China BlueChemical And 2 Dividend Stocks To Enhance Your Portfolio

As global markets navigate tariff uncertainties and mixed economic signals, investors are increasingly seeking stability through strategic portfolio diversification. In this context, dividend stocks like China BlueChemical offer a compelling opportunity to enhance portfolios by providing consistent income streams amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.78% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.48% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.19% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.69% | ★★★★★★ |

Click here to see the full list of 1965 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

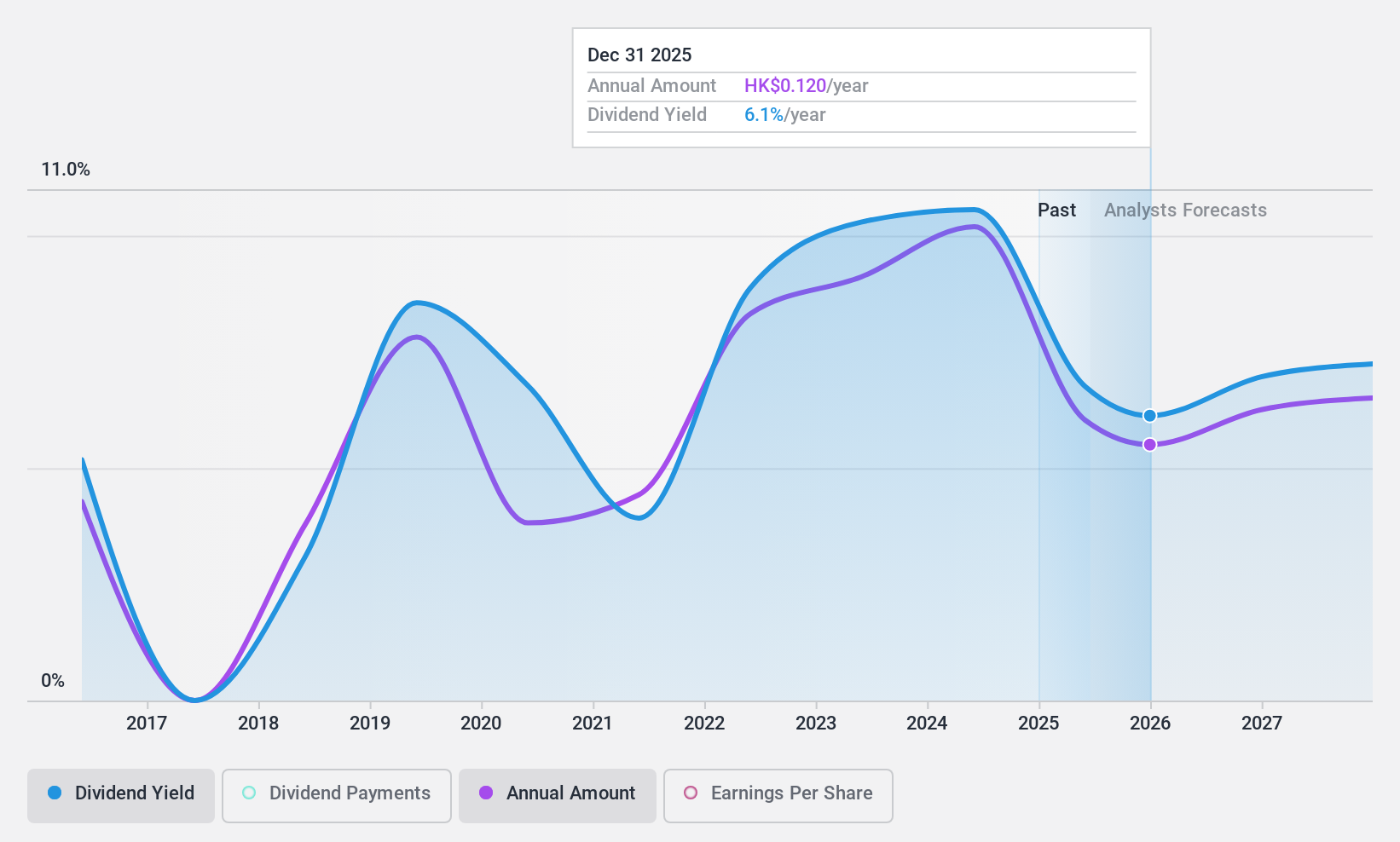

China BlueChemical (SEHK:3983)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China BlueChemical Ltd. develops, produces, and sells mineral fertilizers and chemical products both in the People’s Republic of China and internationally, with a market capitalization of HK$10.28 billion.

Operations: China BlueChemical Ltd. generates revenue from its key segments, including Urea (CN¥4.26 billion), Methanol (CN¥3.11 billion), and Phosphorus and Compound Fertiliser (CN¥2.85 billion).

Dividend Yield: 9.9%

China BlueChemical offers a dividend yield of 9.92%, placing it in the top 25% of Hong Kong's market payers, though its dividend history has been volatile and unreliable over the past decade. The dividends are covered by earnings and cash flows with payout ratios of 70.5% and 65.3%, respectively, suggesting sustainability despite profit margin declines from last year. Recent board changes include Mr. Yang's resignation and Ms. He Qunhui's appointment as an executive director.

