Most Shareholders Will Probably Find That The CEO Compensation For REX American Resources Corporation (NYSE:REX) Is Reasonable

Key Insights

- REX American Resources' Annual General Meeting to take place on 4th of June

- Salary of US$275.0k is part of CEO Zafar Rizvi's total remuneration

- The overall pay is comparable to the industry average

- Over the past three years, REX American Resources' EPS grew by 9.7% and over the past three years, the total shareholder return was 37%

Performance at REX American Resources Corporation (NYSE:REX) has been reasonably good and CEO Zafar Rizvi has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 4th of June, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. We present our case of why we think CEO compensation looks fair.

View our latest analysis for REX American Resources

How Does Total Compensation For Zafar Rizvi Compare With Other Companies In The Industry?

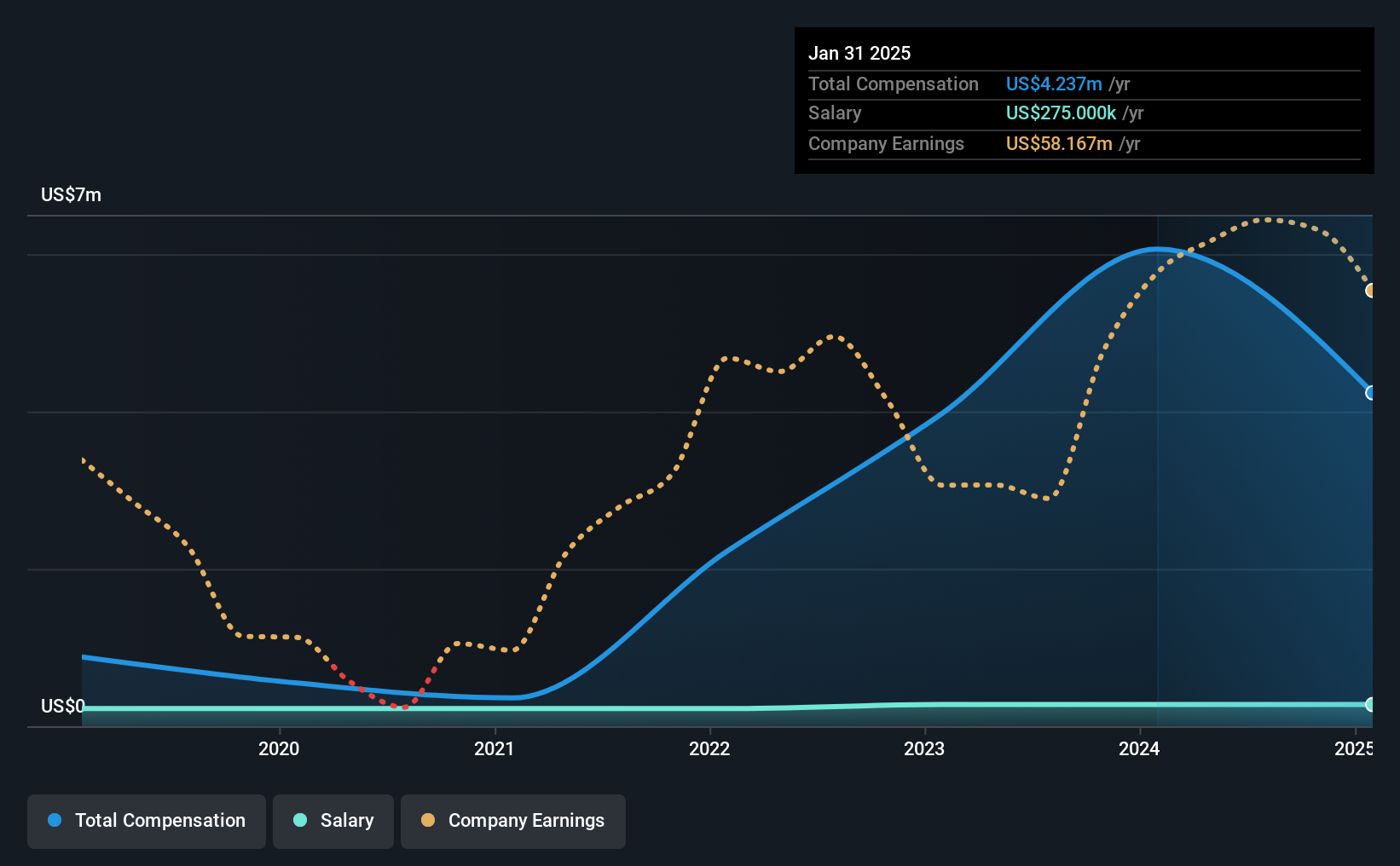

At the time of writing, our data shows that REX American Resources Corporation has a market capitalization of US$709m, and reported total annual CEO compensation of US$4.2m for the year to January 2025. Notably, that's a decrease of 30% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at US$275k.

On comparing similar companies from the American Oil and Gas industry with market caps ranging from US$400m to US$1.6b, we found that the median CEO total compensation was US$3.5m. So it looks like REX American Resources compensates Zafar Rizvi in line with the median for the industry. What's more, Zafar Rizvi holds US$14m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | US$275k | US$275k | 6% |

| Other | US$4.0m | US$5.8m | 94% |

| Total Compensation | US$4.2m | US$6.1m | 100% |

Talking in terms of the industry, salary represented approximately 14% of total compensation out of all the companies we analyzed, while other remuneration made up 86% of the pie. REX American Resources sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

REX American Resources Corporation's Growth

REX American Resources Corporation's earnings per share (EPS) grew 9.7% per year over the last three years. In the last year, its revenue is down 23%.

We would argue that the lack of revenue growth in the last year is less than ideal, but the modest improvement in EPS is good. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has REX American Resources Corporation Been A Good Investment?

We think that the total shareholder return of 37%, over three years, would leave most REX American Resources Corporation shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for REX American Resources that you should be aware of before investing.

Switching gears from REX American Resources, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English