What Are Wall Street Analysts' Target Price for Assurant Stock?

Valued at $10 billion by market cap, Assurant, Inc. (AIZ) is a leading global provider of risk management products and services, specializing in safeguarding connected devices, homes, and automobiles. Headquartered in Atlanta, Georgia, and founded in 1892, the company operates in 21 countries across North America, Latin America, Europe, and the Asia Pacific.

Shares of AIZ have outperformed the broader market over the past year. AIZ has gained 18.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 11.6%. In 2025, AIZ stock is down 5.7%, compared to SPX’s marginal rise on a YTD basis.

Narrowing the focus, AIZ has surpassed the Invesco KBW Property & Casualty Insurance ETF (KBWP), which has gained about 17.5% over the past year. However, the ETF’s 6.8% rise on a YTD basis outshines the stock’s single-digit losses over the same time frame.

On May 6, Assurant announced its Q1 2025 earnings, and its shares surged marginally. It delivered solid revenue growth of 7% year-over-year to $3.07 billion, driven by strong performance in both its Global Lifestyle and Global Housing segments.

Despite facing $157 million in catastrophe-related losses, primarily from California wildfires, adjusted EPS came in at $3.39, beating expectations. The company reaffirmed its 2025 outlook and returned $103 million to shareholders, signaling continued confidence in its long-term growth trajectory.

For the current year ending in December, analysts expect AIZ’s EPS to decline 1.7% to $16.36 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

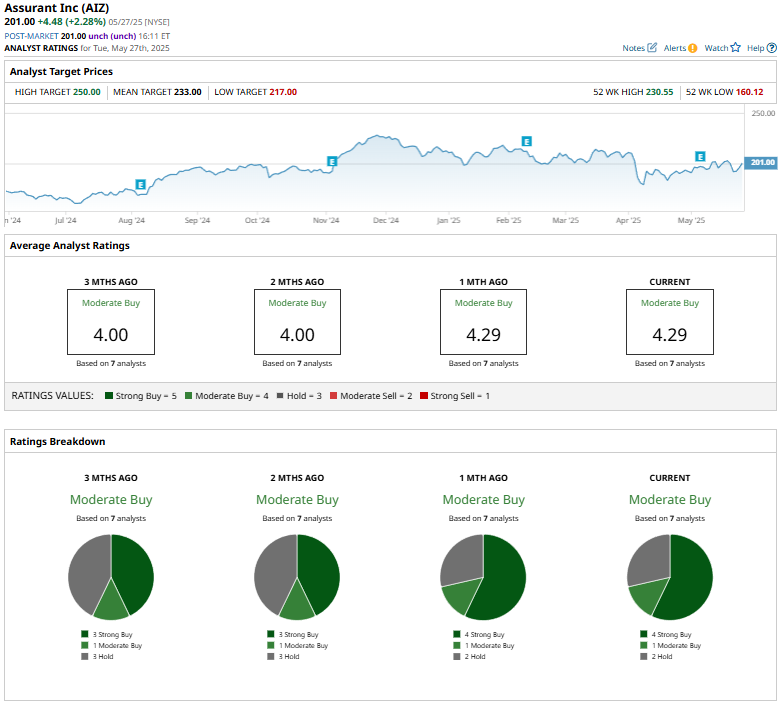

Among the seven analysts covering AIZ stock, the consensus is a “Moderate Buy.” That’s based on four “Strong Buy” ratings, one “Moderate Buy,” and two “Holds.”

This configuration is more bullish than two months ago, with three analysts suggesting a “Moderate Buy.”

On May 7, Morgan Stanley (MS) analyst Bob Huang maintained an "Equal Weight" rating on Assurant and raised the price target from $200 to $217. This adjustment reflects a slightly more optimistic outlook on the company's financial prospects, particularly within its Global Lifestyle segment.

The mean price target of $233 represents a 15.9% premium to AIZ’s current price levels. The Street-high price target of $250 suggests an upside potential of 24.4%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English