Cathie Wood Says Palantir, Tesla, Coinbase And This Amazon Rival Are 'Tip Of The Spear' As Innovation Disrupts Old World In Equity Benchmarks

Fund manager Cathie Wood highlighted a handful of innovative and disruptive stocks that she says are set to displace the old guard in leading equity benchmarks.

What Happened: On Wednesday, the CEO of Ark Invest took to X to reaffirm her conviction in several of the firm's most prominent holdings, describing them as being at the “tip of the spear” as technology-driven innovation disrupts legacy industries and “displaces the old world in equity benchmarks.”

The companies she spotlighted include Tesla Inc. (NASDAQ:TSLA), Palantir Technologies Inc. (NYSE:PLTR), Coinbase Global Inc. (NASDAQ:COIN) and Shopify Inc. (NYSE:SHOP), which represent core positions worth over $2.78 billion across Ark’s family of funds.

This comes following Coinbase Global Inc.’s (NASDAQ:COIN) inclusion into the S&P 500 which was announced early this week, making it the first crypto company to do so. The company is replacing Discover Financial Services Inc. (NYSE:DFS) in the index, which is being acquired.

Wood suggests that traditional index funds are increasingly misaligned with innovation, and says that “benchmarks are likely to chase innovation at an accelerated rate in the years ahead.”

Why It Matters: Wood said on Tuesday that Coinbase’s inclusion into the S&P 500 would compel other index-sensitive fund managers to consider the stock.

Renowned for her bold, high-conviction bets, Wood doubled down on stocks such as Tesla, Coinbase, and Robinhood Markets Inc. (NASDAQ:HOOD) amid the turmoil surrounding equity markets during the first week of April, acquiring $65 million worth of stock.

Speaking at an interview recently, Wood reiterated her bullish stance on Bitcoin (BTC/USD), stating a base-case scenario of $700,000 to $750,000 for the cryptocurrency by 2030, and a bullish case at $1.5 million.

“We have always had a 2030 target, the base case in the $700,000 to $750,000 range, the bull case in the $1.5 million range,” she said, citing the digital currency’s potential to seize gold’s share as a store of value.

| Stocks / ETFs | Year-To-Date Returns | Ark’s Cumulative Holdings |

| Tesla Inc. (NASDAQ:TSLA) | -8.33% | 10.05% |

| Palantir Technologies Inc. (NYSE:PLTR) | +73.13% | 5.49% |

| Coinbase Global Inc. (NASDAQ:COIN) | +2.41% | 7.54% |

| Shopify Inc. (NYSE:SHOP) | +3.65% | 4.67% |

| Robinhood Markets Inc. (NASDAQ:HOOD) | +55.65% | 4.96% |

| Ark Innovation ETF (BATS: ARKK) | -0.09% | – |

| Ark Next Generation Internet ETF (BATS:ARKW) | +9.44% | – |

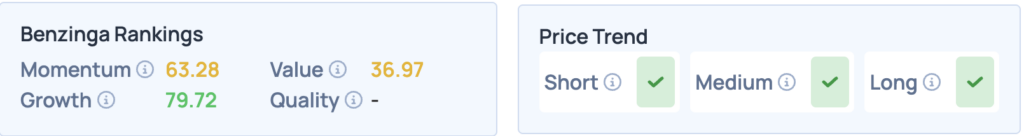

According to Benzinga’s Edge Stock Rankings, Coinbase scores in 79th percentile on growth, with a favorable price trend in the short, medium and long term. Let’s see how it compares with Tesla, Palantir, and other big Ark Invest holdings.

Photo Courtesy: Ira Lichi On Shutterstock.com

Read More:

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English