Exploring 3 Undiscovered Gems in the US Market

Over the last 7 days, the United States market has experienced a 2.7% drop, although it has risen by 9.1% over the past year with earnings forecasted to grow by 14% annually. In this dynamic environment, identifying stocks that are not only resilient but also poised for future growth can be key to uncovering potential opportunities in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Central Bancompany | 32.38% | 5.41% | 6.60% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Innovex International | 1.49% | 42.69% | 44.34% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Qudian | 6.38% | -68.48% | -57.47% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

HarborOne Bancorp (NasdaqGS:HONE)

Simply Wall St Value Rating: ★★★★★★

Overview: HarborOne Bancorp, Inc. offers financial services to individuals, families, small and mid-size businesses, and municipalities with a market capitalization of approximately $454.63 million.

Operations: HarborOne Bancorp generates revenue primarily through its HarborOne Bank segment, contributing approximately $143.80 million, and its HarborOne Mortgage segment, adding about $18.91 million.

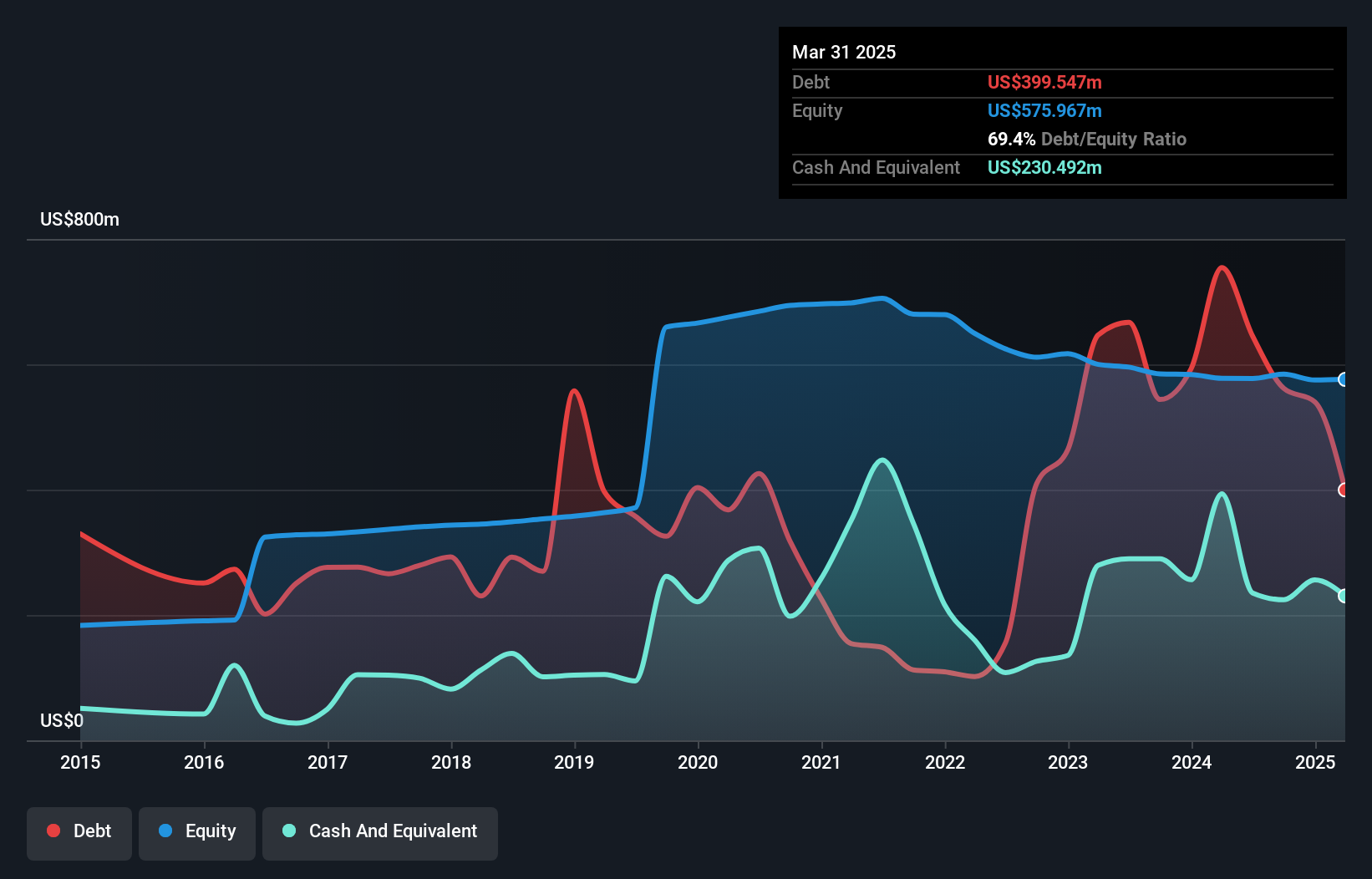

HarborOne Bancorp, with assets totaling US$5.7 billion and equity of US$576 million, stands out for its strong financial health. It has a robust allowance for bad loans at 160% and maintains non-performing loans at a low 0.6%. Total deposits reach US$4.6 billion against loans of US$4.8 billion, supported by primarily low-risk funding sources like customer deposits. The company reported an impressive earnings growth of 59% last year, surpassing industry averages by a wide margin. Recently, HarborOne announced a merger agreement with Eastern Bankshares valued at approximately $510 million, signaling potential strategic expansion opportunities ahead.

- Click to explore a detailed breakdown of our findings in HarborOne Bancorp's health report.

Gain insights into HarborOne Bancorp's past trends and performance with our Past report.

Ennis (NYSE:EBF)

Simply Wall St Value Rating: ★★★★★★

Overview: Ennis, Inc. is a company that produces and sells business forms and other printed products in the United States, with a market cap of approximately $485.37 million.

Operations: Ennis generates revenue primarily from its print segment, which reported $394.62 million. The company's financial performance is highlighted by a net profit margin of 9.57%.

