Goodbaby International Holdings Limited (HKG:1086) Surges 28% Yet Its Low P/E Is No Reason For Excitement

Goodbaby International Holdings Limited (HKG:1086) shareholders have had their patience rewarded with a 28% share price jump in the last month. The annual gain comes to 108% following the latest surge, making investors sit up and take notice.

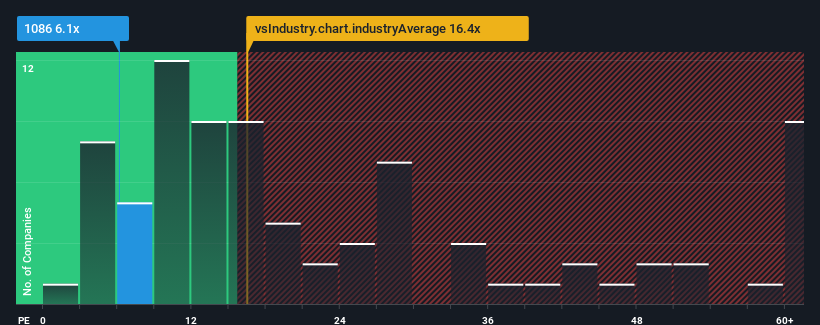

Even after such a large jump in price, Goodbaby International Holdings may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.1x, since almost half of all companies in Hong Kong have P/E ratios greater than 11x and even P/E's higher than 23x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Our free stock report includes 2 warning signs investors should be aware of before investing in Goodbaby International Holdings. Read for free now.Goodbaby International Holdings certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Goodbaby International Holdings

How Is Goodbaby International Holdings' Growth Trending?

In order to justify its P/E ratio, Goodbaby International Holdings would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 75% gain to the company's bottom line. Pleasingly, EPS has also lifted 187% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 13% as estimated by the sole analyst watching the company. With the market predicted to deliver 18% growth , the company is positioned for a weaker earnings result.

With this information, we can see why Goodbaby International Holdings is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Despite Goodbaby International Holdings' shares building up a head of steam, its P/E still lags most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Goodbaby International Holdings' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 2 warning signs for Goodbaby International Holdings you should be aware of.

If these risks are making you reconsider your opinion on Goodbaby International Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English