Guotai Junan International Holdings' (HKG:1788) Dividend Will Be Increased To HK$0.02

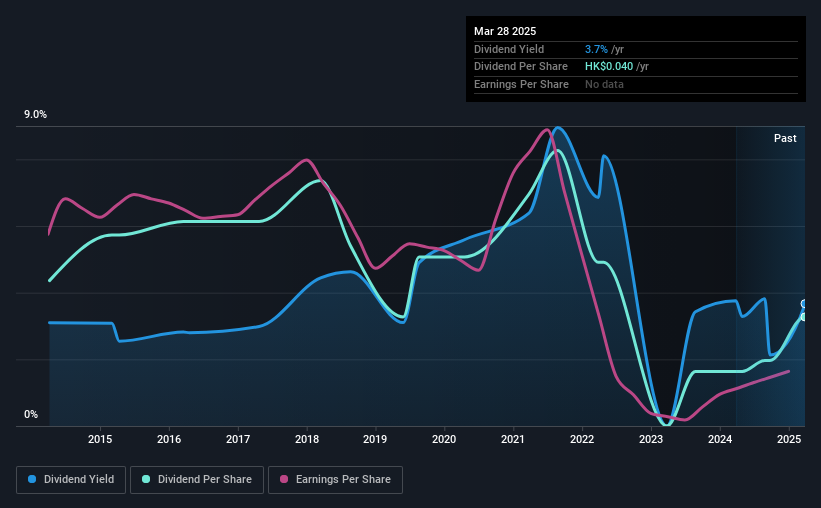

The board of Guotai Junan International Holdings Limited (HKG:1788) has announced that it will be paying its dividend of HK$0.02 on the 17th of June, an increased payment from last year's comparable dividend. This takes the annual payment to 3.7% of the current stock price, which is about average for the industry.

Guotai Junan International Holdings' Future Dividends May Potentially Be At Risk

We aren't too impressed by dividend yields unless they can be sustained over time. Before making this announcement, Guotai Junan International Holdings was paying out a fairly large proportion of earnings, and it wasn't generating positive free cash flows either. This is a pretty unsustainable practice, and could be risky if continued for the long term.

Looking forward, EPS could fall by 20.8% if the company can't turn things around from the last few years. If the dividend continues along recent trends, we estimate the payout ratio could reach 100%, which could put the dividend in jeopardy if the company's earnings don't improve.

Check out our latest analysis for Guotai Junan International Holdings

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. The annual payment during the last 10 years was HK$0.0533 in 2015, and the most recent fiscal year payment was HK$0.04. This works out to be a decline of approximately 2.8% per year over that time. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Has Limited Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Earnings per share has been sinking by 21% over the last five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

The Dividend Could Prove To Be Unreliable

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The track record isn't great, and the payments are a bit high to be considered sustainable. We don't think Guotai Junan International Holdings is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've identified 2 warning signs for Guotai Junan International Holdings (1 makes us a bit uncomfortable!) that you should be aware of before investing. Is Guotai Junan International Holdings not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English