These Analysts Revise Their Forecasts On Karyopharm Therapeutics After Q1 Results

Karyopharm Therapeutics Inc. (NASDAQ:KPTI) reported mixed financial results for the first quarter on Monday.

The company posted quarterly losses of $2.77 per share which beat the analyst consensus estimate of losses of $4.16 per share. The company reported quarterly sales of $30.02 million which missed the analyst consensus estimate of $35.24 million.

“We are pleased that our Phase 3 SENTRY trial in patients with JAKi-naïve myelofibrosis has passed its pre-specified futility analysis and continues as planned without modifications. Our conviction in this trial is further strengthened by our new data in hard-to-treat myelofibrosis patients where we observed spleen volume reduction, symptom improvement, hemoglobin stabilization and evidence of disease modification with selinexor monotherapy, addressing all four hallmarks of the disease,” said Richard Paulson, President and Chief Executive Officer of Karyopharm.

Karyopharm Therapeutics affirmed FY2025 sales guidance of $140.00 million to $155.00 million versus market estimates of $149.32 million.

Karyopharm Therapeutics shares fell 15.6% to trade at $5.17 on Tuesday.

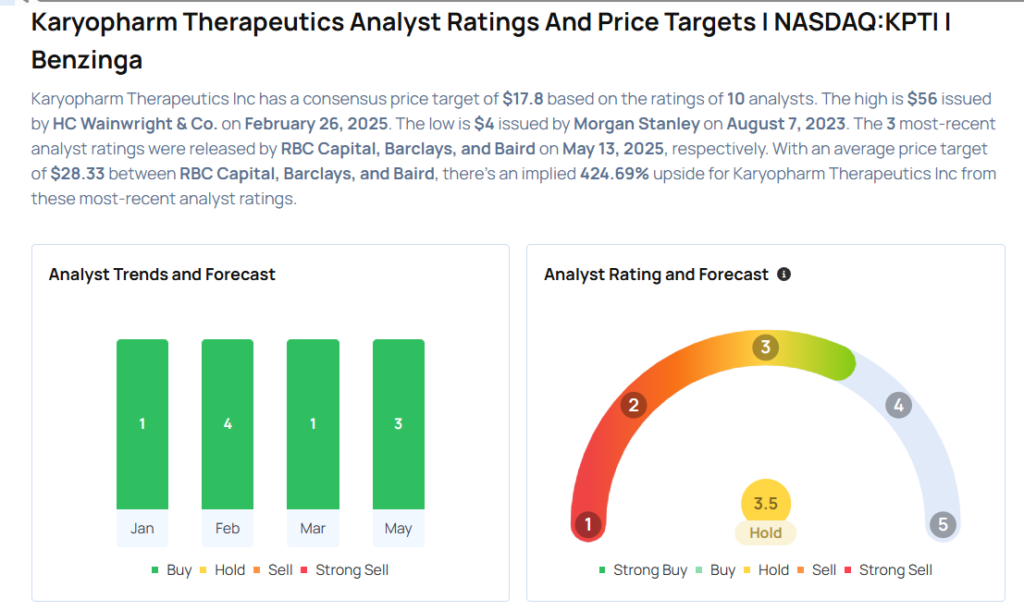

These analysts made changes to their price targets on Karyopharm Therapeutics following earnings announcement.

- Baird analyst Michael Ulz maintained Karyopharm Therapeutics with an Outperform rating and lowered the price target from $54 to $42.

- Barclays analyst Peter Lawson maintained the stock with an Overweight rating and raised the price target from $5 to $10.

- RBC Capital analyst Brian Abrahams maintained Karyopharm Therapeutics with an Outperform rating and lowered the price target from $34 to $33.

Considering buying KPTI stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English