Shareholders May Not Be So Generous With Dah Sing Banking Group Limited's (HKG:2356) CEO Compensation And Here's Why

Key Insights

- Dah Sing Banking Group will host its Annual General Meeting on 30th of May

- Total pay for CEO Derek Wong includes HK$6.97m salary

- Total compensation is 653% above industry average

- Over the past three years, Dah Sing Banking Group's EPS grew by 7.5% and over the past three years, the total shareholder return was 64%

Under the guidance of CEO Derek Wong, Dah Sing Banking Group Limited (HKG:2356) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 30th of May. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

View our latest analysis for Dah Sing Banking Group

Comparing Dah Sing Banking Group Limited's CEO Compensation With The Industry

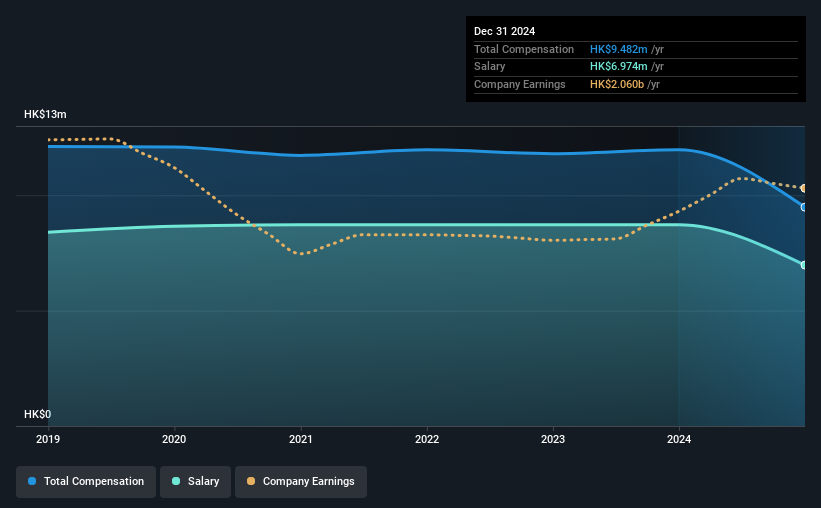

According to our data, Dah Sing Banking Group Limited has a market capitalization of HK$12b, and paid its CEO total annual compensation worth HK$9.5m over the year to December 2024. That's a notable decrease of 21% on last year. In particular, the salary of HK$6.97m, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the Hong Kong Banks industry with market capitalizations ranging between HK$7.8b and HK$25b had a median total CEO compensation of HK$1.3m. Accordingly, our analysis reveals that Dah Sing Banking Group Limited pays Derek Wong north of the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$7.0m | HK$8.7m | 74% |

| Other | HK$2.5m | HK$3.3m | 26% |

| Total Compensation | HK$9.5m | HK$12m | 100% |

On an industry level, around 66% of total compensation represents salary and 34% is other remuneration. According to our research, Dah Sing Banking Group has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Dah Sing Banking Group Limited's Growth Numbers

Dah Sing Banking Group Limited's earnings per share (EPS) grew 7.5% per year over the last three years. Its revenue is up 11% over the last year.

This revenue growth could really point to a brighter future. And the modest growth in EPS isn't bad, either. Although we'll stop short of calling the stock a top performer, we think the company has potential. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Dah Sing Banking Group Limited Been A Good Investment?

We think that the total shareholder return of 64%, over three years, would leave most Dah Sing Banking Group Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 1 warning sign for Dah Sing Banking Group that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English