Asian Market's Top Value Stock Picks For April 2025

As global markets grapple with economic uncertainty and inflation concerns, the Asian stock markets have shown resilience, presenting opportunities for value investors. In this environment, identifying undervalued stocks becomes crucial as they may offer potential for growth amidst cautious optimism and market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Asia Vital Components (TWSE:3017) | NT$454.00 | NT$897.72 | 49.4% |

| Chison Medical Technologies (SHSE:688358) | CN¥30.92 | CN¥61.74 | 49.9% |

| Fujikura (TSE:5803) | ¥5398.00 | ¥10642.73 | 49.3% |

| RACCOON HOLDINGS (TSE:3031) | ¥958.00 | ¥1899.50 | 49.6% |

| Insource (TSE:6200) | ¥799.00 | ¥1581.10 | 49.5% |

| Tongqinglou Catering (SHSE:605108) | CN¥20.28 | CN¥40.37 | 49.8% |

| Fenbi (SEHK:2469) | HK$2.49 | HK$4.92 | 49.4% |

| Digital China Holdings (SEHK:861) | HK$2.76 | HK$5.50 | 49.8% |

| Holtek Semiconductor (TWSE:6202) | NT$44.10 | NT$87.57 | 49.6% |

| Kanto Denka Kogyo (TSE:4047) | ¥869.00 | ¥1724.96 | 49.6% |

Here's a peek at a few of the choices from the screener.

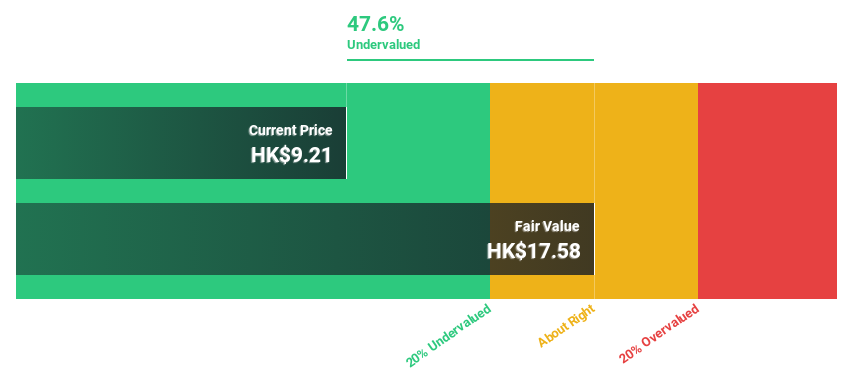

Consun Pharmaceutical Group (SEHK:1681)

Overview: Consun Pharmaceutical Group Limited is engaged in the research, development, manufacturing, and sale of Chinese medicines and medical contrast medium products in the People’s Republic of China with a market cap of HK$7.68 billion.

Operations: The company's revenue is derived from the Consun Pharmaceutical Segment, contributing CN¥2.53 billion, and the Yulin Pharmaceutical Segment, adding CN¥442.84 million.

Estimated Discount To Fair Value: 47.7%

Consun Pharmaceutical Group appears undervalued, trading at HK$9.24, significantly below its estimated fair value of HK$17.66. Recent earnings growth of 16.1% and expected annual profit growth of 13% surpass the Hong Kong market's average, indicating strong operational performance. The company reported increased sales and net income for 2024, alongside a proposed dividend of HK$0.3 per share. However, it has an unstable dividend track record despite its robust cash flow potential and promising product developments like the SK-08 Tablet for CKD treatment.

- In light of our recent growth report, it seems possible that Consun Pharmaceutical Group's financial performance will exceed current levels.

- Dive into the specifics of Consun Pharmaceutical Group here with our thorough financial health report.

