High Growth Tech Stocks in Asia with Promising Potential

Amid mixed performances in global markets, the Asian tech sector is drawing attention as smaller-cap indexes like the S&P MidCap 400 and Russell 2000 have recently outperformed larger counterparts. In light of ongoing trade tensions and economic uncertainties, investors are increasingly focused on companies with robust growth potential and innovative capabilities that can navigate these challenging conditions effectively.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 32.80% | 30.38% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Delton Technology (Guangzhou) | 21.21% | 24.38% | ★★★★★★ |

| Accton Technology | 23.22% | 27.16% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

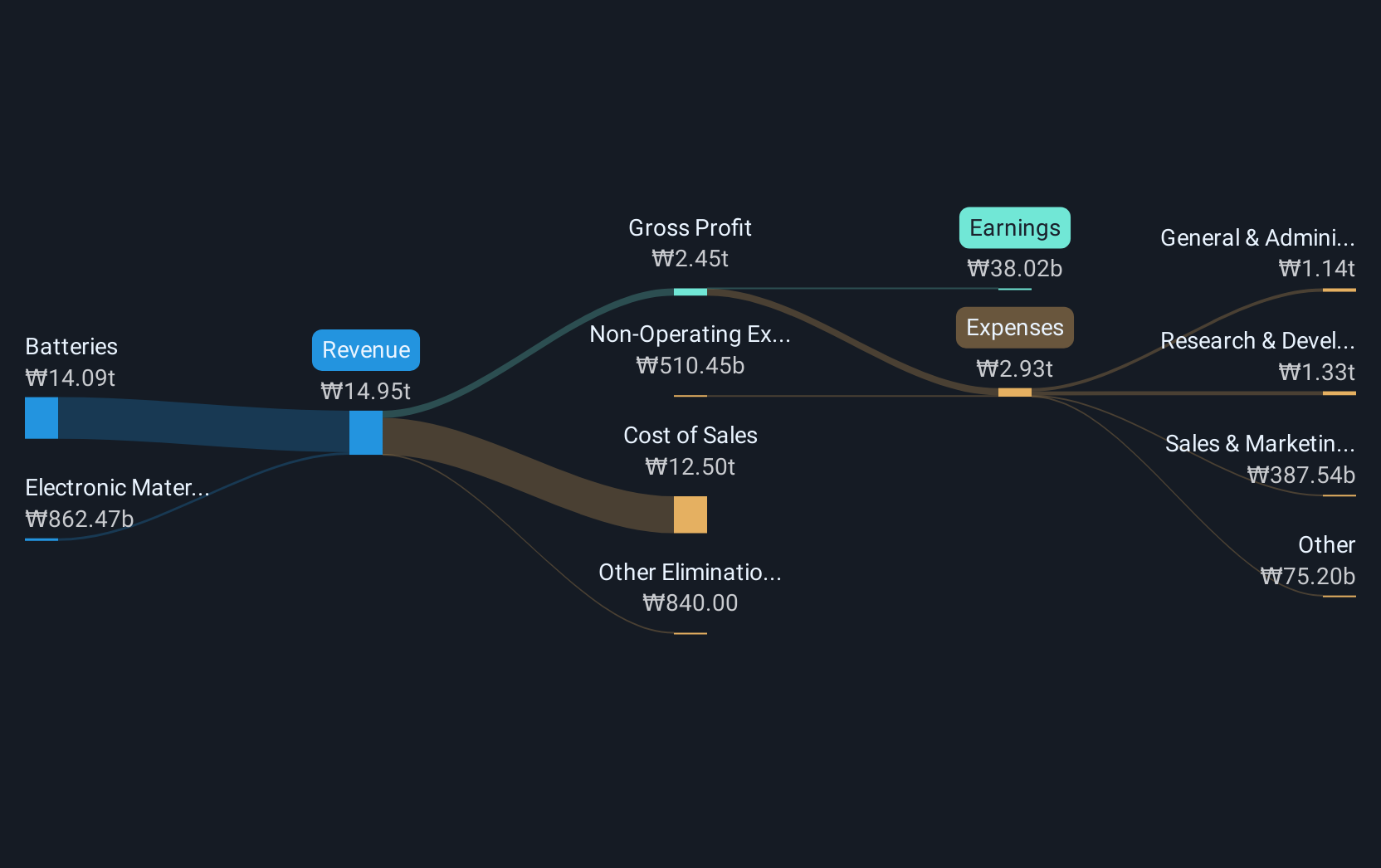

Samsung SDI (KOSE:A006400)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Samsung SDI Co., Ltd. is a global manufacturer and seller of batteries with operations across South Korea, Europe, China, North America, Southeast Asia, and other international markets with a market cap of ₩12.62 trillion.

Operations: The company's primary revenue stream is from the Energy Solution segment, generating ₩15.69 trillion, while the Electronic Material segment contributes ₩901 billion.

Samsung SDI is making significant strides in the high-growth tech sector, particularly with its recent advancements in battery technology. The company has pioneered the production of 46-series cylindrical batteries, enhancing energy density and safety features through innovative materials like high-nickel NCA cathodes and SCN anodes. This development not only positions Samsung SDI as a leader in battery solutions for micro-mobility and potentially electric vehicles but also underscores its commitment to technological innovation, evidenced by a substantial R&D expense ratio that consistently aligns with or exceeds industry norms. Additionally, Samsung SDI's financial performance reflects robust growth prospects with forecasted revenue and earnings growth rates of 12.7% and 32.7% per year respectively, outpacing the Korean market averages significantly. These factors combined suggest that Samsung SDI is well-equipped to maintain its competitive edge in the evolving tech landscape.

