Flexible Solutions Earnings and Revenues Miss Estimates in Q1

Flexible Solutions International, Inc. FSI reported a loss of 2 cents per share for the first quarter of 2025. This compares to earnings of 4 cents per share in the year-ago quarter. The figure missed the Zacks Consensus Estimate of earnings of 5 cents.

FSI registered revenues of around $7.5 million for the quarter, down roughly 19% year over year. The figure also missed the Zacks Consensus Estimate of $10.2 million.

FSI’s Segment Highlights

Sales from FSI’s Energy and Water Conservation products for the reported quarter fell roughly 3% year over year to around $0.04 million. Sales were impacted by lower customer orders.

Sales of Biodegradable Polymers declined roughly 19% year over year to around $7.4 million in the quarter on reduced customer orders.

FSI’s Financials

Flexible Solutions ended the quarter with cash of roughly $9.6 million, up around 26% from the prior quarter. Long-term debt was roughly $6.5 million, down around 2% sequentially.

Flexible Solutions’ Outlook

Flexible Solutions said the customers who adjusted inventory in the first quarter returned to normal order patterns in April. FSI also noted that new opportunities continue to unfold in applications such as detergent, oil field extraction, water treatment, turf, ornamental and agricultural to further boost sales in the NanoChem division and the ENP subsidiary, which continue to be the dominant sources of its revenues and cash flow. Flexible Solutions also expects its cash resources to be adequate to meet its cash flow requirements and future commitments.

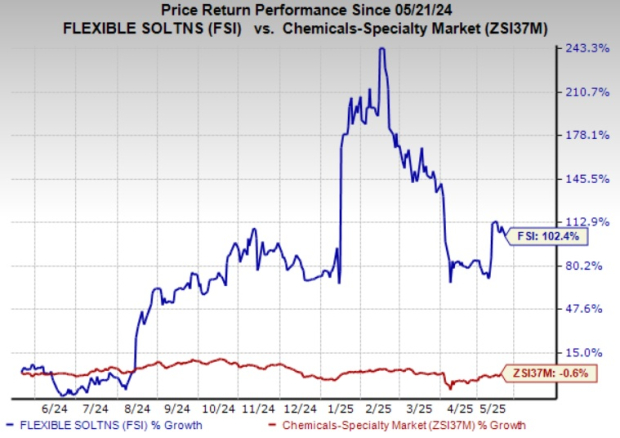

FSI Stock’s Price Performance

Shares of Flexible Solutions have rallied 102.4% over a year against the Zacks Chemicals Specialty industry’s 0.6% decline.

Image Source: Zacks Investment Research

FSI’s Zacks Rank & Other Chemical Releases

FSI currently carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ingevity Corporation NGVT logged adjusted earnings of 99 cents per share in the first quarter, up from 47 cents a year ago. NGVT expects 2025 sales to be between $1.25 billion and $1.40 billion, and adjusted EBITDA between $380 million and $415 million.

The Chemours Company’s CC adjusted earnings were 13 cents per share for the first quarter. The metric fell short of the Zacks Consensus Estimate of 19 cents per share. CC expects full-year 2025 adjusted EBITDA between $825 million and $950 million.

Element Solutions Inc. ESI logged first-quarter adjusted earnings per share of 34 cents per share. It beat the Zacks Consensus Estimate of 33 cents. ESI anticipates adjusted EBITDA for 2025 to be between $520 million and $540 million.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Element Solutions Inc. (ESI): Free Stock Analysis Report

Flexible Solutions International Inc. (FSI): Free Stock Analysis Report

The Chemours Company (CC): Free Stock Analysis Report

Ingevity Corporation (NGVT): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English