AEON Credit Service (Asia) (HKG:900) Will Pay A Larger Dividend Than Last Year At HK$0.25

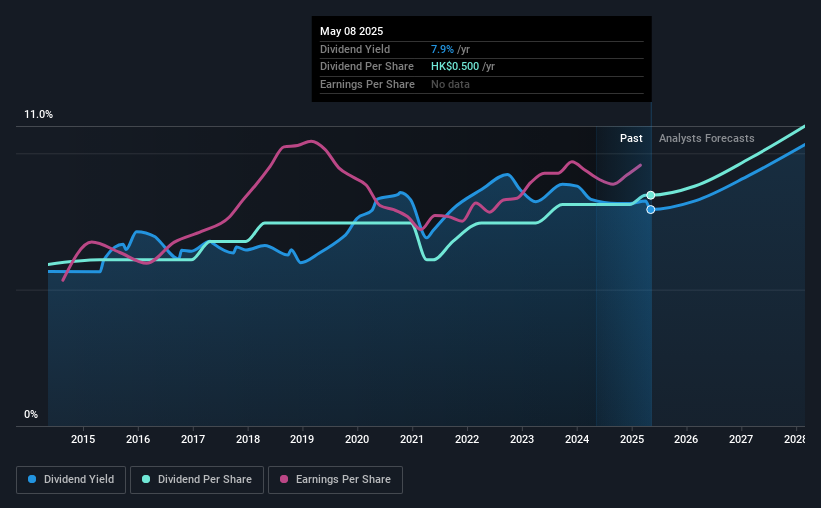

AEON Credit Service (Asia) Company Limited (HKG:900) has announced that it will be increasing its dividend from last year's comparable payment on the 31st of July to HK$0.25. The payment will take the dividend yield to 7.9%, which is in line with the average for the industry.

Our free stock report includes 2 warning signs investors should be aware of before investing in AEON Credit Service (Asia). Read for free now.AEON Credit Service (Asia)'s Projected Earnings Seem Likely To Cover Future Distributions

Solid dividend yields are great, but they only really help us if the payment is sustainable. Based on the last dividend, AEON Credit Service (Asia) is earning enough to cover the payment, but then it makes up 177% of cash flows. While the company may be more focused on returning cash to shareholders than growing the business at this time, we think that a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

Over the next year, EPS is forecast to expand by 50.5%. Assuming the dividend continues along recent trends, we think the payout ratio could be 35% by next year, which is in a pretty sustainable range.

Check out our latest analysis for AEON Credit Service (Asia)

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The annual payment during the last 10 years was HK$0.35 in 2015, and the most recent fiscal year payment was HK$0.50. This means that it has been growing its distributions at 3.6% per annum over that time. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

AEON Credit Service (Asia) May Find It Hard To Grow The Dividend

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. AEON Credit Service (Asia) hasn't seen much change in its earnings per share over the last five years. Growth of 1.6% per annum is not particularly high, which might explain why the company is paying out a higher proportion of earnings. This isn't bad in itself, but unless earnings growth pick up we wouldn't expect dividends to grow either.

Our Thoughts On AEON Credit Service (Asia)'s Dividend

In summary, while it's always good to see the dividend being raised, we don't think AEON Credit Service (Asia)'s payments are rock solid. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We don't think AEON Credit Service (Asia) is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 2 warning signs for AEON Credit Service (Asia) (1 makes us a bit uncomfortable!) that you should be aware of before investing. Is AEON Credit Service (Asia) not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English