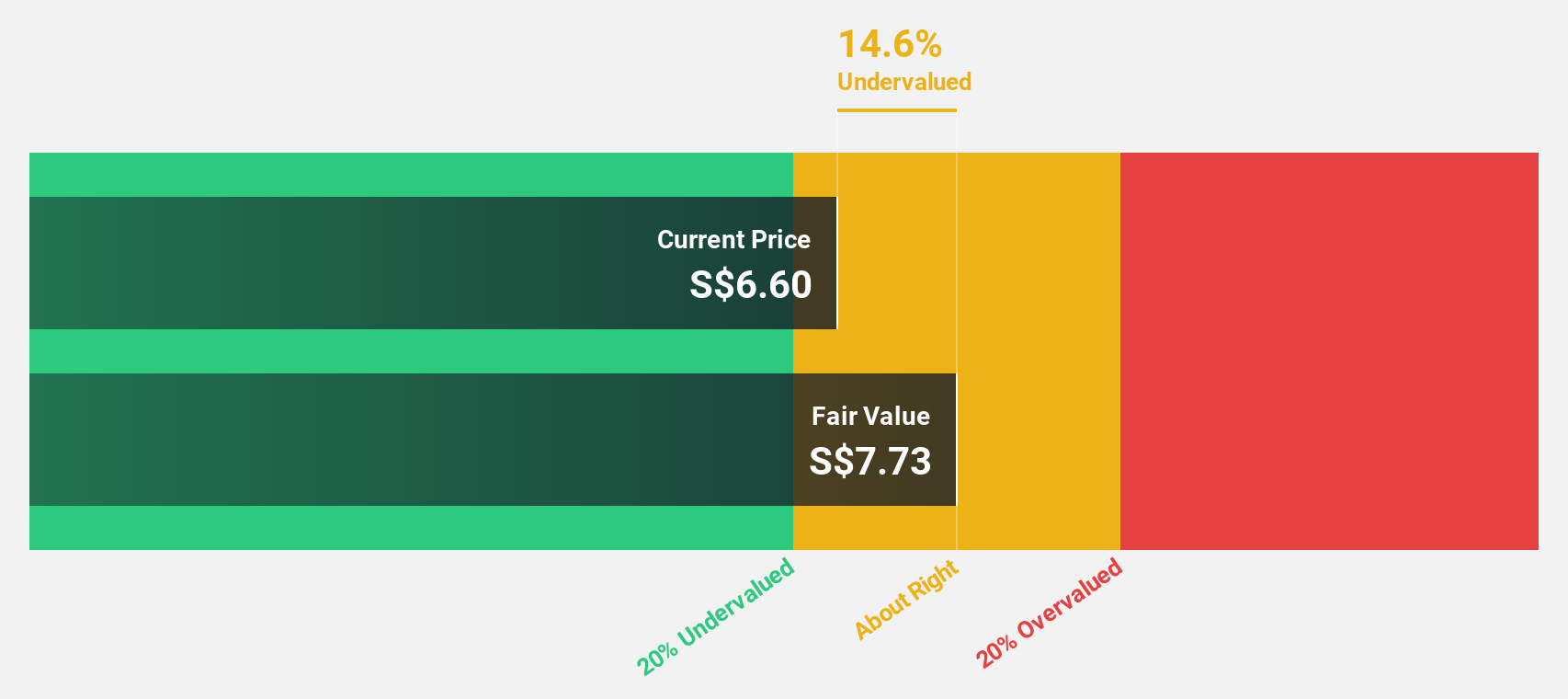

iFAST (SGX:AIY)

Overview: iFAST Corporation Ltd. operates as a provider of investment products and services across Singapore, Hong Kong, Malaysia, China, and the United Kingdom with a market capitalization of SGD2.21 billion.

Operations: The company's revenue is primarily derived from its Banking Operations segment, which generated SGD52.01 million.

Estimated Discount To Fair Value: 19.5%

iFAST Corporation Ltd. is trading at S$7.42, below its estimated fair value of S$9.21, reflecting potential undervaluation based on cash flows. The company reported strong financials with Q4 2024 revenue and net income growth to S$104.14 million and S$19.28 million, respectively. Despite significant insider selling recently, iFAST's earnings are expected to grow significantly over the next three years, supported by strategic alliances like the partnership with TSFC Securities in Thailand for fintech expansion.

- The growth report we've compiled suggests that iFAST's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of iFAST stock in this financial health report.

