Asian Market: Discovering 3 Stocks That May Be Trading Below Their Estimated Value

As the Asian markets navigate through a period of economic recalibration amid global trade uncertainties and evolving inflation dynamics, investors are increasingly focused on identifying opportunities that may be trading below their intrinsic value. In this context, understanding what constitutes an undervalued stock is crucial—typically characterized by strong fundamentals and potential for growth that isn't fully reflected in their current market price.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥77.25 | CN¥153.79 | 49.8% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥42.93 | CN¥85.11 | 49.6% |

| RACCOON HOLDINGS (TSE:3031) | ¥820.00 | ¥1617.60 | 49.3% |

| H.U. Group Holdings (TSE:4544) | ¥3049.00 | ¥6011.28 | 49.3% |

| Shenzhen Yinghe Technology (SZSE:300457) | CN¥17.25 | CN¥34.44 | 49.9% |

| cottaLTD (TSE:3359) | ¥432.00 | ¥853.28 | 49.4% |

| Zhuhai CosMX Battery (SHSE:688772) | CN¥13.52 | CN¥27.01 | 49.9% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.79 | NZ$1.58 | 49.9% |

| Dive (TSE:151A) | ¥919.00 | ¥1819.21 | 49.5% |

| China Kings Resources GroupLtd (SHSE:603505) | CN¥21.43 | CN¥42.38 | 49.4% |

Here's a peek at a few of the choices from the screener.

