3 Stocks That May Be Undervalued By Up To 48.5%

As the U.S. stock market experiences significant volatility, with recent surges driven by shifts in trade policy and a rally in the technology sector, investors are keenly observing potential opportunities amidst these fluctuations. In this environment of uncertainty and rapid changes, identifying undervalued stocks becomes crucial for those looking to capitalize on potential mispricings that may offer substantial upside once market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Mid Penn Bancorp (NasdaqGM:MPB) | $26.65 | $52.26 | 49% |

| Burke & Herbert Financial Services (NasdaqCM:BHRB) | $55.38 | $108.55 | 49% |

| Super Group (SGHC) (NYSE:SGHC) | $8.41 | $16.48 | 49% |

| UMH Properties (NYSE:UMH) | $16.47 | $32.46 | 49.3% |

| Advanced Flower Capital (NasdaqGM:AFCG) | $4.72 | $9.39 | 49.7% |

| Excelerate Energy (NYSE:EE) | $28.93 | $57.35 | 49.6% |

| TXO Partners (NYSE:TXO) | $15.30 | $29.92 | 48.9% |

| ZEEKR Intelligent Technology Holding (NYSE:ZK) | $29.17 | $57.33 | 49.1% |

| FinWise Bancorp (NasdaqGM:FINW) | $14.445 | $28.38 | 49.1% |

| Clearfield (NasdaqGM:CLFD) | $38.30 | $74.77 | 48.8% |

Here we highlight a subset of our preferred stocks from the screener.

Bank of Marin Bancorp (NasdaqCM:BMRC)

Overview: Bank of Marin Bancorp, with a market cap of $329.01 million, serves as the holding company for Bank of Marin and offers various financial services to small to medium-sized businesses, not-for-profit organizations, and commercial real estate investors in the United States.

Operations: The company generates revenue of $70.63 million from its banking services provided to small to medium-sized businesses, not-for-profit organizations, and commercial real estate investors in the United States.

Estimated Discount To Fair Value: 10.9%

Bank of Marin Bancorp's stock is currently trading at US$20.48, slightly below its estimated fair value of US$22.99, indicating potential undervaluation based on discounted cash flow analysis. The company has reported strong revenue growth forecasts of 30.1% per year, outpacing the broader US market's 8.6%. However, while earnings are expected to grow significantly at 98.46% annually and become profitable within three years, the dividend coverage remains a concern with current payouts potentially unsustainable from earnings alone. Recent financial results show improved net income and interest income compared to last year but also highlight increased net charge-offs in the first quarter of 2025.

- In light of our recent growth report, it seems possible that Bank of Marin Bancorp's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Bank of Marin Bancorp's balance sheet health report.

Arrow Financial (NasdaqGS:AROW)

Overview: Arrow Financial Corporation is a bank holding company offering diverse commercial and consumer banking, along with financial products and services in the United States, with a market cap of approximately $427.22 million.

Operations: The company generates revenue of $135.11 million from its community banking segment.