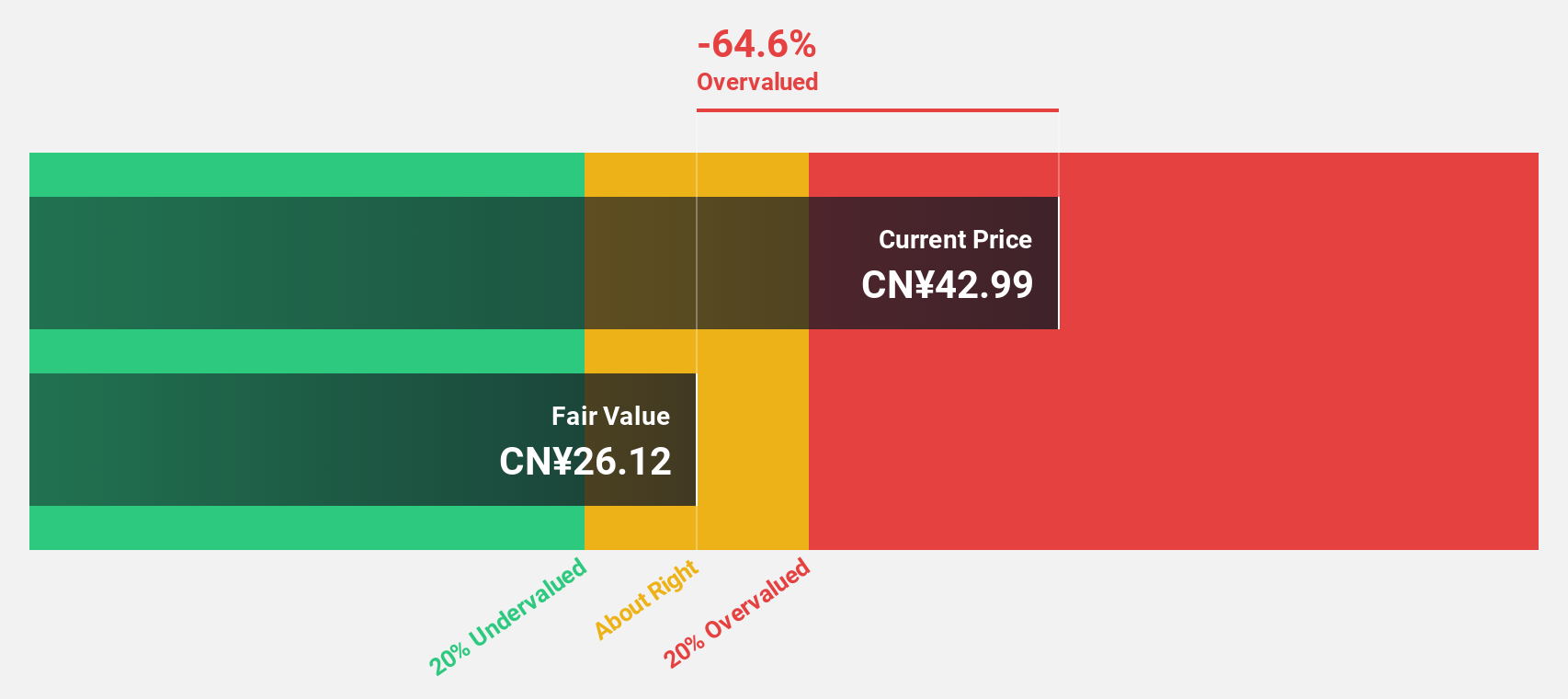

Haisco Pharmaceutical Group (SZSE:002653)

Overview: Haisco Pharmaceutical Group Co., Ltd. is engaged in the research, development, manufacturing, and sale of pharmaceuticals in China with a market cap of CN¥42.19 billion.

Operations: Haisco Pharmaceutical Group Co., Ltd. generates its revenue through the research, development, manufacturing, and sale of pharmaceuticals in China.

Estimated Discount To Fair Value: 27.4%

Haisco Pharmaceutical Group, trading at CN¥38.03, is valued below its estimated fair value of CN¥52.36, indicating potential undervaluation based on cash flows. The company forecasts robust annual revenue and earnings growth of 23% and 35.7%, respectively, outpacing the Chinese market averages. Despite a low dividend yield of 0.71% not being well-covered by earnings or cash flows, recent private placements aim to raise over CN¥1 billion to support strategic initiatives and growth opportunities.

- The analysis detailed in our Haisco Pharmaceutical Group growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Haisco Pharmaceutical Group's balance sheet health report.

Key Takeaways

- Click through to start exploring the rest of the 273 Undervalued Asian Stocks Based On Cash Flows now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English