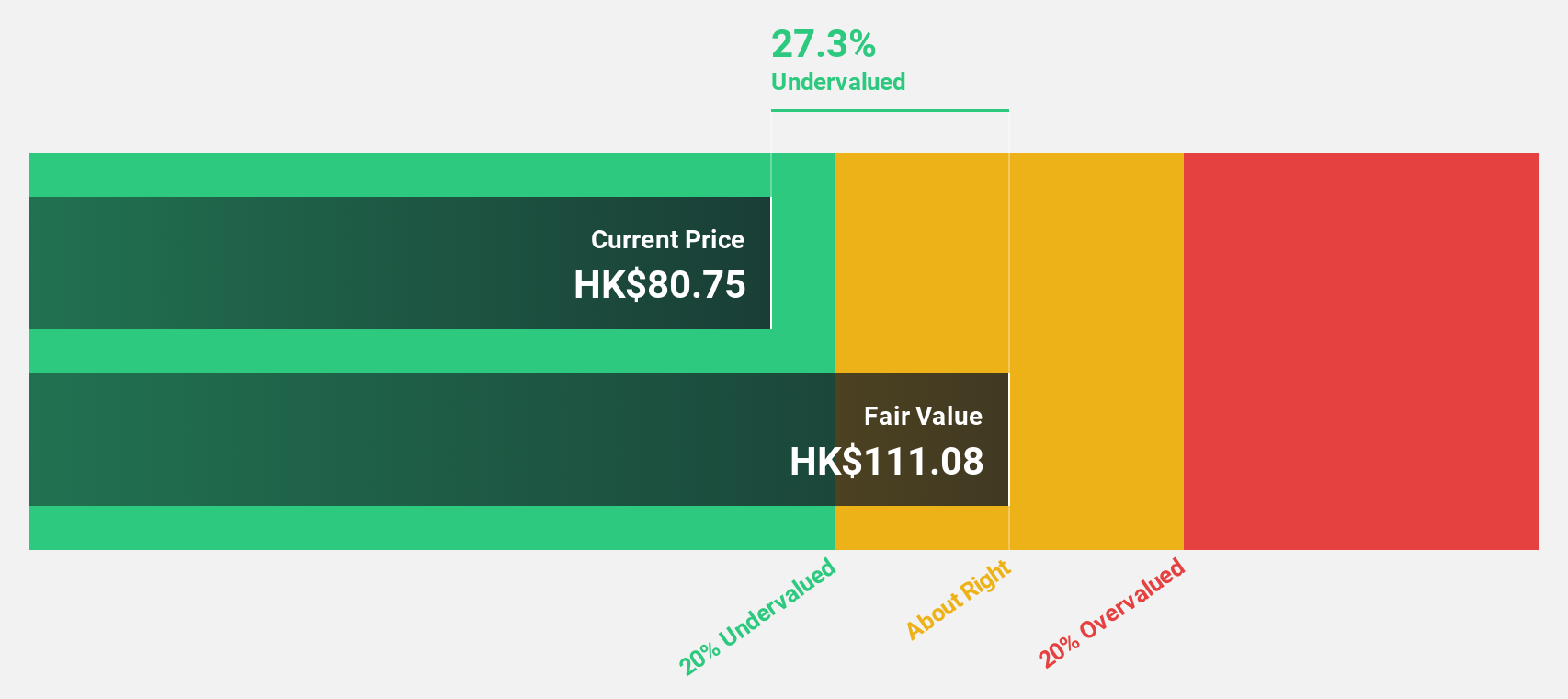

Innovent Biologics (SEHK:1801)

Overview: Innovent Biologics, Inc. is a biopharmaceutical company focused on the research and development of antibody and protein medicine products in China, the United States, and internationally, with a market cap of approximately HK$104.09 billion.

Operations: Innovent Biologics generates revenue primarily from its biotechnology segment, amounting to CN¥9.42 billion.

Estimated Discount To Fair Value: 42.1%

Innovent Biologics is trading at HK$63.1, significantly below its estimated fair value of HK$109.06, suggesting it may be undervalued based on cash flows. With earnings expected to grow 41.08% annually and anticipated profitability within three years, the company shows promising financial prospects despite a forecasted low return on equity of 13.9%. Recent advancements in clinical trials for treatments like picankibart and mazdutide could enhance future revenue streams and market positioning in Asia's biopharma sector.

- Our earnings growth report unveils the potential for significant increases in Innovent Biologics' future results.

- Take a closer look at Innovent Biologics' balance sheet health here in our report.

