Lifetime Brands, Inc. (NASDAQ:LCUT) Just Reported, And Analysts Assigned A US$6.00 Price Target

Lifetime Brands, Inc. (NASDAQ:LCUT) shareholders are probably feeling a little disappointed, since its shares fell 9.8% to US$3.23 in the week after its latest first-quarter results. It was a pretty bad result overall; while revenues were in line with expectations at US$140m, statutory losses exploded to US$0.19 per share. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

We've discovered 2 warning signs about Lifetime Brands. View them for free.

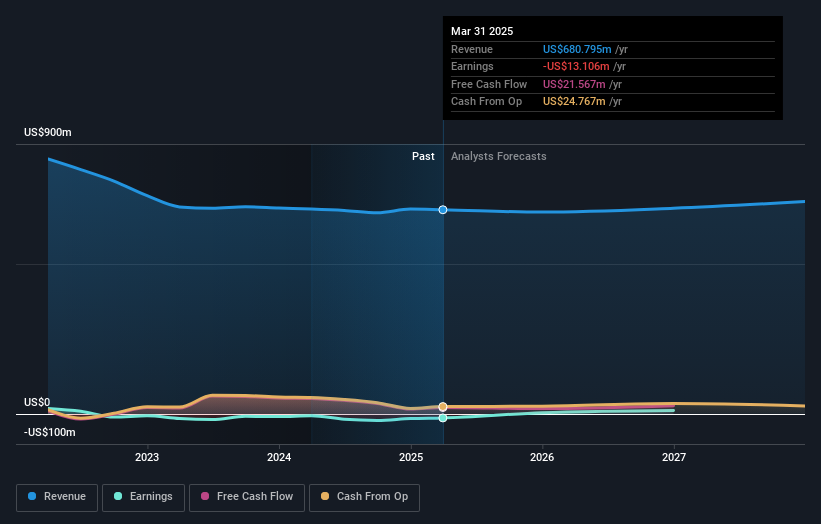

Taking into account the latest results, Lifetime Brands' twin analysts currently expect revenues in 2025 to be US$673.0m, approximately in line with the last 12 months. Lifetime Brands is also expected to turn profitable, with statutory earnings of US$0.01 per share. Yet prior to the latest earnings, the analysts had been anticipated revenues of US$693.1m and earnings per share (EPS) of US$0.30 in 2025. The analysts seem less optimistic after the recent results, reducing their revenue forecasts and making a large cut to earnings per share numbers.

Check out our latest analysis for Lifetime Brands

The consensus price target fell 29% to US$6.00, with the weaker earnings outlook clearly leading valuation estimates.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would also point out that the forecast 1.5% annualised revenue decline to the end of 2025 is better than the historical trend, which saw revenues shrink 3.8% annually over the past five years Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 4.1% annually. So while a broad number of companies are forecast to grow, unfortunately Lifetime Brands is expected to see its revenue affected worse than other companies in the industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Lifetime Brands. Unfortunately, they also downgraded their revenue estimates, and our data indicates underperformance compared to the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of Lifetime Brands' future valuation.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for Lifetime Brands going out as far as 2027, and you can see them free on our platform here.

Plus, you should also learn about the 2 warning signs we've spotted with Lifetime Brands .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English