Do Goodbaby International Holdings' (HKG:1086) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Goodbaby International Holdings (HKG:1086). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Goodbaby International Holdings

How Quickly Is Goodbaby International Holdings Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Goodbaby International Holdings managed to grow EPS by 6.2% per year, over three years. This may not be setting the world alight, but it does show that EPS is on the upwards trend.

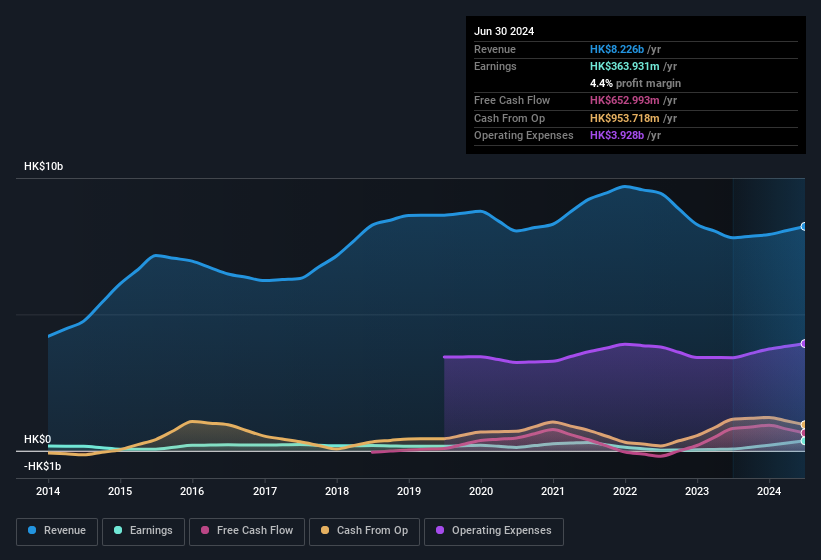

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Goodbaby International Holdings shareholders can take confidence from the fact that EBIT margins are up from 0.2% to 5.5%, and revenue is growing. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Goodbaby International Holdings isn't a huge company, given its market capitalisation of HK$1.6b. That makes it extra important to check on its balance sheet strength.

Are Goodbaby International Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news is that Goodbaby International Holdings insiders spent a whopping HK$63m on stock in just one year, without so much as a single sale. Buying like that is a fantastic look for the company and should rouse the market in anticipation for the future. We also note that it was the Non-Executive Director, Jingqiu Fu, who made the biggest single acquisition, paying HK$45m for shares at about HK$0.65 each.

The good news, alongside the insider buying, for Goodbaby International Holdings bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold HK$267m worth of its stock. This considerable investment should help drive long-term value in the business. That amounts to 16% of the company, demonstrating a degree of high-level alignment with shareholders.

Is Goodbaby International Holdings Worth Keeping An Eye On?

One important encouraging feature of Goodbaby International Holdings is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Goodbaby International Holdings (at least 1 which is concerning) , and understanding them should be part of your investment process.

Keen growth investors love to see insider activity. Thankfully, Goodbaby International Holdings isn't the only one. You can see a a curated list of Hong Kong companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English