Guotai Junan International Holdings (HKG:1788) Will Pay A Larger Dividend Than Last Year At HK$0.02

Guotai Junan International Holdings Limited (HKG:1788) has announced that it will be increasing its dividend from last year's comparable payment on the 17th of June to HK$0.02. This takes the annual payment to 4.2% of the current stock price, which is about average for the industry.

Guotai Junan International Holdings' Projections Indicate Future Payments May Be Unsustainable

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. The last payment made up 88% of earnings, but cash flows were much higher. This leaves plenty of cash for reinvestment into the business.

If the company can't turn things around, EPS could fall by 20.8% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could reach 99%, which could put the dividend in jeopardy if the company's earnings don't improve.

Check out our latest analysis for Guotai Junan International Holdings

Dividend Volatility

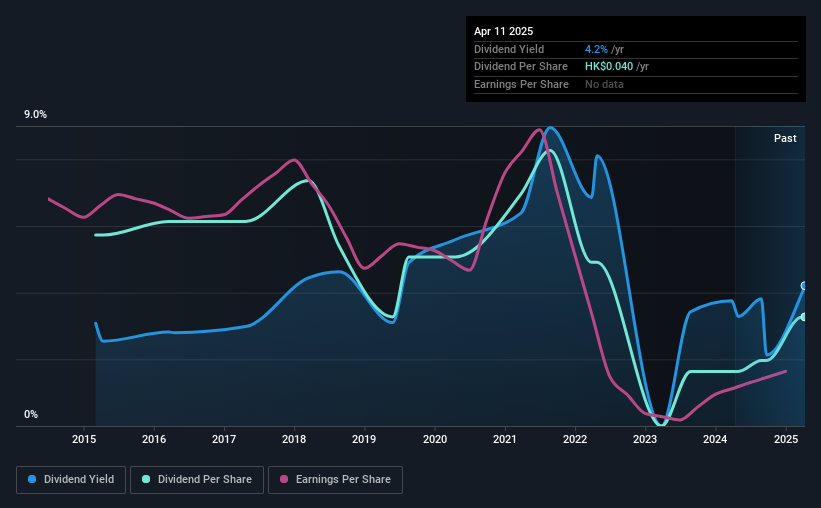

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2015, the annual payment back then was HK$0.07, compared to the most recent full-year payment of HK$0.04. The dividend has shrunk at around 5.4% a year during that period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth Potential Is Shaky

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Earnings per share has been sinking by 21% over the last five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

Our Thoughts On Guotai Junan International Holdings' Dividend

In summary, while it's always good to see the dividend being raised, we don't think Guotai Junan International Holdings' payments are rock solid. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We don't think Guotai Junan International Holdings is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 2 warning signs for Guotai Junan International Holdings (of which 1 makes us a bit uncomfortable!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English