Exploring 3 High Growth Tech Stocks In Asia

The Asian tech market is currently navigating a landscape shaped by the recent de-escalation in U.S.-China trade tensions, which has positively influenced global market sentiment and provided a boost to equities across the region. In this environment, identifying high growth tech stocks involves looking for companies that not only demonstrate strong innovation and adaptability but also have the resilience to capitalize on easing trade barriers and shifting economic indicators.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.64% | 30.42% | ★★★★★★ |

| Auras Technology | 21.79% | 25.47% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.98% | 29.01% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.42% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| PharmaResearch | 25.25% | 28.29% | ★★★★★★ |

| giftee | 21.53% | 63.67% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

| RemeGen | 23.19% | 65.54% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

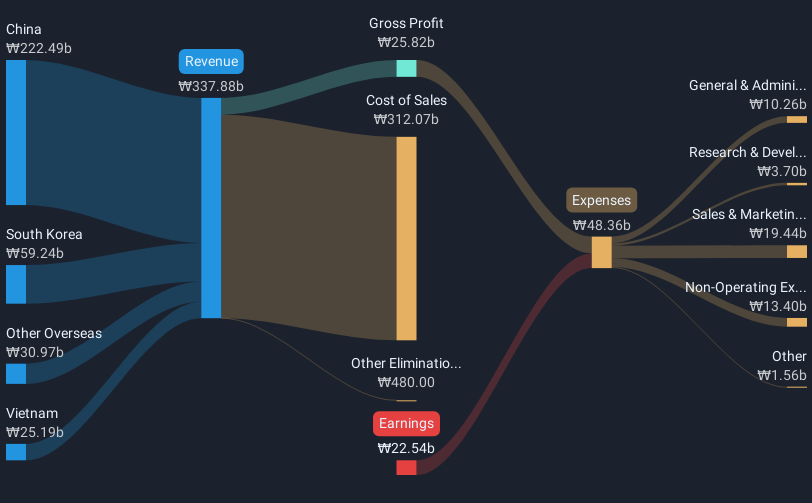

JNTC (KOSDAQ:A204270)

Simply Wall St Growth Rating: ★★★★★★

Overview: JNTC Co., Ltd. specializes in producing connectors, hinges, and tempered glass products in South Korea with a market capitalization of approximately ₩941.63 billion.

Operations: The company generates revenue primarily from the manufacturing and sales of mobile parts, amounting to ₩273.24 billion.

JNTC Co., Ltd. is navigating a challenging landscape with its unprofitable status yet shows promising signs with a projected annual revenue growth of 34.3%, outpacing the Korean market's average of 7.4%. Despite the volatility in its share price over the past three months, the company's commitment to innovation is evident from its R&D investments, aligning with industry demands for rapid technological advancements. With earnings expected to surge by 86% annually, JNTC is strategically positioned to leverage its developments in high-growth tech sectors across Asia. The anticipation around turning profitable within three years further underscores its potential trajectory amidst competitive pressures and evolving market dynamics.

- Unlock comprehensive insights into our analysis of JNTC stock in this health report.

Examine JNTC's past performance report to understand how it has performed in the past.

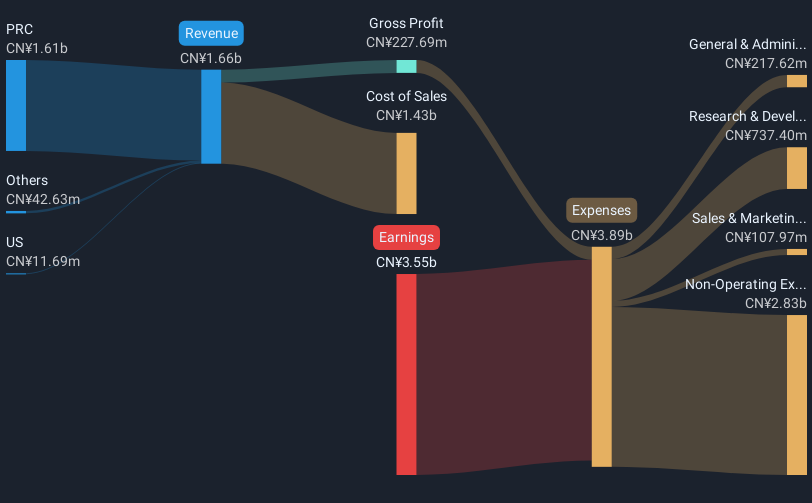

Robosense Technology (SEHK:2498)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Robosense Technology Co., Ltd is an investment holding company that offers LiDAR and perception solutions across China, the United States, and other international markets, with a market cap of HK$17.94 billion.

