3 Premier Undervalued Small Caps With Insider Buying In Asian Markets

In recent weeks, Asian markets have been buoyed by positive trade developments and monetary policy adjustments, with small-cap indices showing resilience amid broader economic uncertainties. As investors navigate these dynamic conditions, identifying small-cap stocks with solid fundamentals and potential insider confidence can be a strategic approach to uncovering value in the region's diverse markets.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.6x | 1.1x | 37.40% | ★★★★★★ |

| Atturra | 29.7x | 1.2x | 33.87% | ★★★★★☆ |

| Hansen Technologies | 288.3x | 2.8x | 23.41% | ★★★★★☆ |

| Viva Energy Group | NA | 0.1x | 46.57% | ★★★★★☆ |

| Puregold Price Club | 9.0x | 0.4x | 28.61% | ★★★★☆☆ |

| Dicker Data | 19.9x | 0.7x | -41.53% | ★★★★☆☆ |

| Sing Investments & Finance | 7.0x | 3.6x | 43.25% | ★★★★☆☆ |

| Smart Parking | 73.0x | 6.4x | 46.60% | ★★★☆☆☆ |

| Integral Diagnostics | 163.7x | 1.9x | 41.66% | ★★★☆☆☆ |

| Charter Hall Long WALE REIT | NA | 11.5x | 22.51% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

Bravura Solutions (ASX:BVS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bravura Solutions is a software company specializing in providing comprehensive technology solutions for the wealth management and funds administration industries, with a market cap of approximately A$0.22 billion.

Operations: Bravura Solutions generates revenue primarily through its core operations, with recent figures indicating a gross profit margin of 28.72%. The company has experienced fluctuations in net income, with a notable shift to positive net income margins reaching 28.15% as of December 2024, after several periods of negative margins. Operating expenses and non-operating expenses have significantly impacted its financial performance over time.

PE: 13.5x

Bravura Solutions, a tech company in Asia's small-cap sector, recently experienced insider confidence with share purchases by executives in early 2025. Despite being dropped from the S&P/ASX Emerging Companies Index in March 2025, they maintain high-quality earnings despite large one-off items impacting results. However, their reliance on external borrowing presents higher risk. With Shezad Okhai stepping in as interim CEO from April 28, 2025, leadership changes might influence future growth prospects amidst forecasted earnings declines over the next three years.

- Click to explore a detailed breakdown of our findings in Bravura Solutions' valuation report.

Examine Bravura Solutions' past performance report to understand how it has performed in the past.

China XLX Fertiliser (SEHK:1866)

Simply Wall St Value Rating: ★★★★☆☆

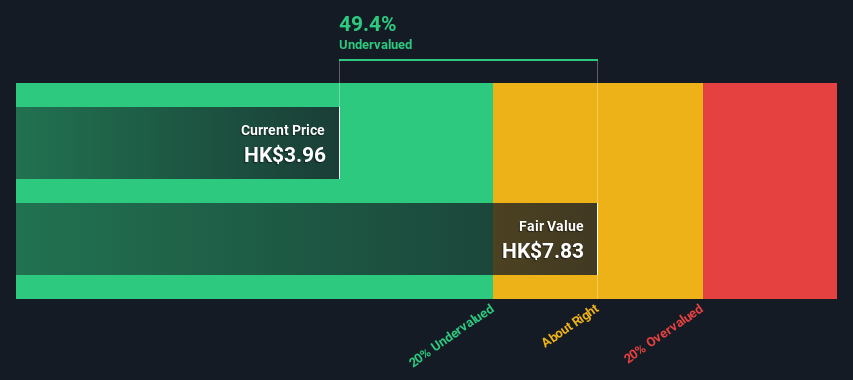

Overview: China XLX Fertiliser is a company engaged in the production and sale of chemical fertilizers, including urea and compound fertilizers, with a market capitalization of CN¥8.5 billion.

Operations: China XLX Fertiliser generates revenue primarily from Urea and Compound Fertiliser, contributing significantly to its total income. The company's gross profit margin has shown variability, reaching 24.49% in September 2021 before declining to 16.91% by December 2024. Operating expenses have consistently impacted profitability, with notable allocations towards general and administrative costs.

PE: 4.2x

China XLX Fertiliser, a company with a focus on agricultural inputs, has shown insider confidence through Qingjin Zhang's purchase of 270,000 shares valued at approximately CNY 1.09 million in March 2025. This move suggests potential optimism about future growth prospects. While earnings are projected to rise by nearly 20% annually, the firm faces challenges with high debt levels and reliance on external borrowing for funding. Despite these hurdles, the company reported an increase in net income to CNY 1.46 billion for the year ending December 2024 and proposed a final dividend of RMB 0.26 per share pending approval at their upcoming AGM in June.

- Unlock comprehensive insights into our analysis of China XLX Fertiliser stock in this valuation report.

Gain insights into China XLX Fertiliser's past trends and performance with our Past report.

Sinofert Holdings (SEHK:297)

Simply Wall St Value Rating: ★★★☆☆☆

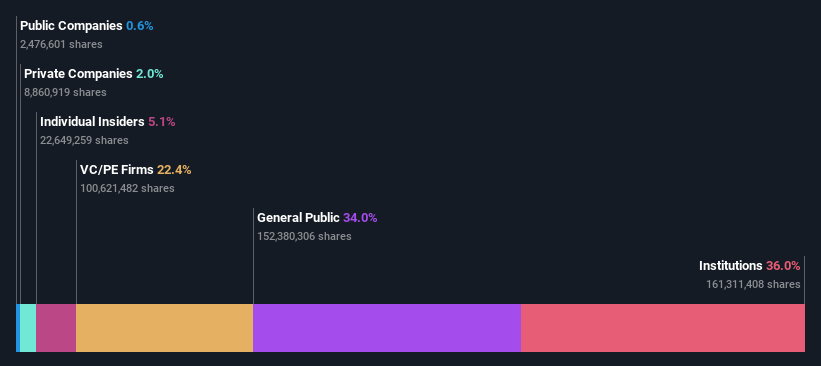

Overview: Sinofert Holdings is a leading fertilizer company in China, involved in the production, distribution, and trading of fertilizers, with a market cap of CN¥3.5 billion.

Operations: Sinofert Holdings generates revenue primarily from its Basic Business and Growth Business segments, contributing CN¥14.05 billion and CN¥10.85 billion, respectively. The company has seen a notable trend in its gross profit margin, which reached 11.76% by the end of 2024 from earlier lower levels, indicating an improvement in profitability relative to cost of goods sold over time.

PE: 7.5x

Sinofert Holdings, a small company in the fertilizer industry, shows potential with its recent financial performance. Despite sales slightly declining to CNY 21.26 billion for 2024 from CNY 21.73 billion in 2023, net income rose significantly to CNY 1.06 billion from CNY 625 million last year, indicating improved profitability. Earnings per share increased to CNY 0.1511 from CNY 0.0891 previously, reflecting operational efficiency gains amidst external borrowing risks due to lack of customer deposits as funding sources.

- Get an in-depth perspective on Sinofert Holdings' performance by reading our valuation report here.

Assess Sinofert Holdings' past performance with our detailed historical performance reports.

Summing It All Up

- Reveal the 65 hidden gems among our Undervalued Asian Small Caps With Insider Buying screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English