Lisi Group (Holdings) Limited's (HKG:526) 25% Jump Shows Its Popularity With Investors

Lisi Group (Holdings) Limited (HKG:526) shareholders are no doubt pleased to see that the share price has bounced 25% in the last month, although it is still struggling to make up recently lost ground. The annual gain comes to 106% following the latest surge, making investors sit up and take notice.

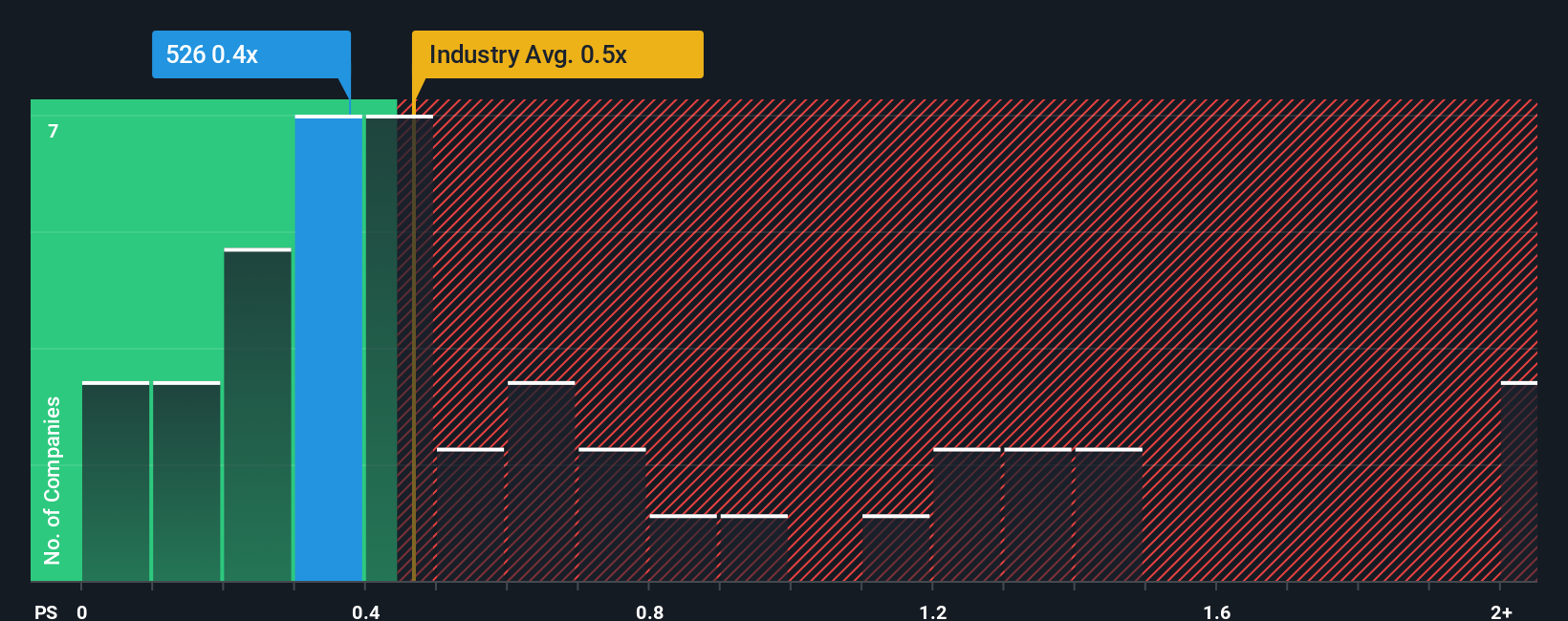

Although its price has surged higher, you could still be forgiven for feeling indifferent about Lisi Group (Holdings)'s P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Consumer Durables industry in Hong Kong is also close to 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Lisi Group (Holdings)

How Lisi Group (Holdings) Has Been Performing

Revenue has risen firmly for Lisi Group (Holdings) recently, which is pleasing to see. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Lisi Group (Holdings)'s earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

Lisi Group (Holdings)'s P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. Pleasingly, revenue has also lifted 37% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 9.6% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this in consideration, it's clear to see why Lisi Group (Holdings)'s P/S matches up closely to its industry peers. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Bottom Line On Lisi Group (Holdings)'s P/S

Lisi Group (Holdings)'s stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we've seen, Lisi Group (Holdings)'s three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

You should always think about risks. Case in point, we've spotted 3 warning signs for Lisi Group (Holdings) you should be aware of.

If you're unsure about the strength of Lisi Group (Holdings)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English