3 Top Undervalued Small Caps With Recent Insider Action In The Market

The United States market has shown robust performance recently, climbing 4.5% over the last week and 11% over the past year, with earnings projected to grow by 14% per annum in the coming years. In this dynamic environment, identifying stocks that are potentially undervalued yet exhibit recent insider activity can be a strategic approach for investors seeking opportunities within small-cap companies.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 10.7x | 3.0x | 46.18% | ★★★★★☆ |

| Flowco Holdings | 7.2x | 0.8x | 48.99% | ★★★★★☆ |

| Barrett Business Services | 20.9x | 0.9x | 46.76% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.8x | 33.59% | ★★★★☆☆ |

| West Bancorporation | 13.2x | 4.2x | 34.53% | ★★★☆☆☆ |

| Niagen Bioscience | 58.8x | 7.7x | 23.04% | ★★★☆☆☆ |

| Columbus McKinnon | 53.7x | 0.5x | 33.06% | ★★★☆☆☆ |

| MVB Financial | 12.6x | 1.7x | 43.31% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.5x | -2991.48% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.2x | -445.17% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

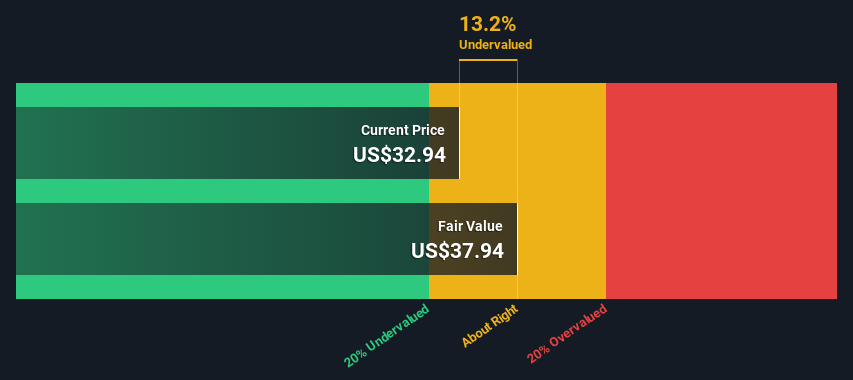

Advance Auto Parts (NYSE:AAP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Advance Auto Parts operates as an automotive aftermarket parts provider, supplying replacement parts, accessories, batteries, and maintenance items for cars and trucks across North America with a market cap of approximately $4.14 billion.

Operations: The company generates its revenue primarily from retail auto parts sales, with recent figures showing a gross profit margin of 42.22%. Operating expenses, including significant general and administrative costs, have had a notable impact on profitability, contributing to a net income margin that has experienced fluctuations over the periods observed.

PE: -3.5x

Advance Auto Parts, a smaller player in the U.S. market, is navigating through a transformative phase. Recently completing store closures, they plan to open 30 new locations this year and 100 more by 2027, enhancing their footprint where they hold strong market positions. Despite reporting a net loss of US$414 million for Q4 2024 and facing funding risks due to reliance on external borrowing, insider confidence remains evident with share purchases earlier this year. Earnings are projected to grow significantly at over 77% annually, suggesting potential for future growth amidst strategic expansion efforts.

