97 billion), Mainland China (NT$12.95 billion), and other Asian countries (NT$3.09 billion). The company's financial performance is influenced by its geographical revenue distribution across these regions.

Acter Group, a promising player in its industry, has shown robust financial performance with earnings growing 20% annually over the past five years. The company's recent quarterly results highlighted sales of TWD 7.52 billion and net income of TWD 628 million, up from TWD 6.29 billion and TWD 508 million respectively from the previous year. Despite a debt-to-equity ratio increase to 5.2%, Acter's high-quality earnings and positive free cash flow indicate strong operational health. Trading at nearly half its estimated fair value, Acter seems well-positioned for future growth amidst ongoing strategic contracts like the recent TWD 517 million deal with SPIL.

- Click here to discover the nuances of Acter Group with our detailed analytical health report.

Examine Acter Group's past performance report to understand how it has performed in the past.

Where To Now?

- Access the full spectrum of 4649 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English