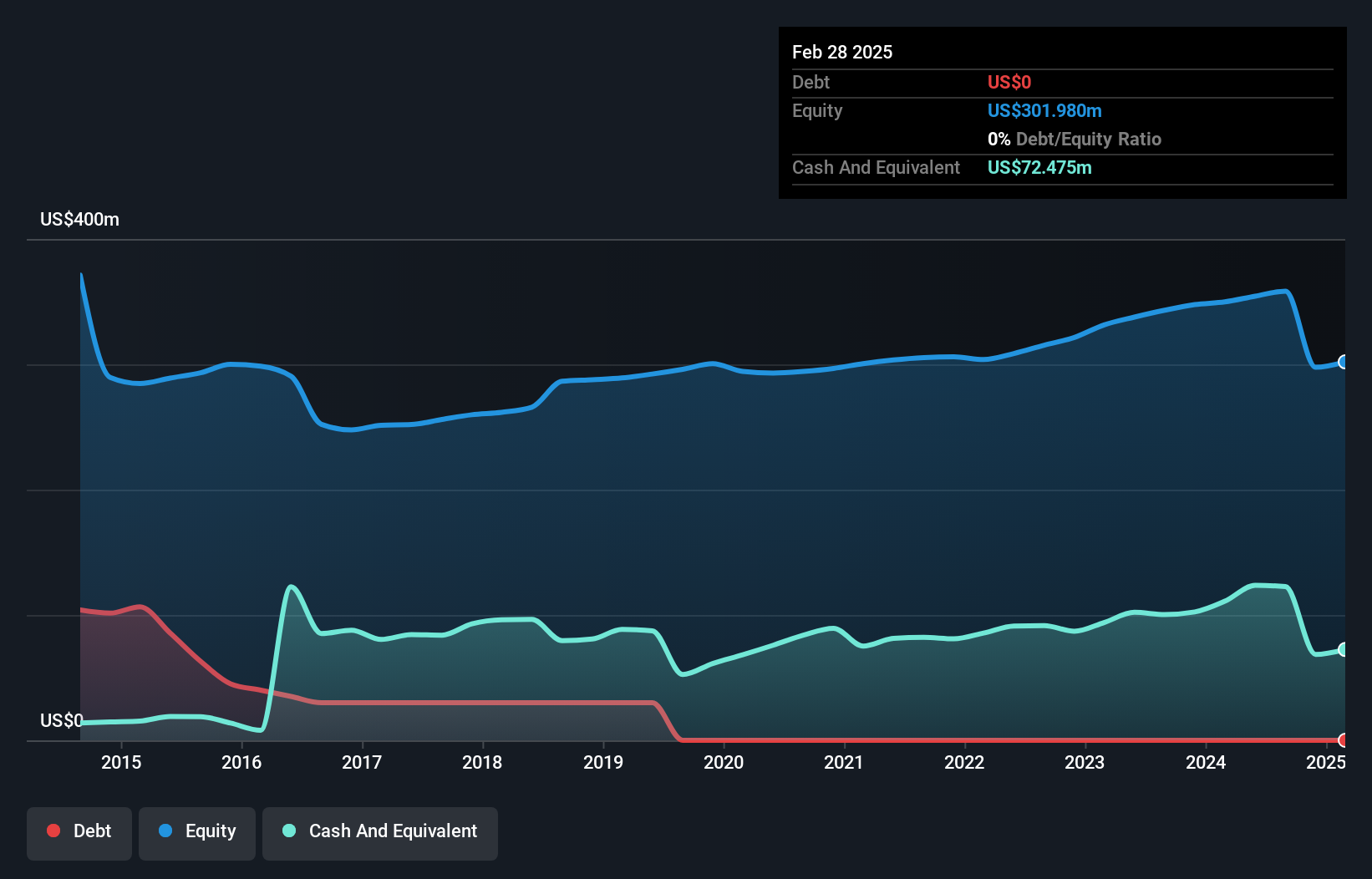

Ennis, a compact player in the commercial services sector, displays intriguing financial characteristics. Despite a 5.6% earnings dip last year against an industry average growth of 7.6%, it trades at a significant discount of 66% below fair value estimates, suggesting potential undervaluation. The firm is debt-free and generates positive free cash flow, indicating solid financial health and operational efficiency. Recent board changes see Wally Gruenes poised to join as Audit Committee chair, replacing Michael Schaefer. With net income at US$9 million for Q4 compared to US$10 million previously, Ennis continues delivering high-quality earnings amidst evolving leadership dynamics.

- Get an in-depth perspective on Ennis' performance by reading our health report here.

Examine Ennis' past performance report to understand how it has performed in the past.

Steelcase (NYSE:SCS)

Simply Wall St Value Rating: ★★★★★★

Overview: Steelcase Inc. offers a range of furniture and architectural products and services both in the United States and internationally, with a market cap of approximately $1.16 billion.

Operations: The company's revenue primarily comes from the Americas segment, generating $2.47 billion, followed by the International segment at $700.80 million.

