Things Look Grim For Ubtech Robotics Corp Ltd (HKG:9880) After Today's Downgrade

Market forces rained on the parade of Ubtech Robotics Corp Ltd (HKG:9880) shareholders today, when the analysts downgraded their forecasts for this year. Revenue and earnings per share (EPS) forecasts were both revised downwards, with analysts seeing grey clouds on the horizon.

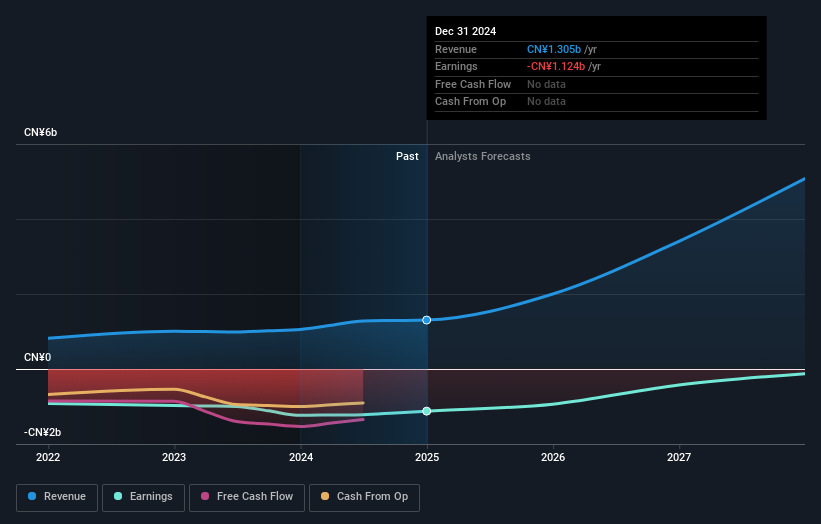

Following the downgrade, the current consensus from Ubtech Robotics' three analysts is for revenues of CN¥2.0b in 2025 which - if met - would reflect a major 53% increase on its sales over the past 12 months. Losses are presumed to reduce, shrinking 15% per share from last year to CN¥2.16. However, before this estimates update, the consensus had been expecting revenues of CN¥2.4b and CN¥1.70 per share in losses. Ergo, there's been a clear change in sentiment, with the analysts administering a notable cut to this year's revenue estimates, while at the same time increasing their loss per share forecasts.

View our latest analysis for Ubtech Robotics

The consensus price target fell 9.3% to CN¥102, implicitly signalling that lower earnings per share are a leading indicator for Ubtech Robotics' valuation. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. Currently, the most bullish analyst values Ubtech Robotics at CN¥120 per share, while the most bearish prices it at CN¥85.98. This shows there is still some diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's clear from the latest estimates that Ubtech Robotics' rate of growth is expected to accelerate meaningfully, with the forecast 53% annualised revenue growth to the end of 2025 noticeably faster than its historical growth of 16% p.a. over the past three years. Compare this with other companies in the same industry, which are forecast to grow their revenue 12% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Ubtech Robotics is expected to grow much faster than its industry.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses this year, suggesting all may not be well at Ubtech Robotics. While analysts did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. With a serious cut to this year's expectations and a falling price target, we wouldn't be surprised if investors were becoming wary of Ubtech Robotics.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At Simply Wall St, we have a full range of analyst estimates for Ubtech Robotics going out to 2027, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies backed by insiders.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English