Operations: Robosense Technology focuses on providing LiDAR and perception solutions, primarily generating revenue from its Industrial Automation & Controls segment, which accounts for CN¥1.65 billion.

RoboSense Technology, amidst a transformative phase in the high-tech industry, reported a substantial revenue increase to CNY 1.65 billion in 2024 from CNY 1.12 billion the previous year, reflecting a growth of nearly 47%. This surge is underpinned by its pioneering EMX LiDAR technology, which has set new benchmarks in digital LiDAR for automotive applications. Despite current unprofitability with a net loss of CNY 481.83 million, down significantly from CNY 4.34 billion, RoboSense's strategic alliances and product innovations position it well for future profitability and market leadership in intelligent driving solutions. The company's R&D focus remains robust as evidenced by its recent strategic partnership with LionsBot to enhance robotic visual perception capabilities—a move that not only diversifies application but also strengthens its competitive edge in the smart technology ecosystem.

- Delve into the full analysis health report here for a deeper understanding of Robosense Technology.

Understand Robosense Technology's track record by examining our Past report.

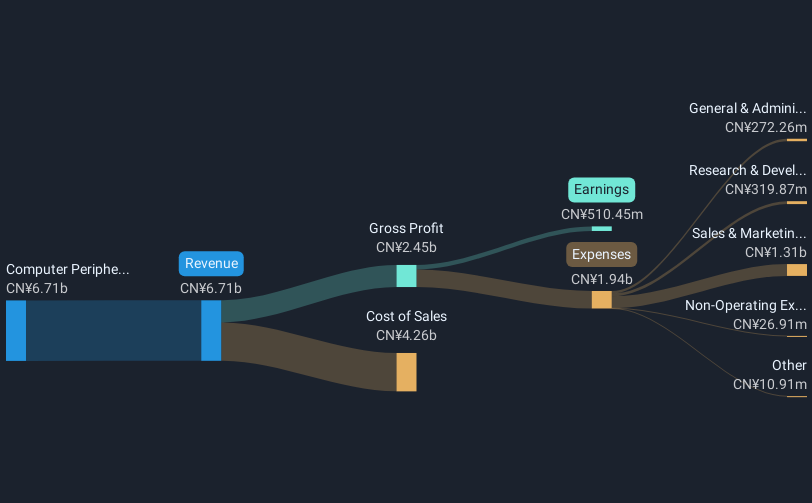

Ugreen Group (SZSE:301606)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ugreen Group Limited is involved in the research, development, design, production, and sale of consumer electronic products both within China and internationally, with a market capitalization of CN¥21.18 billion.

Operations: Ugreen Group generates revenue primarily from its computer peripherals segment, which accounts for CN¥6.71 billion. The company focuses on consumer electronic products in both domestic and international markets.

Ugreen Group's recent performance underscores its robust position in the high-tech sector in Asia, with a notable annual revenue jump to CNY 6.17 billion, up from CNY 4.80 billion the previous year, marking a growth of over 28%. This surge is propelled by its innovative NASync series, which leverages AI to revolutionize data management for content creators—a niche yet rapidly expanding market segment. The company's commitment to R&D is evident as it consistently allocates substantial resources towards innovation; for instance, its groundbreaking NASync iDX6011 series has set new standards in network-attached storage technology. Furthermore, Ugreen's strategic product launches and dividend affirmations reflect a forward-looking approach that aligns with industry demands and investor expectations.

- Click here to discover the nuances of Ugreen Group with our detailed analytical health report.

Review our historical performance report to gain insights into Ugreen Group's's past performance.

Where To Now?

- Dive into all 495 of the Asian High Growth Tech and AI Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English