Exploring Three Undiscovered Gems with Strong Potential

As global markets navigate the uncertainties surrounding the incoming Trump administration and its potential policy shifts, small-cap stocks have experienced a mixed performance amid fluctuating interest rates and economic indicators. In this environment, identifying promising stocks often involves looking for companies with robust fundamentals, innovative business models, or niche market positions that can thrive despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Transcorp Power | 46.33% | 114.79% | 152.92% | ★★★★★☆ |

| Thai Energy Storage Technology | 9.49% | -1.42% | 1.73% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Tethys Petroleum | NA | 29.98% | 44.48% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Greatview Aseptic Packaging (SEHK:468)

Simply Wall St Value Rating: ★★★★★★

Overview: Greatview Aseptic Packaging Company Limited is an investment holding company that offers packaging solutions for the liquid food industry both in China and internationally, with a market cap of HK$3.39 billion.

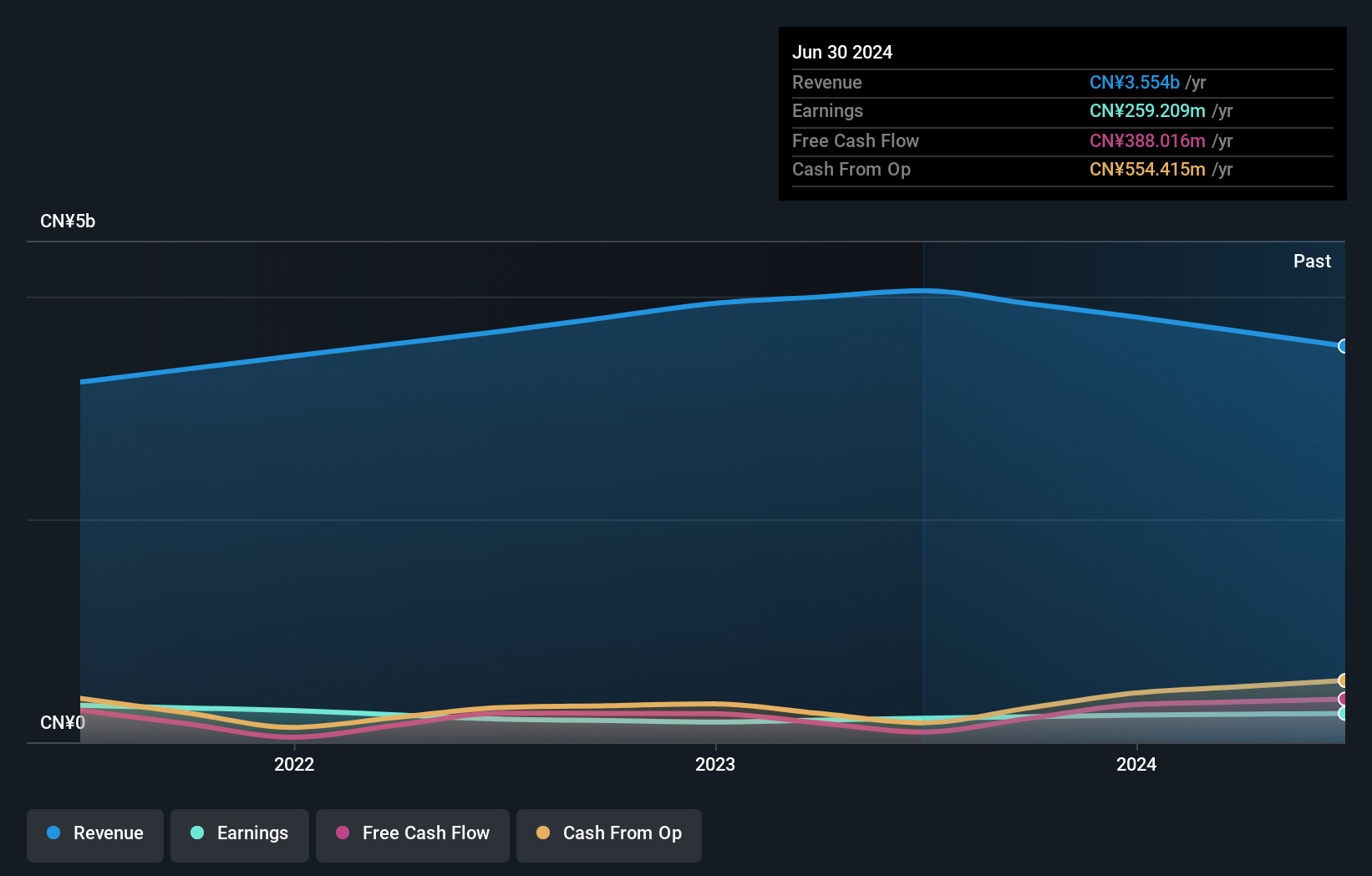

Operations: The company's primary revenue stream is derived from its Packaging & Containers segment, generating CN¥3.55 billion.