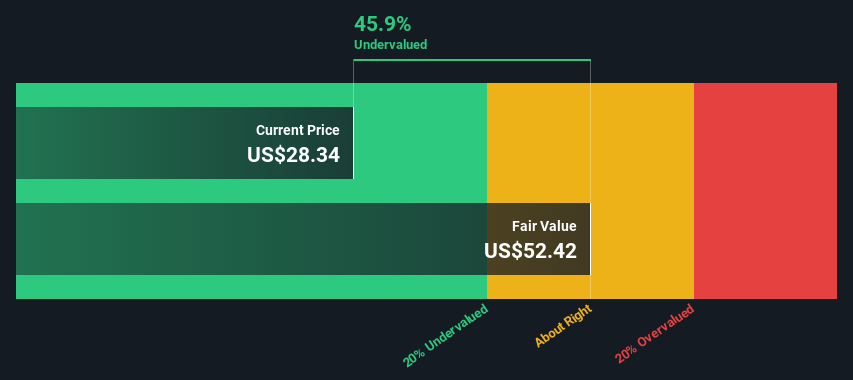

Live Oak Bancshares (NYSE:LOB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Live Oak Bancshares operates as a banking platform primarily focused on providing financial services to small businesses, with a market capitalization of approximately $1.65 billion.

Operations: The primary revenue stream is derived from its banking platform for small businesses, generating $399.32 million. Operating expenses are significant, with general and administrative costs reaching $266.99 million in the latest period. The net income margin has fluctuated over time, recently recorded at 14.93%.

PE: 21.6x

Live Oak Bancshares, a small financial entity, shows mixed signals with a high bad loans ratio of 4.6% and a low allowance for these loans at 39%. Despite these challenges, earnings are projected to grow significantly by 54.45% annually. Recent insider confidence is evident from share purchases in the past six months, suggesting belief in future prospects. The appointment of Patrick T. McHenry to the board may enhance governance and strategic direction amidst recent financial pressures like increased net charge-offs totaling US$6.77 million this quarter compared to US$3.16 million last year.

- Dive into the specifics of Live Oak Bancshares here with our thorough valuation report.

Examine Live Oak Bancshares' past performance report to understand how it has performed in the past.

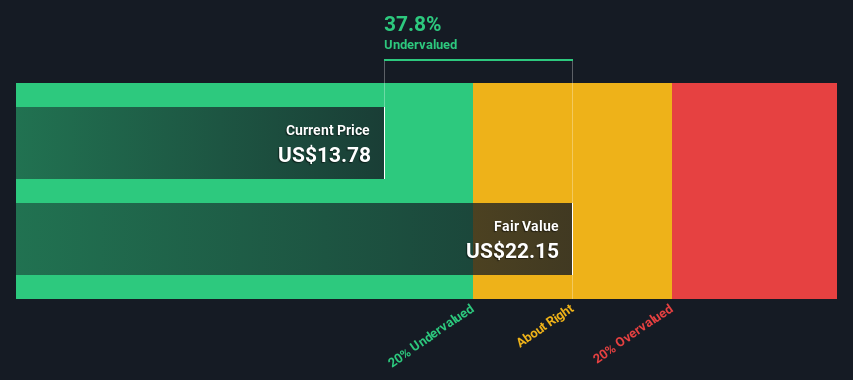

MasterBrand (NYSE:MBC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MasterBrand is a company that specializes in the design and manufacturing of furniture and fixtures, with operations generating approximately $2.72 billion in revenue.

Operations: MasterBrand primarily generates revenue from its Furniture & Fixtures segment, with recent figures showing $2.72 billion in revenue. The company's cost of goods sold (COGS) for the same period was $1.85 billion, contributing to a gross profit margin of 32.18%. Operating expenses include significant allocations towards general and administrative costs, which were $563.6 million in the latest reporting period.

PE: 13.8x

MasterBrand, a company with a focus on cabinetry, recently reported first-quarter sales of US$660.3 million, up from US$638.1 million the previous year, but net income dropped to US$13.3 million from US$37.5 million. Despite declining profit margins and high debt levels, insider confidence is evident as Robert Crisci purchased 20,000 shares for approximately US$307K in February 2025. The company plans to repurchase up to $50 million worth of its shares by March 2028, potentially boosting shareholder value amidst modest sales forecasts for 2025.

- Delve into the full analysis valuation report here for a deeper understanding of MasterBrand.

Gain insights into MasterBrand's historical performance by reviewing our past performance report.

Where To Now?

- Delve into our full catalog of 104 Undervalued US Small Caps With Insider Buying here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English