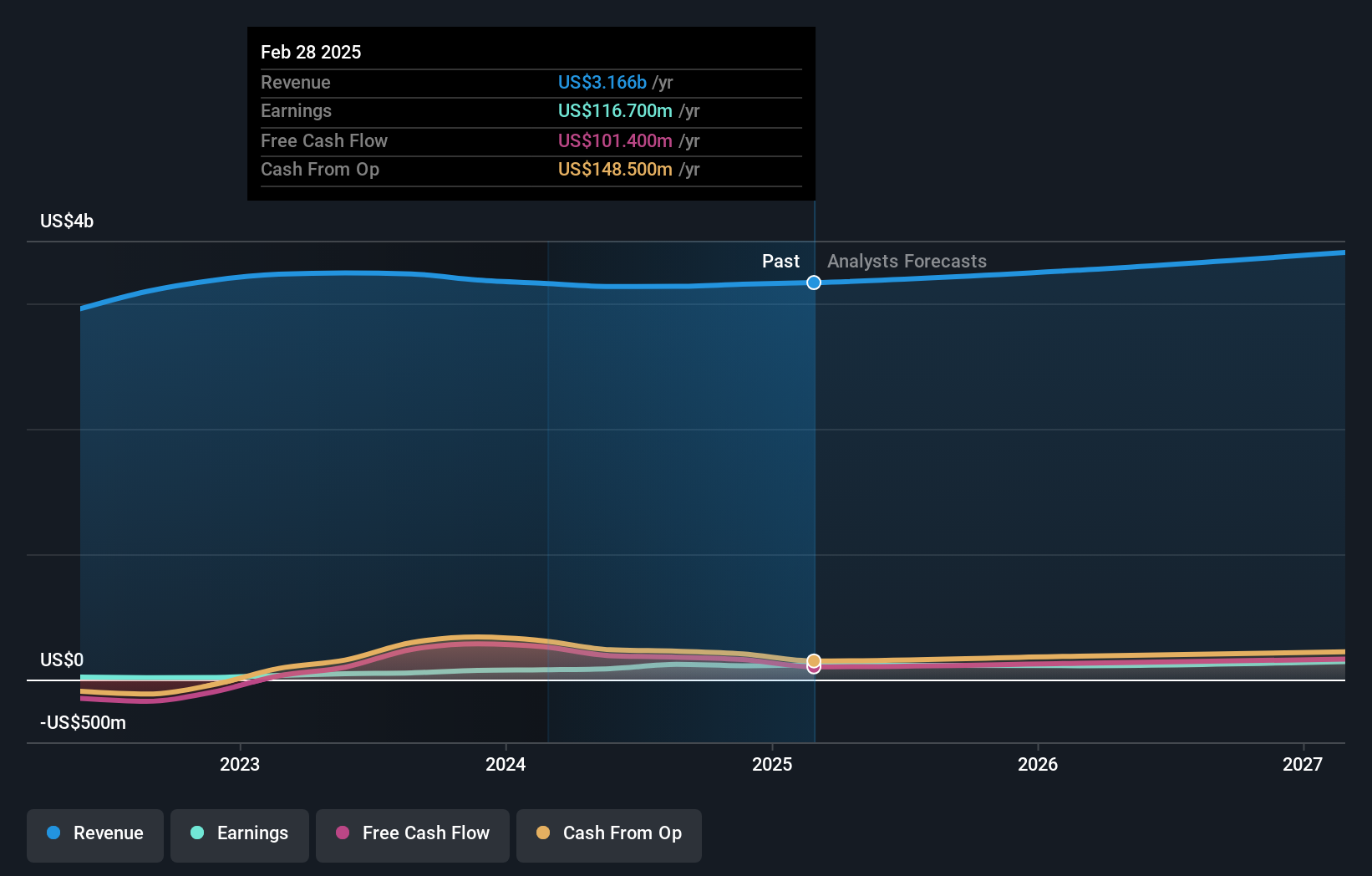

Steelcase, a notable player in the office furniture industry, recently reported earnings growth of 48.7%, surpassing the commercial services industry's 7.6% increase. The company's net debt to equity ratio stands at a satisfactory 6.2%, reflecting prudent financial management over the past five years as it decreased from 49.9% to 47%. Steelcase's interest payments are well covered by EBIT, with a coverage ratio of 9.4x, indicating strong operational profitability despite challenges like economic uncertainties and tariffs. Recent buybacks saw Steelcase repurchase shares worth US$26.5 million, enhancing shareholder value amidst ongoing market dynamics.

Make It Happen

- Discover the full array of 283 US Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English