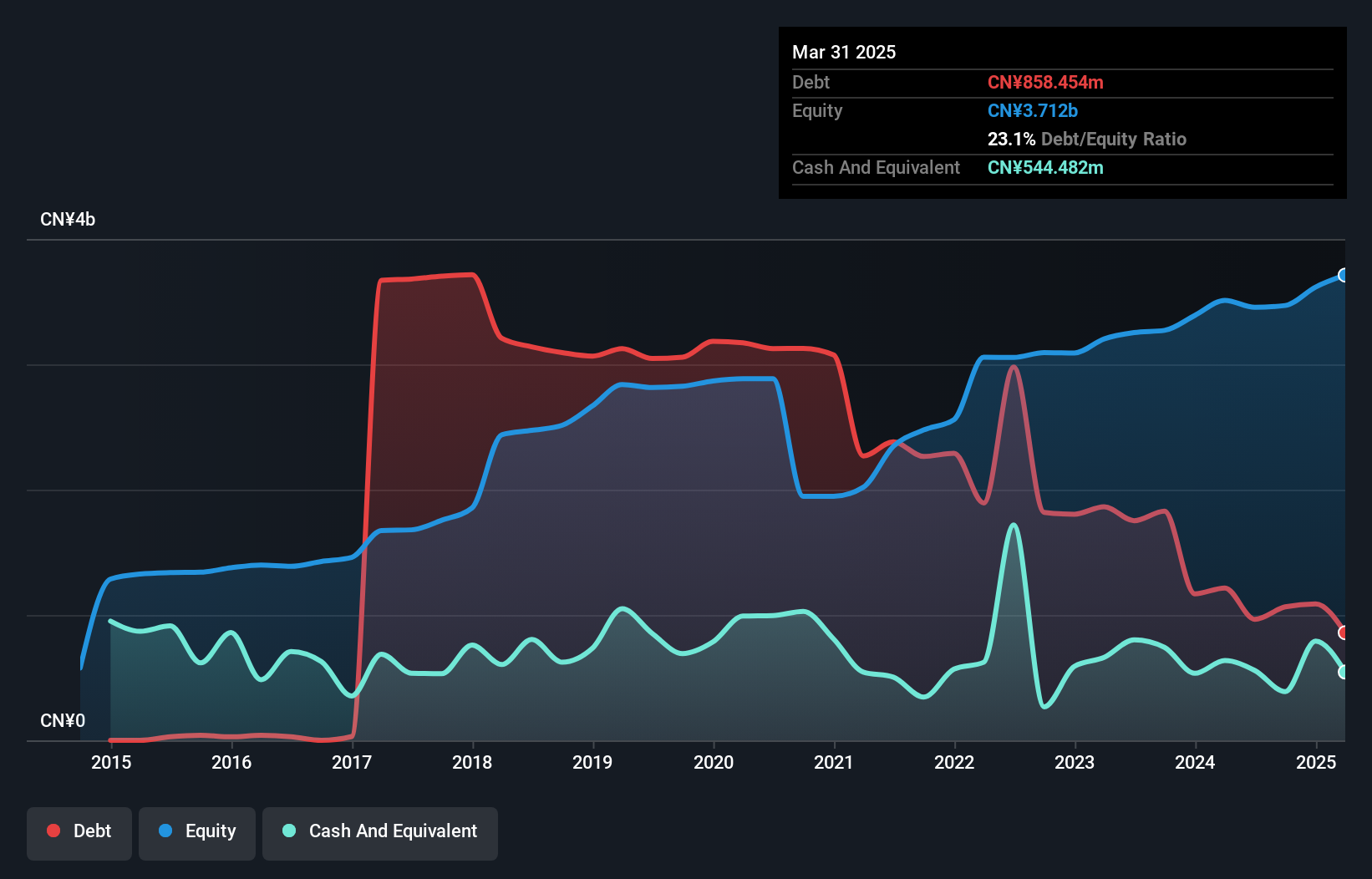

Greatview Aseptic Packaging, a smaller player in the packaging industry, has seen its earnings grow by 20.6% over the past year, although this lags behind the industry's 35% growth rate. The company boasts high-quality earnings and is trading at a significant discount of 89.2% below its estimated fair value. Despite recent shareholder dilution, Greatview's financial health appears robust with more cash than total debt and a reduced debt-to-equity ratio from 4.9 to 1.1 over five years. Recent board changes include appointing new directors to strengthen governance as they navigate auditor transitions amidst ongoing operational adjustments.

- Unlock comprehensive insights into our analysis of Greatview Aseptic Packaging stock in this health report.

Gain insights into Greatview Aseptic Packaging's past trends and performance with our Past report.

Jinhong Fashion GroupLtd (SHSE:603518)

Simply Wall St Value Rating: ★★★★★★

Overview: Jinhong Fashion Group Co., Ltd. is involved in the design, development, manufacturing, and sale of apparel and accessories for women, men, and children in China with a market capitalization of CN¥2.77 billion.

Operations: Jinhong Fashion Group generates revenue primarily through the sale of apparel and accessories across various segments, including women's, men's, and children's fashion. The company's cost structure includes expenses related to design, development, manufacturing, and sales operations. It has experienced fluctuations in its net profit margin over recent periods.

Jinhong Fashion Group, a smaller player in the luxury industry, has shown impressive earnings growth of 41% over the past year, outpacing the industry's 3.3%. The company trades at roughly 70% below its estimated fair value, indicating potential undervaluation. Despite a notable one-off gain of CN¥66M impacting recent results, Jinhong's net debt to equity ratio stands at a satisfactory 19.5%, down from 108% five years ago. Recent activities include repurchasing shares worth CN¥5M and planning a private placement that could increase key stakeholders' shareholding to nearly 40%, reflecting strategic financial maneuvering.

- Navigate through the intricacies of Jinhong Fashion GroupLtd with our comprehensive health report here.

Learn about Jinhong Fashion GroupLtd's historical performance.

Promate ElectronicLtd (TWSE:6189)

