Exploring High Growth Tech Stocks in Asia April 2025

As trade tensions between the U.S. and China show signs of easing, Asian markets are experiencing a renewed sense of optimism, particularly in the technology sector where growth prospects remain robust. In this environment, identifying high-growth tech stocks involves looking for companies that not only demonstrate strong innovation and adaptability but also have the potential to thrive amid shifting global economic dynamics.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.85% | 28.85% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Delton Technology (Guangzhou) | 21.21% | 24.38% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 31.40% | 31.62% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of antibody drugs with a market cap of HK$88.77 billion.

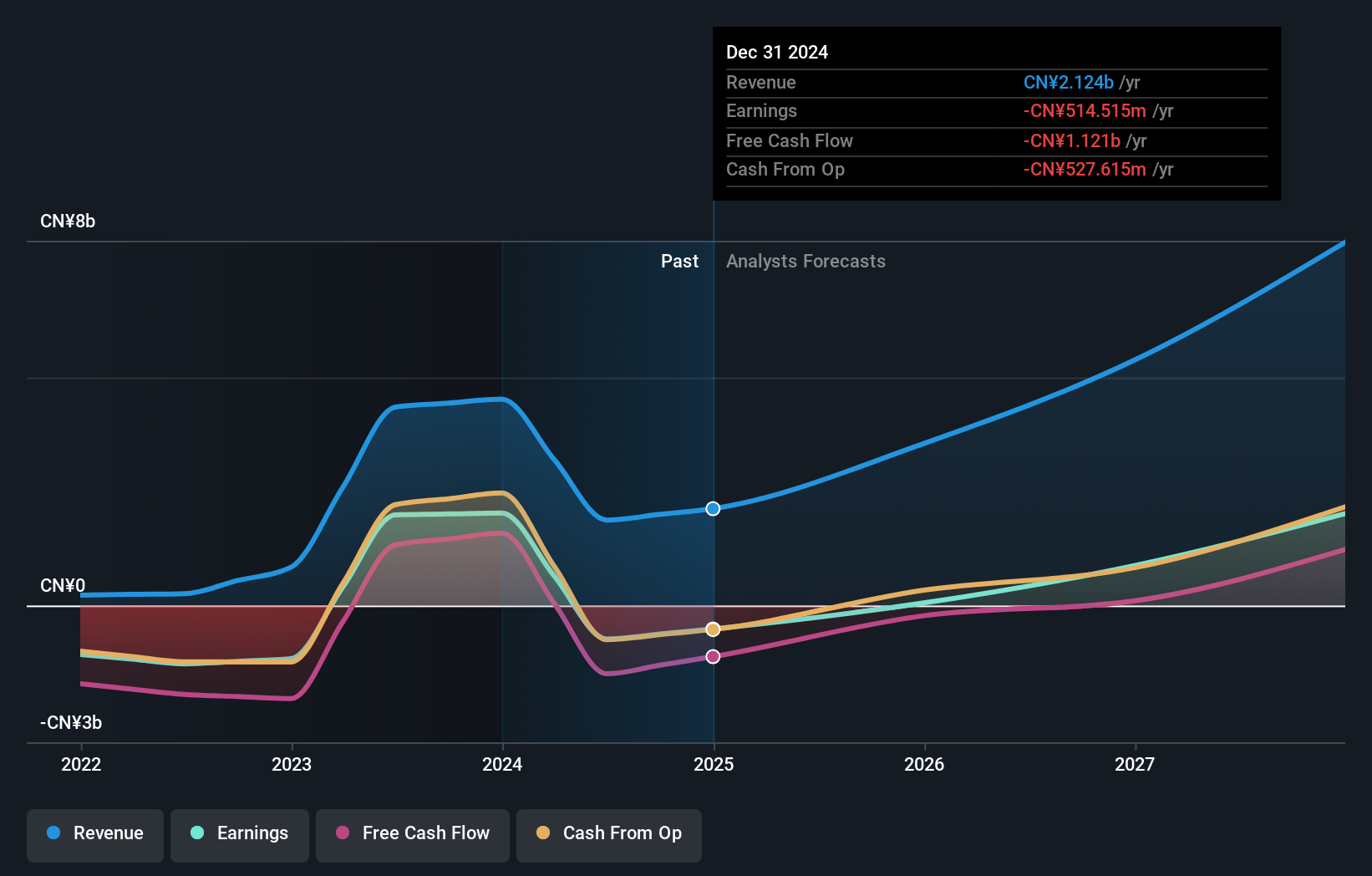

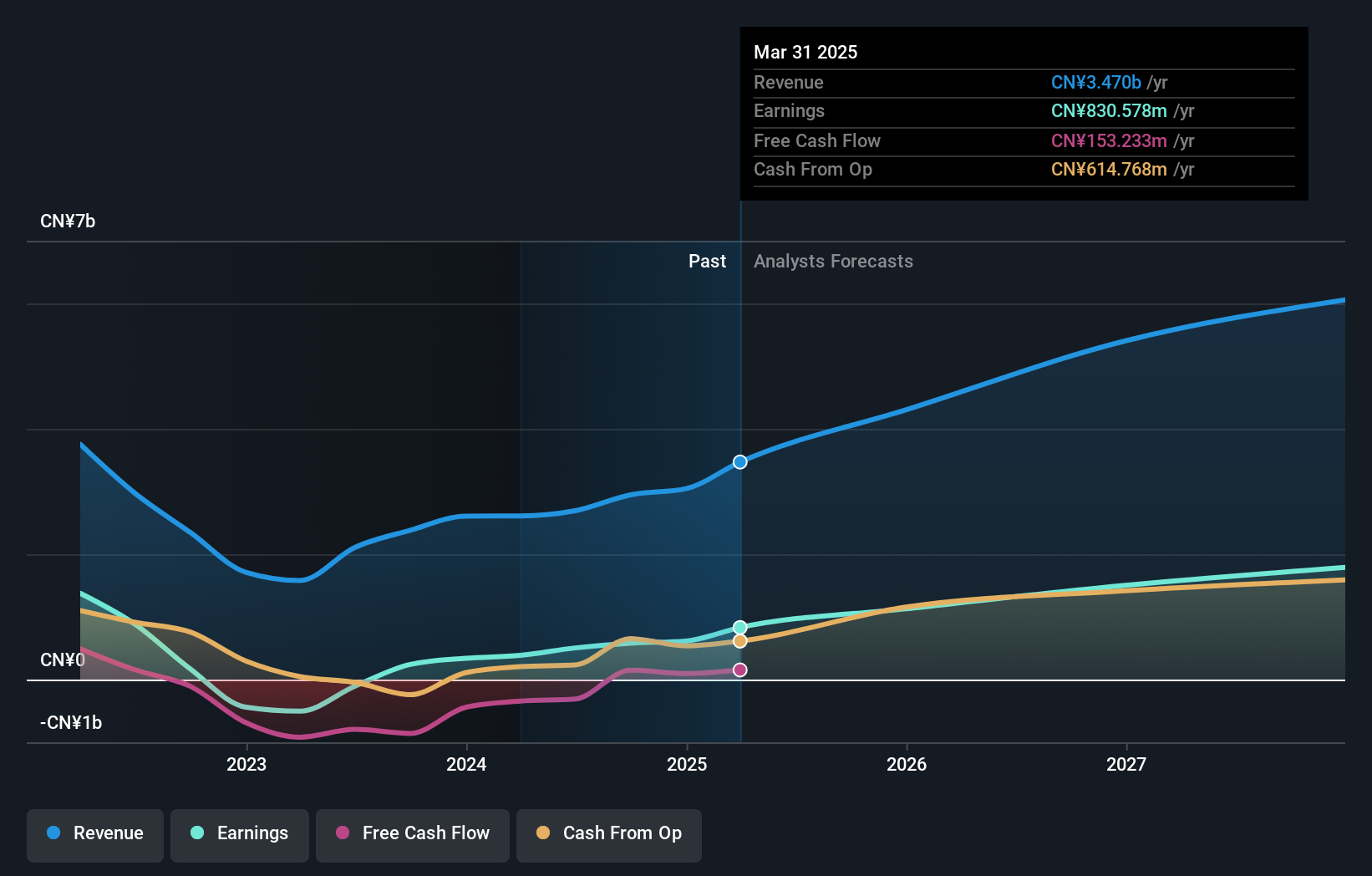

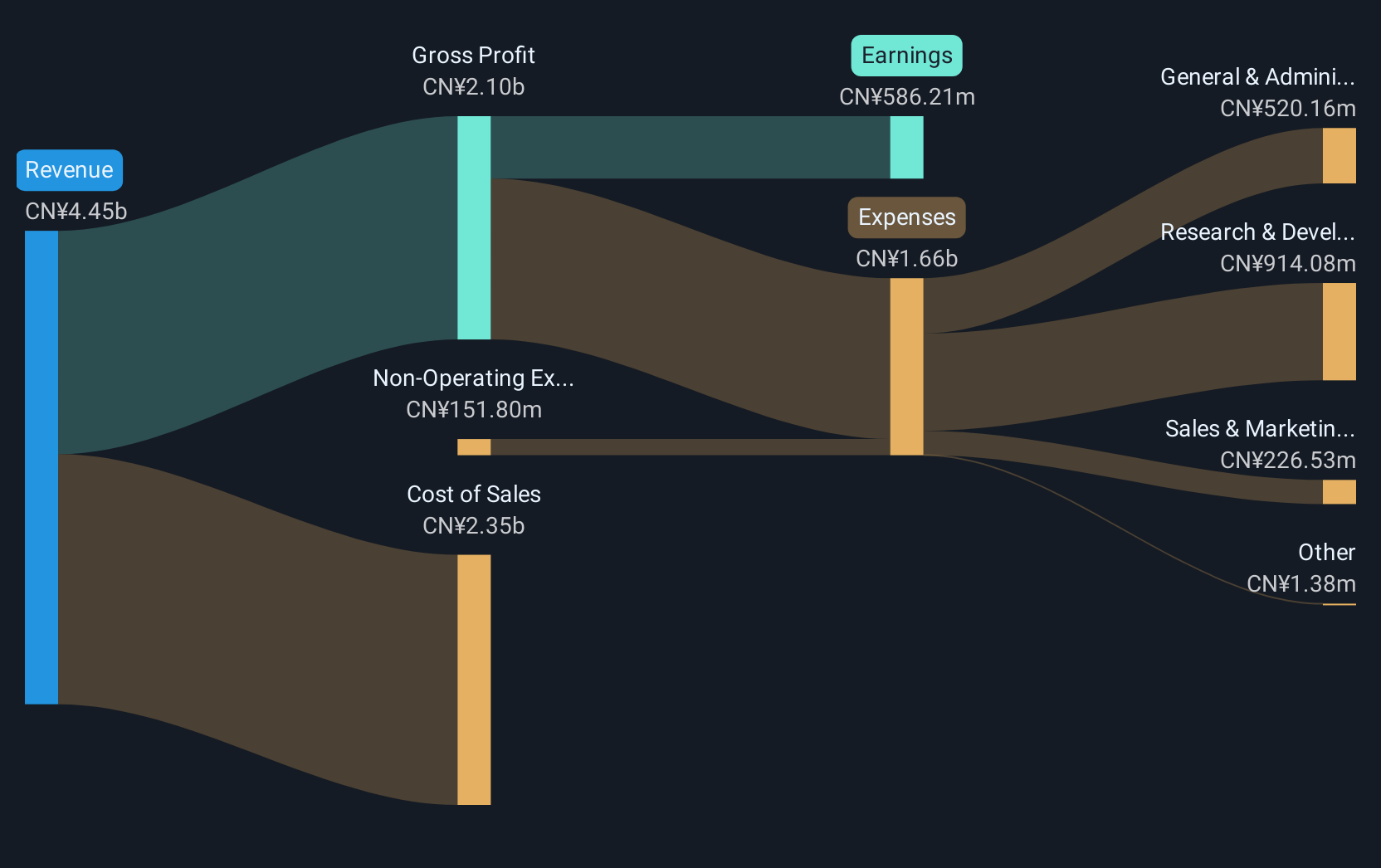

Operations: The company generates revenue primarily from the research, development, production, and sale of biopharmaceutical products, amounting to CN¥2.12 billion.

