Discovering Xi'an Kingfar Property Services And 2 Other Small Caps With Strong Potential

As global markets experience a mixed bag of performances, with major indices like the Russell 2000 underperforming against larger counterparts and economic indicators pointing to a cooling labor market, investors are increasingly looking towards small-cap stocks for potential opportunities. In this environment, identifying stocks with solid fundamentals and growth potential can be crucial for navigating the current landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Xi'an Kingfar Property Services (SEHK:1354)

Simply Wall St Value Rating: ★★★★★★

Overview: Xi'an Kingfar Property Services Co., Ltd. operates in the property services sector with a market cap of HK$2.04 billion.

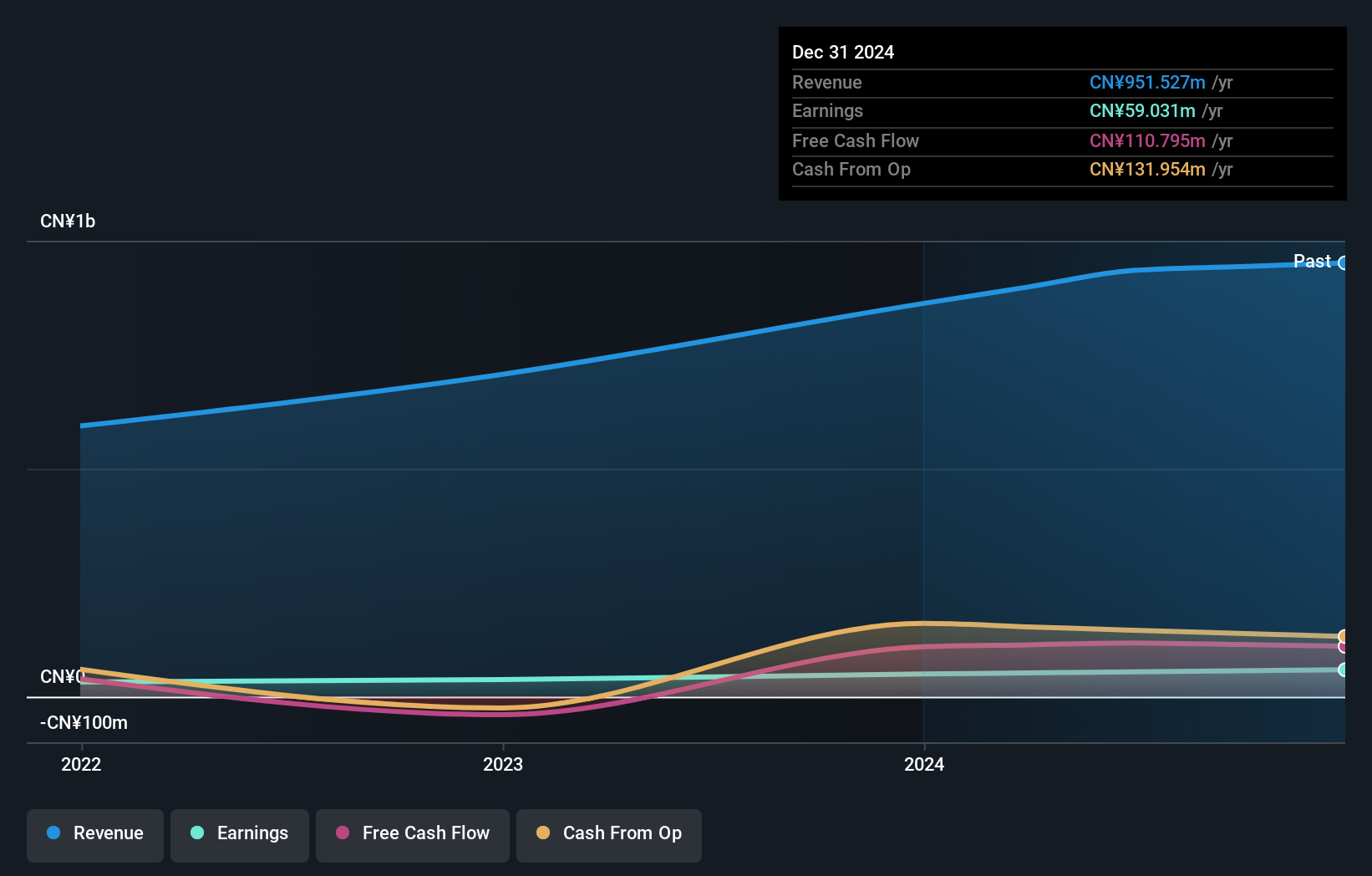

Operations: Xi'an Kingfar generates revenue primarily from property management services. The company has reported a net profit margin of 12% in recent periods, reflecting its operational efficiency within the sector.

Xi'an Kingfar Property Services, a small player in the property management sector, showcases impressive financial health with earnings growth of 25.5% over the past year, outpacing its industry peers. The company is debt-free and boasts high-quality earnings, which likely contributes to its robust performance. Despite a volatile share price recently, it trades at 82% below estimated fair value, indicating potential undervaluation. With free cash flow reaching US$117.93 million as of June 2024 and no interest coverage concerns due to zero debt, Kingfar seems well-positioned for future opportunities in its niche market segment.

Yiwu Huading NylonLtd (SHSE:601113)