Simply Wall St Value Rating: ★★★★★★

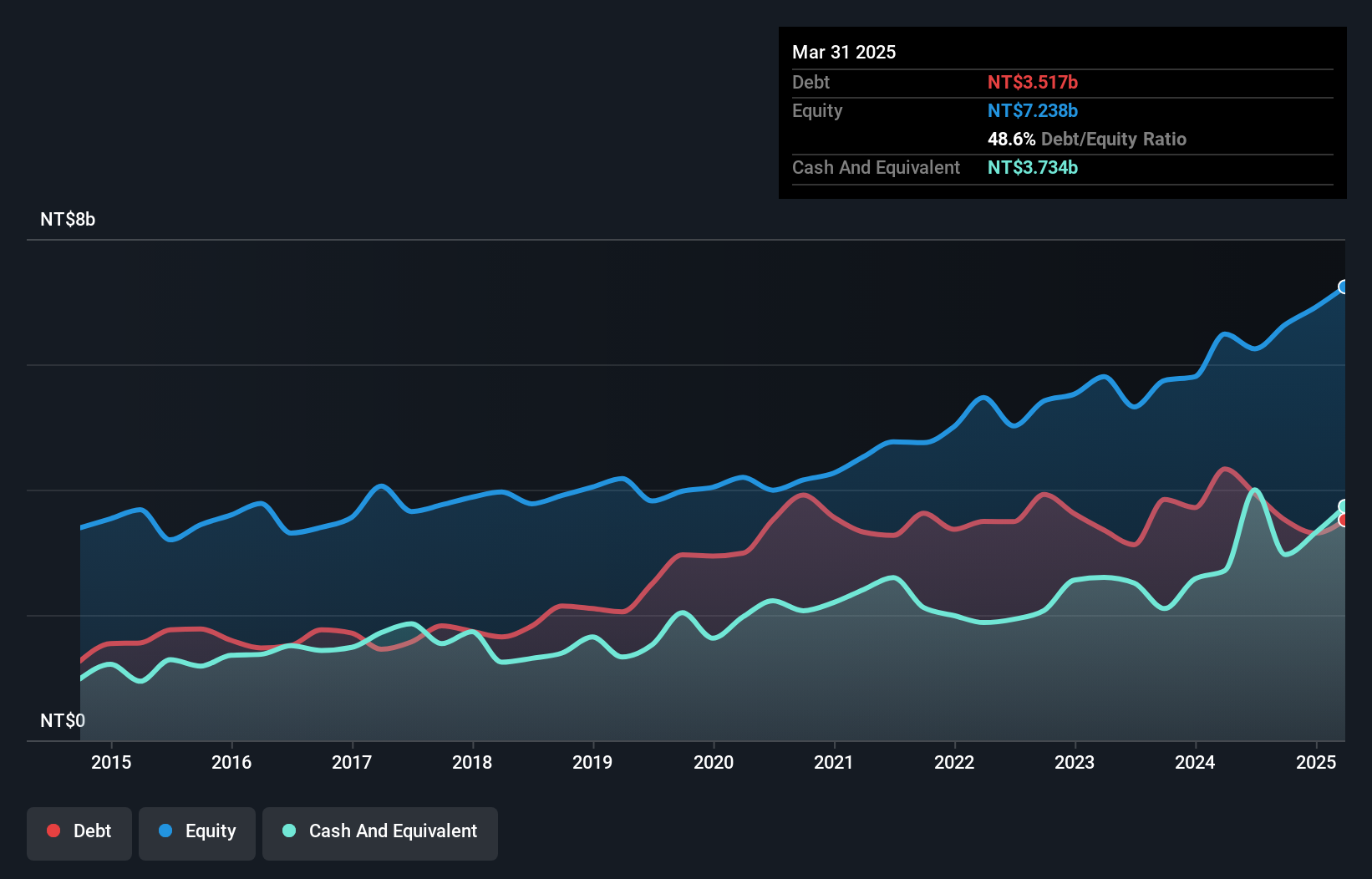

Overview: Promate Electronic Co., Ltd. operates in Taiwan, focusing on the distribution and sale of electronic and electrical components, as well as computer software and electrical products, with a market cap of NT$18.97 billion.

Operations: Promate Electronic Co., Ltd. generates revenue primarily from the distribution and sale of electronic and electrical components, alongside computer software and electrical products in Taiwan. The company has a market capitalization of NT$18.97 billion.

Trading at 73.1% below its estimated fair value, Promate Electronic Ltd. showcases a compelling investment opportunity with earnings growth of 34.4% over the past year, outpacing the electronic industry’s 9%. Despite shareholder dilution in the past year, it remains free cash flow positive and boasts high-quality earnings. The company’s interest payments are well covered by EBIT at 9.7 times coverage, indicating strong financial health. Recent reports show third-quarter sales rose to TWD 8,922 million from TWD 8,364 million last year; however, net income decreased to TWD 286 million from TWD 404 million previously due to various operational challenges.

- Click to explore a detailed breakdown of our findings in Promate ElectronicLtd's health report.

Evaluate Promate ElectronicLtd's historical performance by accessing our past performance report.

Summing It All Up

- Explore the 4627 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English