Akeso, Inc. recently achieved significant regulatory milestones with its innovative biologics, underscoring its potential in high-growth tech sectors within Asia. The company's PD-1/VEGF bispecific antibody, ivonescimab, received NMPA approval for first-line treatment of non-small cell lung cancer (NSCLC), demonstrating superior efficacy with a progression-free survival rate of 11.14 months compared to competitors. Additionally, Akeso's entry into the U.S. market was marked by FDA approval of penpulimab-kcqx for treating nasopharyngeal carcinoma, highlighting its robust international expansion strategy and innovative drug development capabilities. These approvals not only enhance Akeso's therapeutic portfolio but also position it strongly in the competitive oncology sector with projected annual revenue growth at 29.3% and an anticipated leap into profitability within three years.

- Get an in-depth perspective on Akeso's performance by reading our health report here.

Review our historical performance report to gain insights into Akeso's's past performance.

Gan & Lee Pharmaceuticals (SHSE:603087)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gan & Lee Pharmaceuticals is a biopharmaceutical company focused on the research, development, production, and sale of insulin analog active pharmaceutical ingredients and injections in China, with a market capitalization of CN¥29.74 billion.

Operations: Gan & Lee Pharmaceuticals specializes in the production and sale of insulin analog active pharmaceutical ingredients (APIs) and injections, primarily targeting the Chinese market. The company focuses on research and development to support its product offerings in the biopharmaceutical sector.

Gan & Lee Pharmaceuticals has demonstrated a robust performance with first-quarter sales soaring to CNY 984.87 million from CNY 560.33 million year-over-year, complemented by a net income jump to CNY 311.92 million from CNY 96 million. This growth trajectory is mirrored in their aggressive share repurchase strategy, having bought back over 2.1 million shares for approximately CNY 89.92 million since the beginning of the year. Concurrently, their innovative strides in global markets are evident as they advance bofanglutide, a promising GLP-1 receptor agonist, into Phase 2 trials in the U.S., directly challenging established therapies with potential superior efficacy in weight management—a move that could significantly alter competitive dynamics in this high-stakes segment.

- Unlock comprehensive insights into our analysis of Gan & Lee Pharmaceuticals stock in this health report.

Evaluate Gan & Lee Pharmaceuticals' historical performance by accessing our past performance report.

Raytron TechnologyLtd (SHSE:688002)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Raytron Technology Co., Ltd. focuses on the R&D, design, manufacturing, and sales of uncooled infrared imaging and MEMS sensor technology in China, with a market cap of CN¥24.87 billion.

Operations: Raytron specializes in uncooled infrared imaging and MEMS sensor technology, driving its revenue through product sales in China. The company operates within the high-tech sector, emphasizing innovation and development in its core areas.

Raytron Technology Co., Ltd. has shown a consistent upward trajectory, with first-quarter sales rising to CNY 1.14 billion, up from CNY 1.01 billion year-over-year, and net income increasing to CNY 145.82 million from CNY 128.57 million in the same period. This growth is complemented by a strategic share repurchase program, where the company bought back 661,000 shares for CNY 35.26 million in the first quarter of this year alone. Highlighting its innovative edge within Asia's tech landscape, Raytron's commitment to R&D is evident as it continues to invest in new technologies that drive its financial performance forward—evidenced by an earnings forecast promising a robust annual growth of approximately 26.7%. These figures not only underscore Raytron’s strong market position but also hint at its potential to shape future industry trends through technological advancements and smart capital allocation strategies.

- Delve into the full analysis health report here for a deeper understanding of Raytron TechnologyLtd.

Assess Raytron TechnologyLtd's past performance with our detailed historical performance reports.

Make It Happen

- Gain an insight into the universe of 479 Asian High Growth Tech and AI Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English