Simply Wall St Value Rating: ★★★★★★

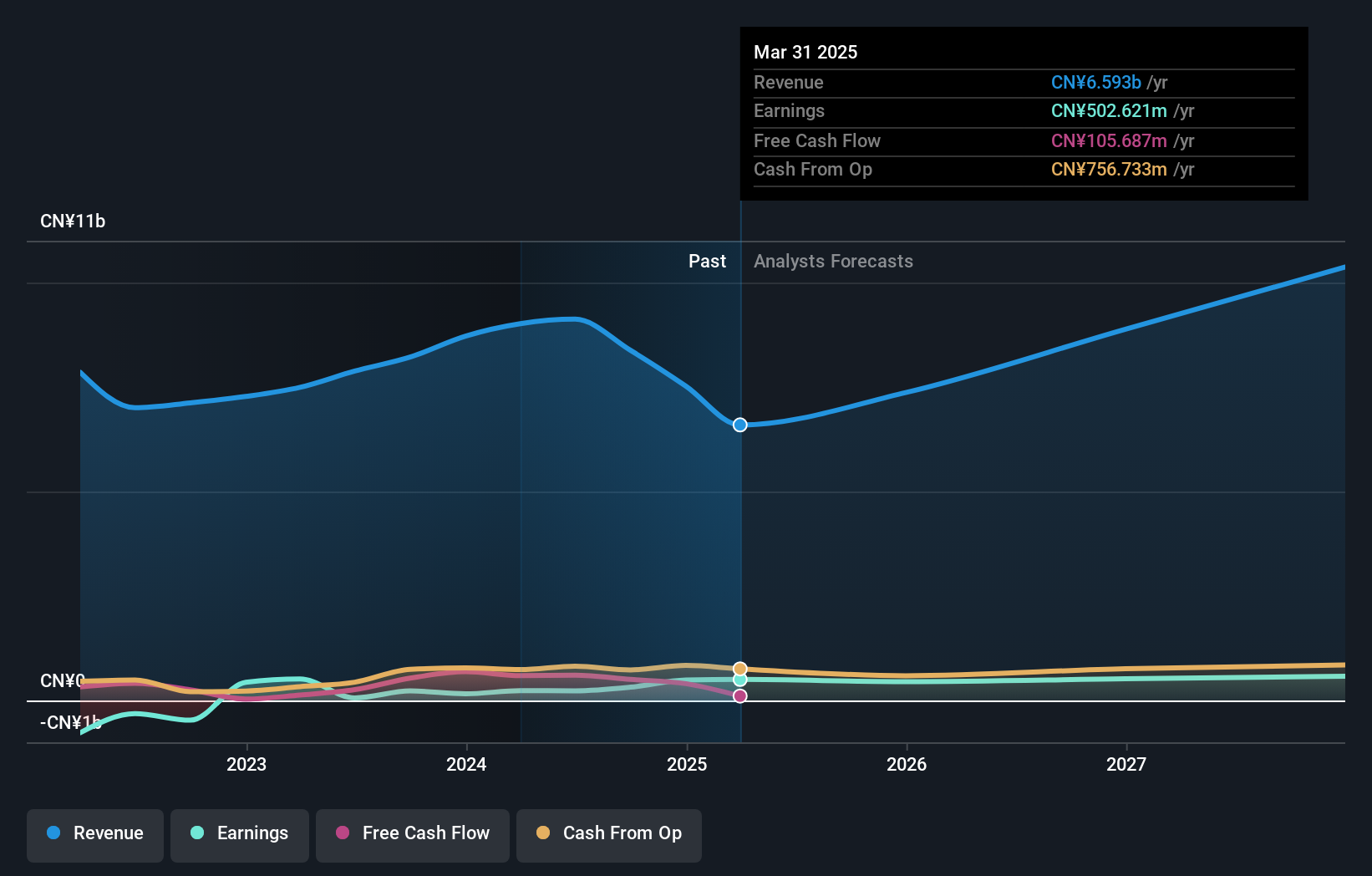

Overview: Yiwu Huading Nylon Co., Ltd. is involved in the research, development, manufacture, and sale of nylon filaments primarily in China, with a market capitalization of approximately CN¥4.31 billion.

Operations: Yiwu Huading generates revenue through the sale of nylon filaments, with a focus on the Chinese market. The company experiences fluctuations in its net profit margin, which is a key indicator of its profitability.

Yiwu Huading, a noteworthy player in the nylon industry, has shown resilience with a 40% earnings growth over the past year, surpassing its industry peers. Its debt-to-equity ratio improved from 26.8 to 10.4 over five years, indicating prudent financial management. Trading at 58% below estimated fair value suggests potential undervaluation. Recent developments include a share subscription agreement with True Love Group for CNY 707 million and a special shareholders meeting scheduled for November. Despite sales dropping to CNY 5.99 billion from CNY 6.34 billion last year, net income rose significantly to CNY 324 million from CNY 165 million, reflecting robust operational performance amidst challenges.

- Get an in-depth perspective on Yiwu Huading NylonLtd's performance by reading our health report here.

Assess Yiwu Huading NylonLtd's past performance with our detailed historical performance reports.

Zhang Xiaoquan (SZSE:301055)