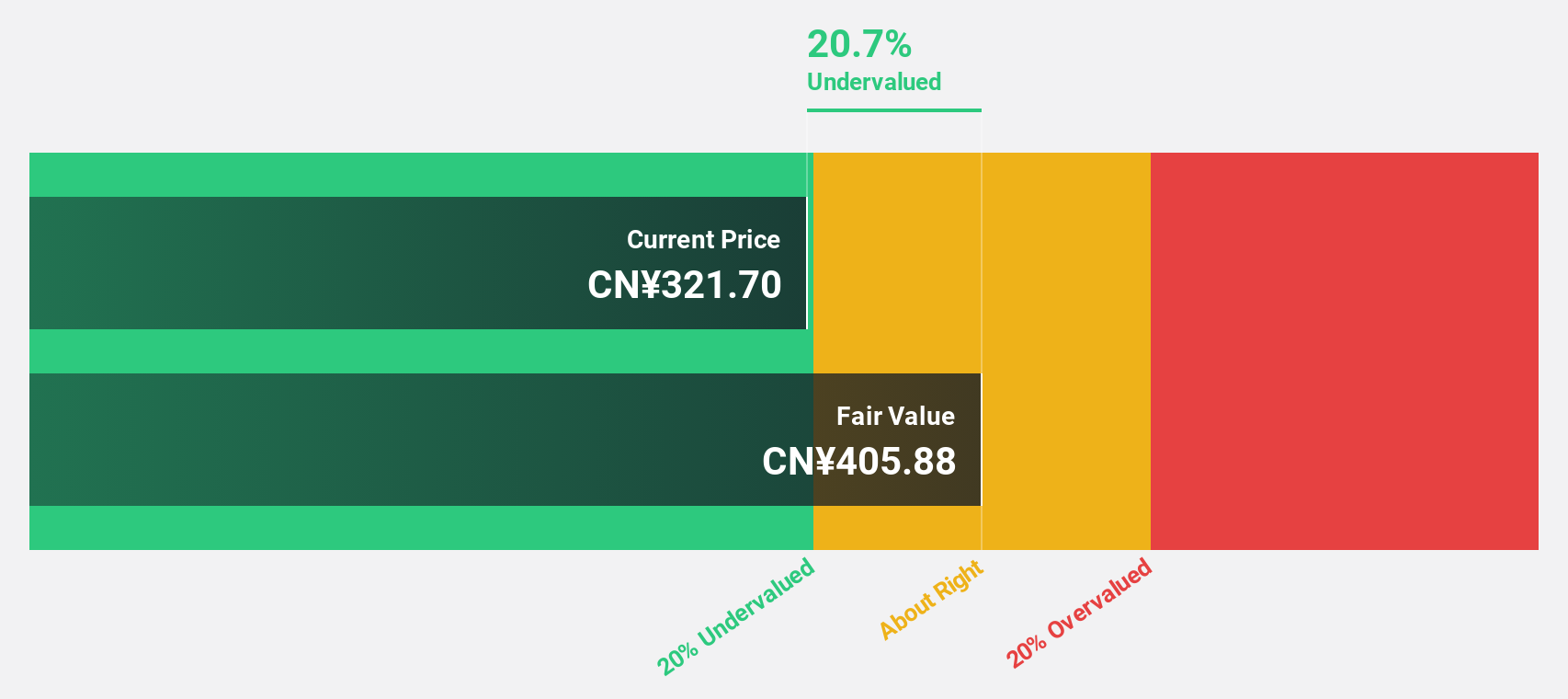

Eastroc Beverage(Group) (SHSE:605499)

Overview: Eastroc Beverage(Group) Co., Ltd. focuses on the research, development, production, and sales of beverages in China with a market cap of CN¥166.40 billion.

Operations: The company generates revenue of CN¥17.20 billion from the production, sales, and wholesale of beverages and pre-packaged foods in China.

Estimated Discount To Fair Value: 17.1%

Eastroc Beverage(Group) Co., Ltd. is trading at CNY 320, below its estimated fair value of CNY 386.2, highlighting potential undervaluation based on cash flows. The company reported strong earnings growth with net income reaching CNY 980.01 million in Q1 2025, up from CNY 663.88 million a year ago. Despite an unstable dividend track record, forecasted earnings and revenue growth outpace the Chinese market average, reflecting robust financial health and future prospects.

- Our comprehensive growth report raises the possibility that Eastroc Beverage(Group) is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Eastroc Beverage(Group).

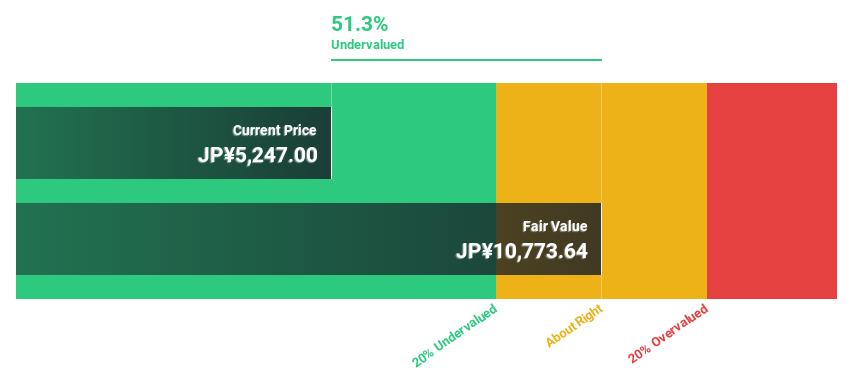

Fujikura (TSE:5803)

Overview: Fujikura Ltd. operates in the energy, telecommunications, electronics, automotive, and real estate sectors across Japan, the United States, China, and internationally with a market cap of approximately ¥1.88 trillion.

Operations: Fujikura Ltd.'s revenue is derived from its operations in the energy, telecommunications, electronics, automotive, and real estate sectors across various international markets.

Estimated Discount To Fair Value: 21.3%

Fujikura Ltd. is trading at ¥6,808, significantly below its estimated fair value of ¥8,651.86, suggesting it may be undervalued based on cash flows. The company's earnings grew by 78.6% over the past year and are expected to continue outpacing the Japanese market with a forecasted annual growth of 10%. Despite a volatile share price and an unstable dividend track record, Fujikura's revenue growth prospects remain strong relative to market averages.

- In light of our recent growth report, it seems possible that Fujikura's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Fujikura's balance sheet health report.

Taking Advantage

- Click here to access our complete index of 307 Undervalued Asian Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English