Shareholders Will Probably Hold Off On Increasing UWM Holdings Corporation's (NYSE:UWMC) CEO Compensation For The Time Being

Key Insights

- UWM Holdings to hold its Annual General Meeting on 4th of June

- CEO Mat Ishbia's total compensation includes salary of US$600.0k

- The overall pay is 31% above the industry average

- Over the past three years, UWM Holdings' EPS fell by 103% and over the past three years, the total shareholder return was 29%

The share price of UWM Holdings Corporation (NYSE:UWMC) has been growing in the past few years, however, the per-share earnings growth has been lacking, suggesting something is amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 4th of June. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

See our latest analysis for UWM Holdings

Comparing UWM Holdings Corporation's CEO Compensation With The Industry

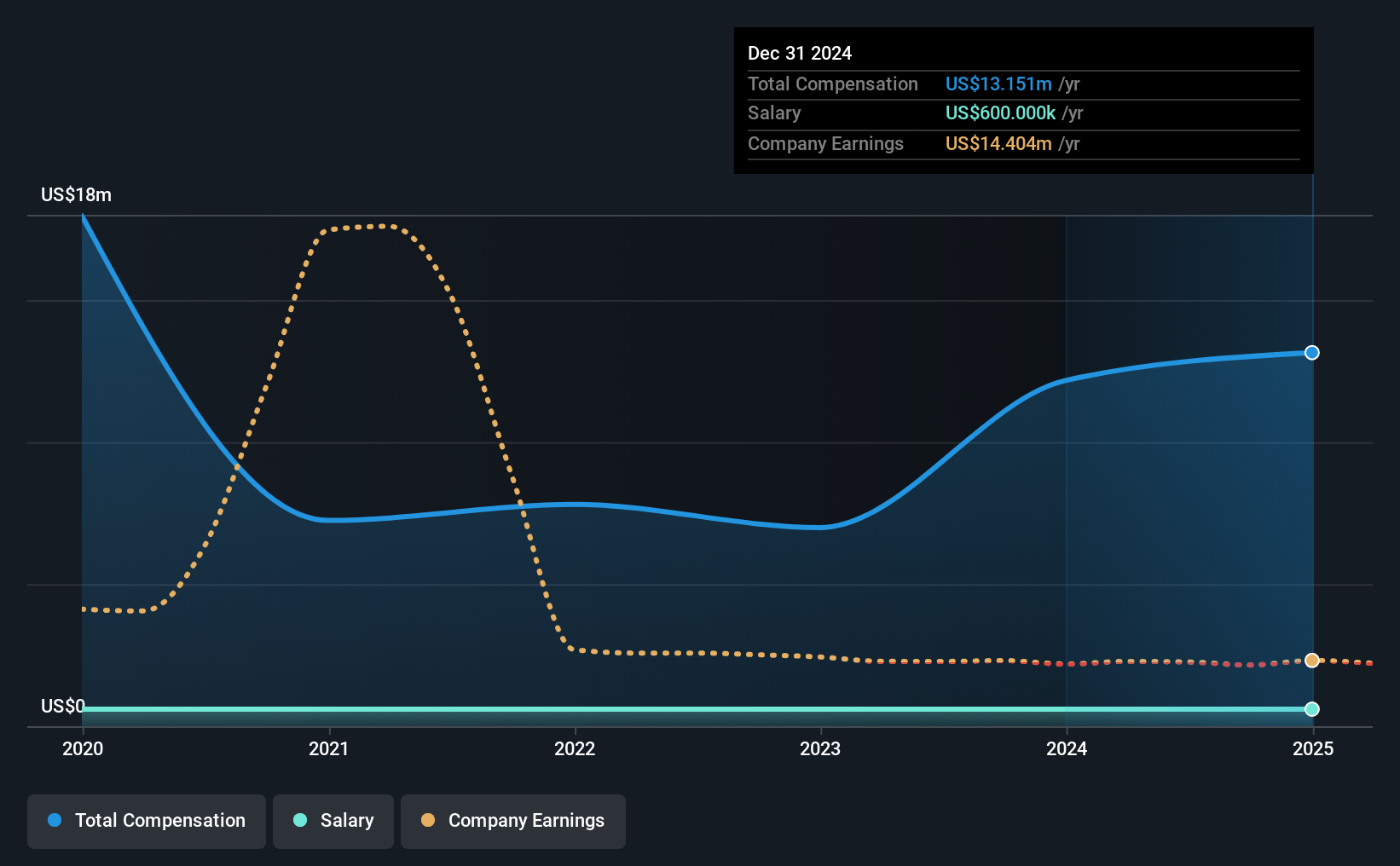

According to our data, UWM Holdings Corporation has a market capitalization of US$6.6b, and paid its CEO total annual compensation worth US$13m over the year to December 2024. Notably, that's an increase of 8.1% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at US$600k.

In comparison with other companies in the American Diversified Financial industry with market capitalizations ranging from US$4.0b to US$12b, the reported median CEO total compensation was US$10m. This suggests that Mat Ishbia is paid more than the median for the industry. Moreover, Mat Ishbia also holds US$21m worth of UWM Holdings stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$600k | US$600k | 5% |

| Other | US$13m | US$12m | 95% |

| Total Compensation | US$13m | US$12m | 100% |

Speaking on an industry level, nearly 12% of total compensation represents salary, while the remainder of 88% is other remuneration. A high-salary is usually a no-brainer when it comes to attracting the best executives, but UWM Holdings paid Mat Ishbia a nominal salary to the CEO over the past 12 months, instead focusing on non-salary compensation. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at UWM Holdings Corporation's Growth Numbers

Over the last three years, UWM Holdings Corporation has shrunk its earnings per share by 103% per year. It achieved revenue growth of 10% over the last year.

The decline in EPS is a bit concerning. There's no doubt that the silver lining is that revenue is up. But it isn't sufficiently fast growth to overlook the fact that EPS has gone backwards over three years. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has UWM Holdings Corporation Been A Good Investment?

UWM Holdings Corporation has served shareholders reasonably well, with a total return of 29% over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

UWM Holdings prefers rewarding its CEO through non-salary benefits. Shareholder returns, while positive, should be looked at along with earnings, which have not grown at all recently. This makes us think the share price momentum may slow in the future. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 2 warning signs for UWM Holdings that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English