Here's Why We Think Goodbaby International Holdings (HKG:1086) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Goodbaby International Holdings (HKG:1086), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Quickly Is Goodbaby International Holdings Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Recognition must be given to the that Goodbaby International Holdings has grown EPS by 42% per year, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

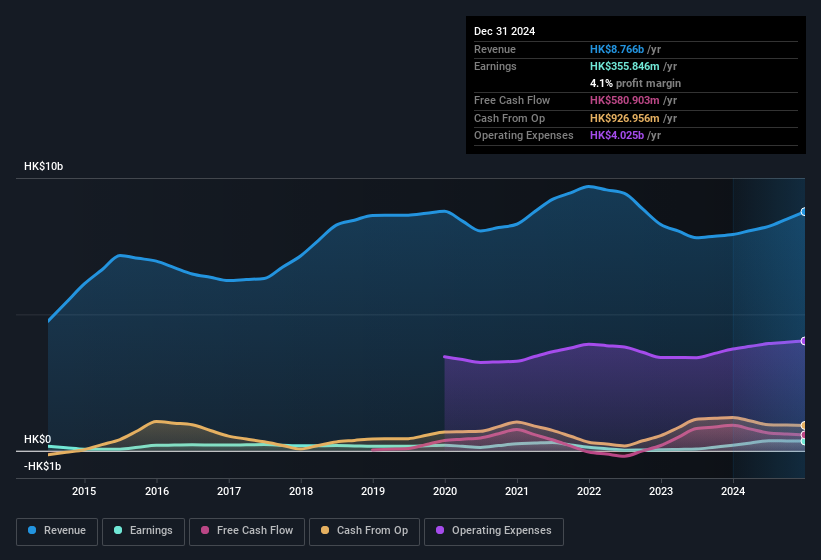

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Goodbaby International Holdings shareholders is that EBIT margins have grown from 3.0% to 5.5% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

See our latest analysis for Goodbaby International Holdings

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Goodbaby International Holdings' balance sheet strength, before getting too excited.

Are Goodbaby International Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One shining light for Goodbaby International Holdings is the serious outlay one insider has made to buy shares, in the last year. In one big hit, Executive Chairman of CYBEX & Executive Director Martin Pos paid HK$13m, for shares at an average price of HK$0.47 per share. Big insider buys like that are a rarity and should prompt discussion on the merits of the business.

On top of the insider buying, it's good to see that Goodbaby International Holdings insiders have a valuable investment in the business. With a whopping HK$396m worth of shares as a group, insiders have plenty riding on the company's success. That holding amounts to 16% of the stock on issue, thus making insiders influential owners of the business and aligned with the interests of shareholders.

Is Goodbaby International Holdings Worth Keeping An Eye On?

Goodbaby International Holdings' earnings per share growth have been climbing higher at an appreciable rate. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Goodbaby International Holdings deserves timely attention. It is worth noting though that we have found 2 warning signs for Goodbaby International Holdings that you need to take into consideration.

Keen growth investors love to see insider activity. Thankfully, Goodbaby International Holdings isn't the only one. You can see a a curated list of Hong Kong companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English