- Click here to discover the nuances of Samsung SDI with our detailed analytical health report.

Explore historical data to track Samsung SDI's performance over time in our Past section.

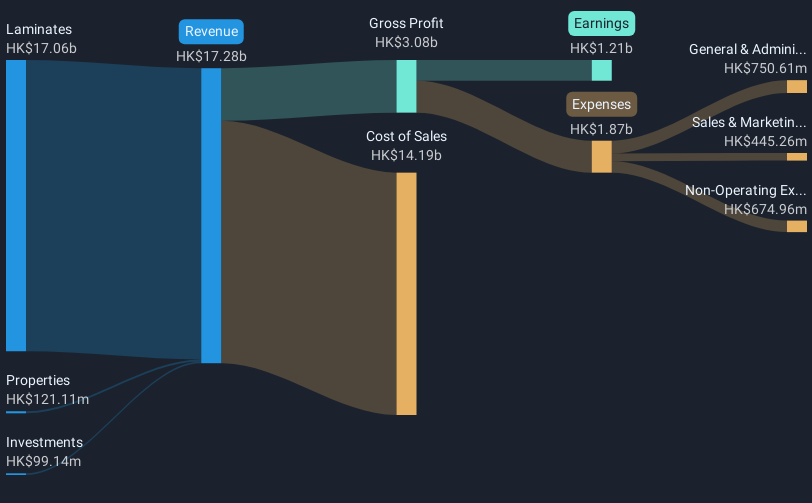

Kingboard Laminates Holdings (SEHK:1888)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingboard Laminates Holdings Limited is an investment holding company that manufactures and sells laminates across the People's Republic of China, Europe, other Asian countries, and the United States with a market cap of HK$25.24 billion.

Operations: Kingboard Laminates Holdings focuses on the production and sale of laminates, catering to markets in China, Europe, other Asian countries, and the United States. The company operates with a market capitalization of HK$25.24 billion.

Kingboard Laminates Holdings has demonstrated a robust performance with its earnings surging by 46.1% over the past year, significantly outpacing the electronic industry's growth of 17.1%. This surge is reflected in its impressive annual revenue and earnings growth projections at 11.4% and 23.2%, respectively, both exceeding Hong Kong market averages. The company's commitment to innovation is evident from its R&D investments, aligning with industry norms to foster advancements in laminate solutions for electronics. Recent financial disclosures reveal a year-over-year sales increase to HKD 18.54 billion and a net income boost to HKD 1.33 billion, underscoring strong operational execution and market responsiveness. Additionally, Kingboard has enhanced shareholder returns through increased dividends, proposing an ordinary dividend of HKD 0.2 per share alongside a special dividend of HKD 0.3 per share for FY2024.

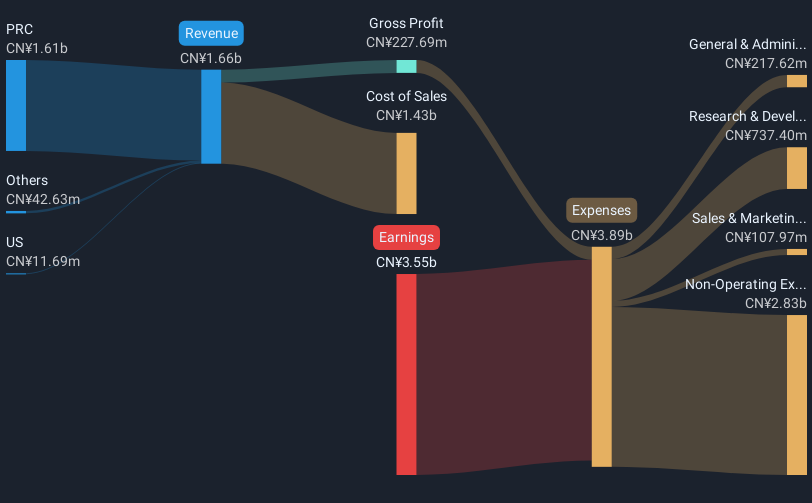

Robosense Technology (SEHK:2498)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Robosense Technology Co., Ltd is an investment holding company that offers LiDAR and perception solutions across the People’s Republic of China, the United States, and internationally, with a market capitalization of HK$16.14 billion.

Operations: Robosense Technology Co., Ltd focuses on providing LiDAR and perception solutions, with significant revenue generated from the Industrial Automation & Controls segment, amounting to CN¥1.65 billion.

Robosense Technology, a trailblazer in digital LiDAR systems, has made significant strides with its latest automotive LiDAR model, EMX, which promises enhanced driving precision through features like high-density scans and robust environmental adaptability. This innovation aligns with the company's 27.2% annual revenue growth and positions it as a leader in the automotive intelligence sector. Despite a net loss reduction to CNY 481.83 million from CNY 4.33 billion last year, Robosense's strategic focus on R&D (spending figures not specified) supports its rapid product development and market penetration efforts—evidenced by recent collaborations like that with LionsBot to enhance robotic visual perception capabilities in cleaning applications. These moves underscore Robosense’s potential to reshape technological landscapes and drive future growth within the high-tech industry in Asia.

- Get an in-depth perspective on Robosense Technology's performance by reading our health report here.

Next Steps

- Discover the full array of 500 Asian High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English