A Look Ahead: Navios Maritime Partners's Earnings Forecast

Navios Maritime Partners (NYSE:NMM) is gearing up to announce its quarterly earnings on Wednesday, 2025-05-07. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Navios Maritime Partners will report an earnings per share (EPS) of $2.84.

Investors in Navios Maritime Partners are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

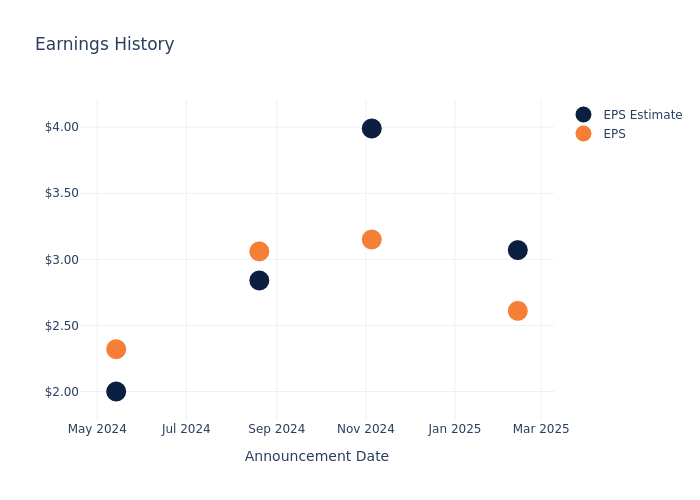

Earnings History Snapshot

Last quarter the company missed EPS by $0.46, which was followed by a 0.18% increase in the share price the next day.

Here's a look at Navios Maritime Partners's past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 3.07 | 3.99 | 2.84 | 2 |

| EPS Actual | 2.61 | 3.15 | 3.06 | 2.32 |

| Price Change % | 0.0% | -1.0% | -2.0% | -1.0% |

Market Performance of Navios Maritime Partners's Stock

Shares of Navios Maritime Partners were trading at $36.37 as of May 05. Over the last 52-week period, shares are down 21.95%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English