Black Sesame International Holding Limited (HKG:2533) Stocks Pounded By 35% But Not Lagging Industry On Growth Or Pricing

To the annoyance of some shareholders, Black Sesame International Holding Limited (HKG:2533) shares are down a considerable 35% in the last month, which continues a horrid run for the company. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

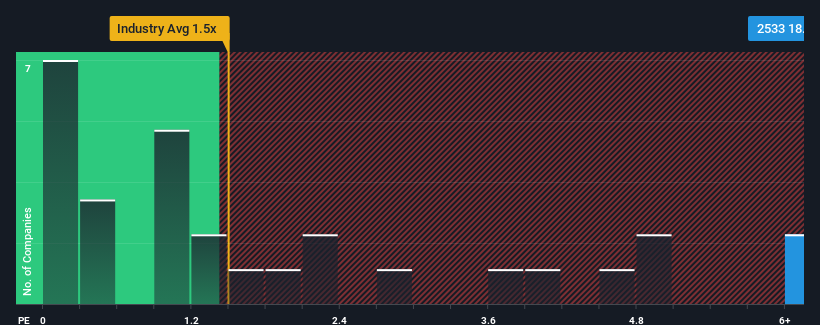

In spite of the heavy fall in price, given around half the companies in Hong Kong's Semiconductor industry have price-to-sales ratios (or "P/S") below 1.5x, you may still consider Black Sesame International Holding as a stock to avoid entirely with its 18.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Black Sesame International Holding

What Does Black Sesame International Holding's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Black Sesame International Holding has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Black Sesame International Holding will help you uncover what's on the horizon.How Is Black Sesame International Holding's Revenue Growth Trending?

In order to justify its P/S ratio, Black Sesame International Holding would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 52% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 69% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 19%, which is noticeably less attractive.

With this information, we can see why Black Sesame International Holding is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Black Sesame International Holding's P/S Mean For Investors?

Even after such a strong price drop, Black Sesame International Holding's P/S still exceeds the industry median significantly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Black Sesame International Holding maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Semiconductor industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Black Sesame International Holding you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English