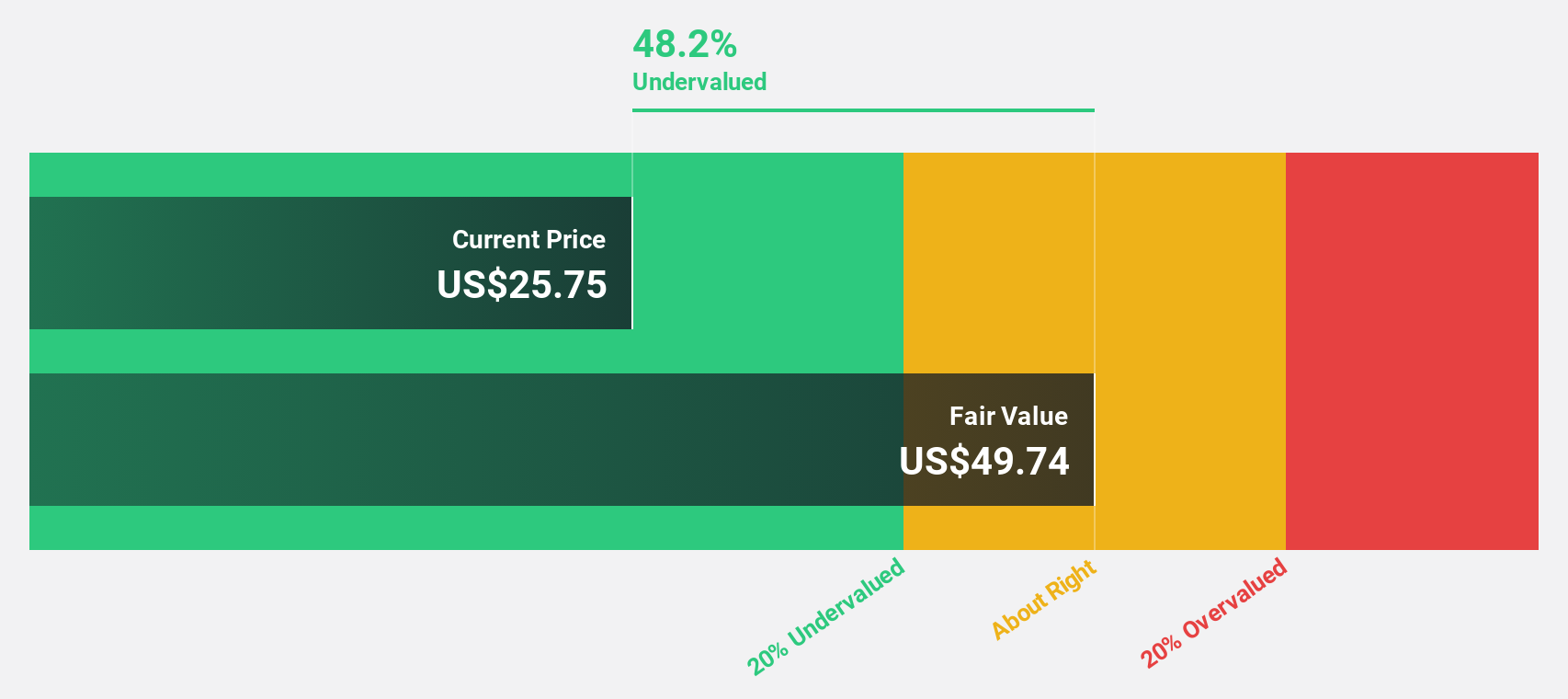

Estimated Discount To Fair Value: 48.5%

Arrow Financial's stock, priced at US$25.62, trades significantly below its estimated fair value of US$49.74, suggesting undervaluation based on discounted cash flow analysis. Despite a decline in net income to US$6.31 million from last year's US$7.66 million, earnings are projected to grow 28.5% annually over the next three years, outpacing the broader market's growth rate of 14.4%. The company maintains a reliable dividend yield of 4.37% and has expanded its buyback plan by an additional $5 million to $10 million total authorization.

- Our growth report here indicates Arrow Financial may be poised for an improving outlook.

- Get an in-depth perspective on Arrow Financial's balance sheet by reading our health report here.

CI&T (NYSE:CINT)

Overview: CI&T Inc., along with its subsidiaries, offers strategy, design, and software engineering services globally and has a market cap of approximately $839.69 million.

Operations: The company generates revenue primarily from its computer services segment, amounting to $444.14 million.

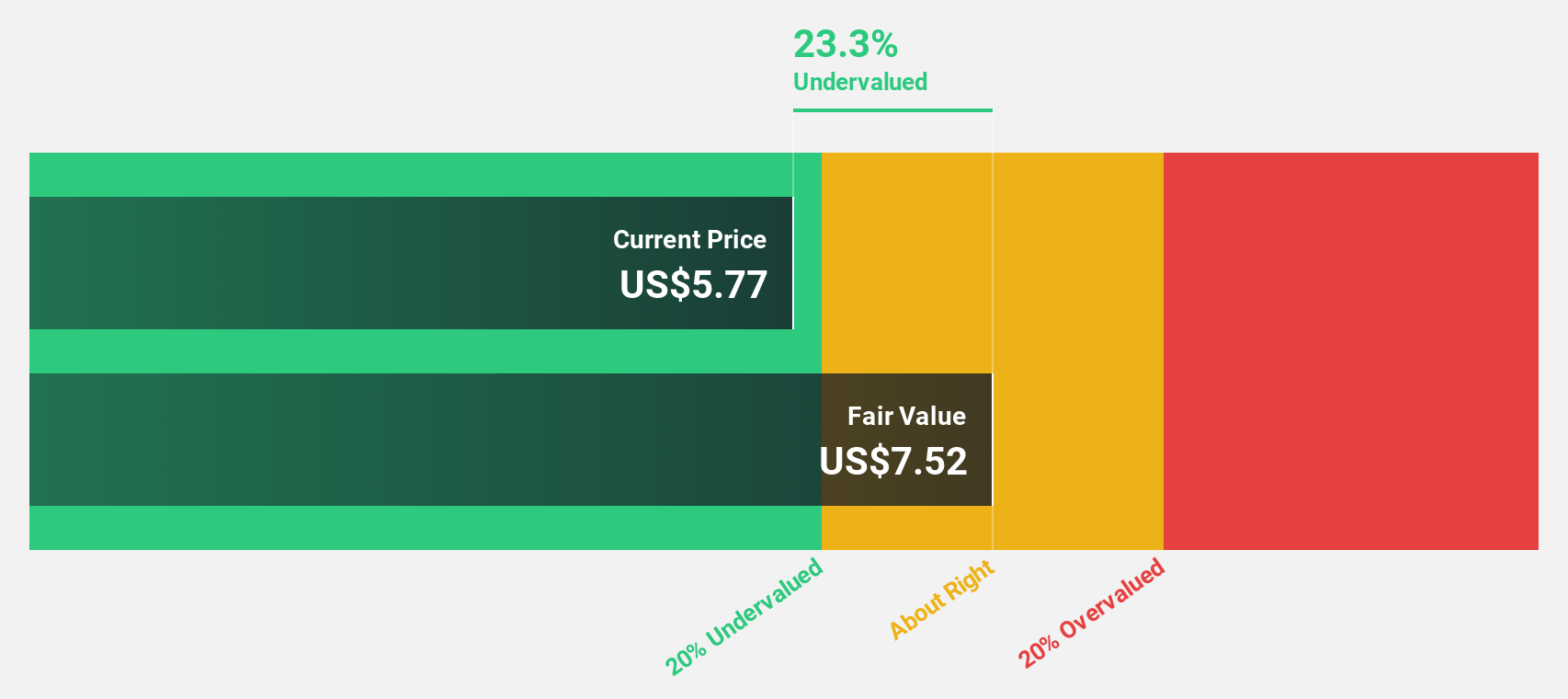

Estimated Discount To Fair Value: 16.8%

CI&T, trading at US$6.29, is undervalued with an estimated fair value of US$7.56. Recent earnings showed significant growth, with net income rising to US$7.45 million from US$4.52 million year-over-year and a forecasted annual earnings growth of 25.6%, outpacing the U.S. market's 14.4%. Although revenue growth is slower than 20% annually, it still surpasses the broader market's rate of 8.6%.

- The analysis detailed in our CI&T growth report hints at robust future financial performance.

- Navigate through the intricacies of CI&T with our comprehensive financial health report here.

Summing It All Up

- Access the full spectrum of 171 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English