- Take a closer look at China BlueChemical's potential here in our dividend report.

- Our valuation report here indicates China BlueChemical may be undervalued.

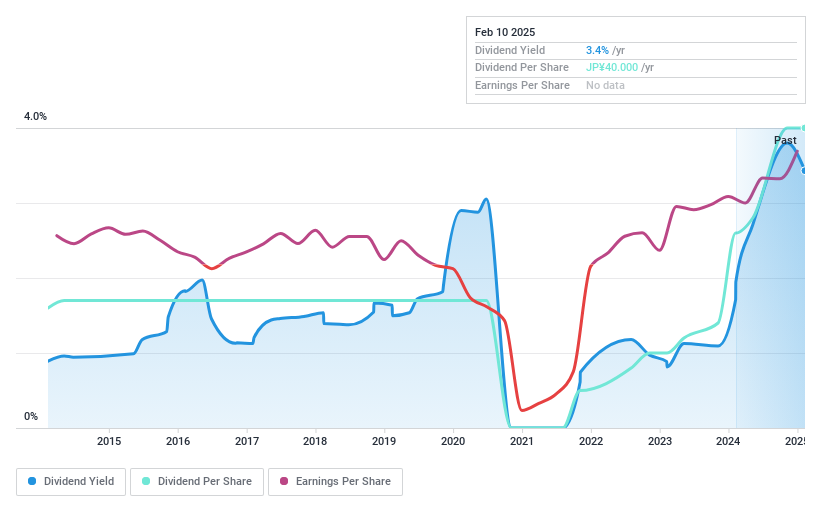

Japan Cash Machine (TSE:6418)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Japan Cash Machine Co., Ltd. is engaged in the development, manufacturing, and sale of money-handling and amusement center machines both domestically and internationally, with a market cap of ¥31.86 billion.

Operations: Japan Cash Machine Co., Ltd. generates revenue through its development, manufacturing, and sales of money-handling machines and amusement center equipment in both domestic and international markets.

Dividend Yield: 3.4%

Japan Cash Machine's dividend yield of 3.38% is below the top tier in Japan, and its dividend history has been volatile with significant annual drops. Despite this, the dividends are well-covered by earnings and cash flows, with low payout ratios of 9.2% and 28%, indicating sustainability. Recent guidance for fiscal year ending March 2025 shows expected net sales of ¥38 billion and operating profit of ¥5.1 billion, suggesting stable financial performance amidst past volatility in payouts.

- Unlock comprehensive insights into our analysis of Japan Cash Machine stock in this dividend report.

- Upon reviewing our latest valuation report, Japan Cash Machine's share price might be too pessimistic.

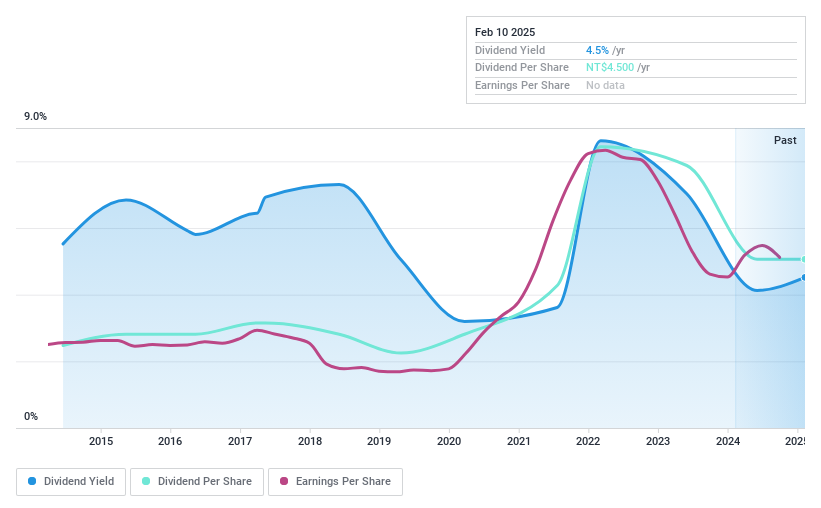

TXC (TWSE:3042)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TXC Corporation is involved in the research, design, development, production, and sale of crystal and oscillator products both in Taiwan and internationally, with a market cap of NT$34.47 billion.

Operations: TXC Corporation generates revenue primarily from its Quartz Components Department, contributing NT$12.37 billion, with additional income from its Real Estate Development Department at NT$13.33 million.

Dividend Yield: 4.5%

TXC's dividend yield of 4.48% ranks in the top 25% of Taiwan's market, yet it faces sustainability issues due to a high cash payout ratio of 187.8%. Despite earnings coverage with a payout ratio of 71.9%, dividends have been unreliable and volatile over the past decade. Recent earnings showed increased sales but declining quarterly net income, which could impact future dividend stability amidst executive changes effective January 2025.

- Delve into the full analysis dividend report here for a deeper understanding of TXC.

- Our valuation report unveils the possibility TXC's shares may be trading at a premium.

Summing It All Up

- Delve into our full catalog of 1965 Top Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English