Hangzhou SF Intra-city Industrial Co., Ltd. (HKG:9699) Not Flying Under The Radar

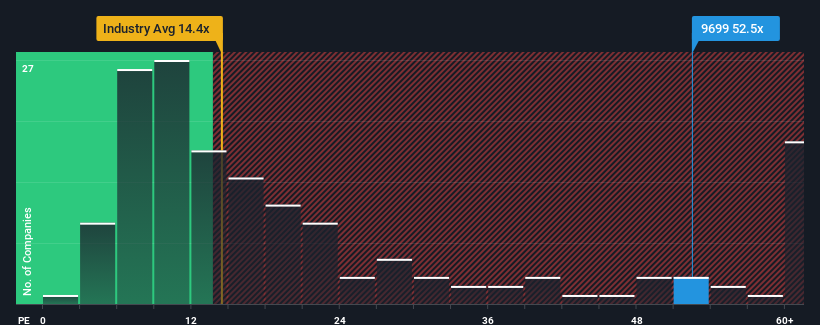

When close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 10x, you may consider Hangzhou SF Intra-city Industrial Co., Ltd. (HKG:9699) as a stock to avoid entirely with its 52.5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times have been advantageous for Hangzhou SF Intra-city Industrial as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Hangzhou SF Intra-city Industrial

How Is Hangzhou SF Intra-city Industrial's Growth Trending?

Hangzhou SF Intra-city Industrial's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 109% last year. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 64% per annum over the next three years. That's shaping up to be materially higher than the 14% per year growth forecast for the broader market.

With this information, we can see why Hangzhou SF Intra-city Industrial is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Hangzhou SF Intra-city Industrial's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Hangzhou SF Intra-city Industrial's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Hangzhou SF Intra-city Industrial with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might also be able to find a better stock than Hangzhou SF Intra-city Industrial. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English