Simply Wall St Value Rating: ★★★★★☆

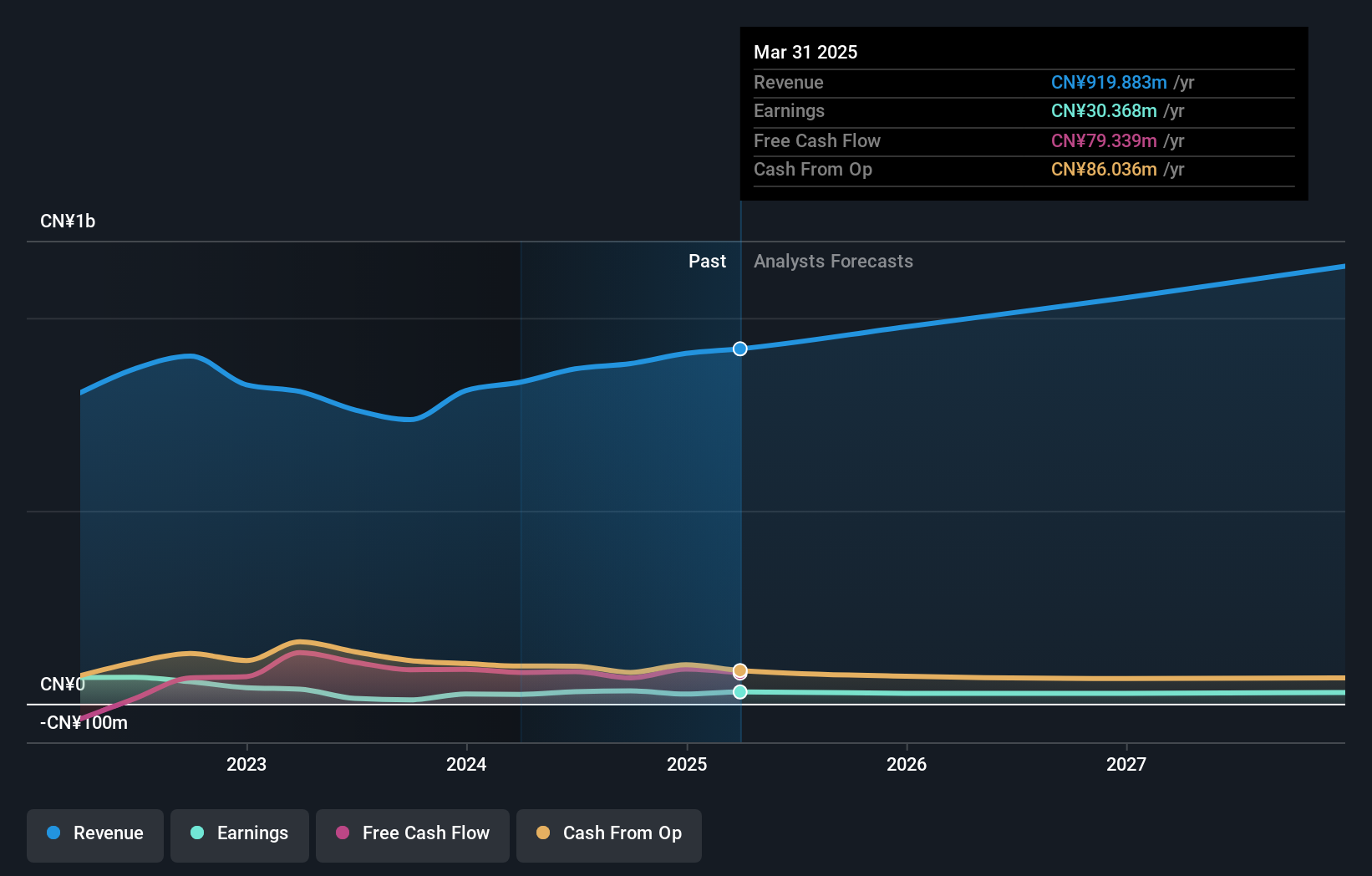

Overview: Zhang Xiaoquan Inc. is involved in the design, research, development, production, sale, and servicing of a range of products including household kitchen supplies and personal care items for both domestic and international markets, with a market cap of CN¥2.52 billion.

Operations: The company generates revenue primarily from the sale of household kitchen supplies, personal care items, garden and agricultural products, and hotel kitchenware supplies. It operates both domestically in China and internationally.

Zhang Xiaoquan, a promising player in its industry, reported impressive earnings growth of 239.7% over the past year, significantly outpacing the Consumer Durables sector's -0.2%. The company has more cash than total debt and maintains a low debt-to-equity ratio of 0.08%, indicating prudent financial management. For the nine months ending September 2024, sales reached CNY 635.88 million compared to CNY 565.81 million previously, with net income climbing to CNY 17.2 million from CNY 9.27 million last year. With high-quality earnings and positive free cash flow, Zhang Xiaoquan seems well-positioned for continued growth amidst competitive dynamics.

Key Takeaways

- Get an in-depth perspective on all 4621 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English