Exploring Sunrun And 2 Promising Undervalued Small Caps With Insider Action

The United States market has shown a positive trajectory, rising by 2.0% over the past week and climbing 12% in the last year, with earnings forecasted to grow by 14% annually. In this context of growth, identifying stocks that are perceived as undervalued and exhibit insider activity can be an intriguing opportunity for investors seeking potential value in small-cap companies like Sunrun and others.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 0.9x | 36.24% | ★★★★★★ |

| Five Star Bancorp | 12.1x | 4.7x | 48.03% | ★★★★★☆ |

| Barrett Business Services | 20.4x | 0.9x | 47.78% | ★★★★☆☆ |

| S&T Bancorp | 10.4x | 3.6x | 44.91% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 27.39% | ★★★★☆☆ |

| Titan Machinery | NA | 0.2x | -336.07% | ★★★★☆☆ |

| MVB Financial | 13.0x | 1.7x | 39.00% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -53.10% | ★★★☆☆☆ |

| BlueLinx Holdings | 13.5x | 0.2x | -69.09% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.4x | -2704.10% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Sunrun (NasdaqGS:RUN)

Simply Wall St Value Rating: ★★★☆☆☆

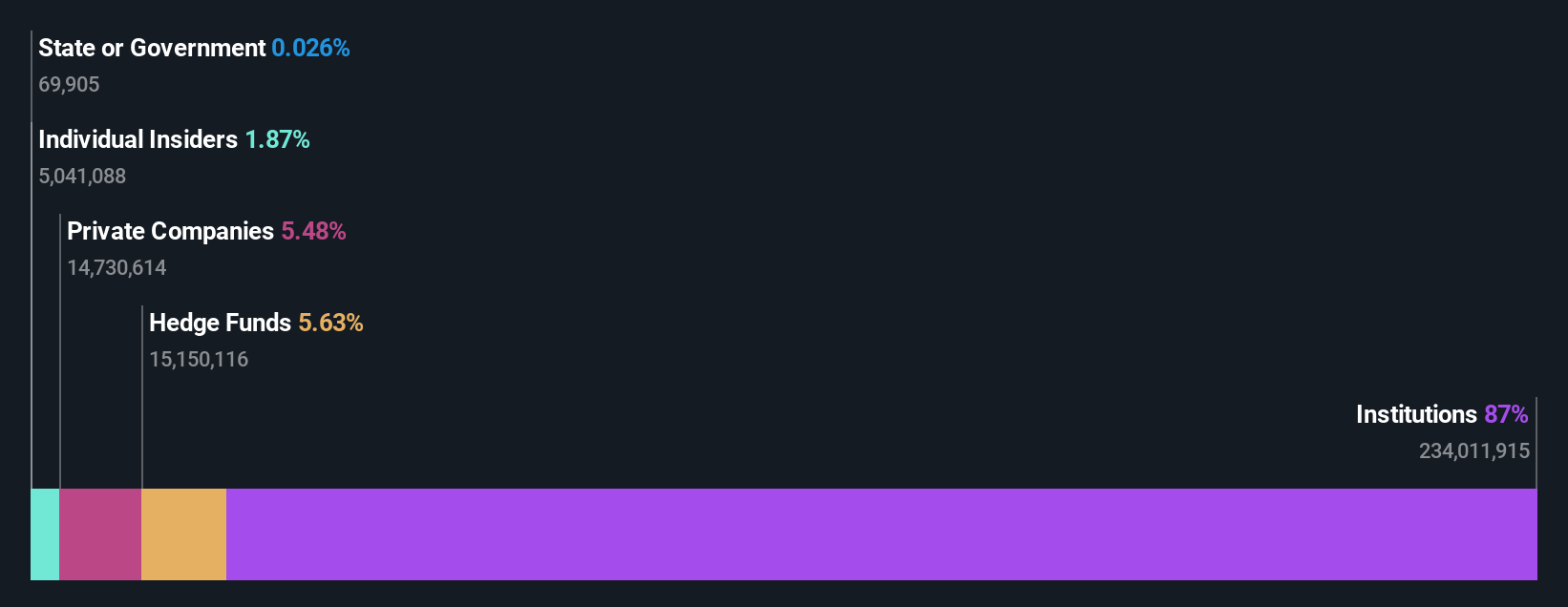

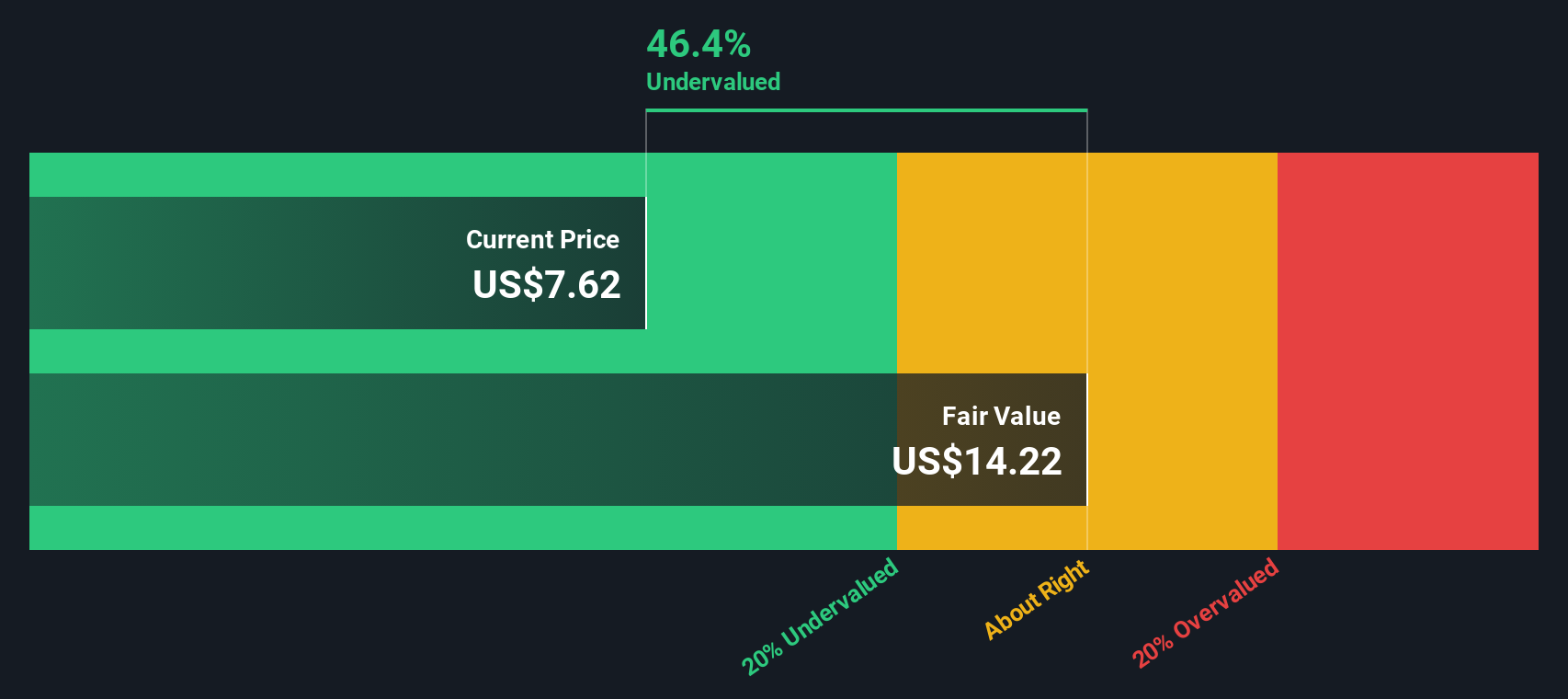

Overview: Sunrun is a company that provides solar energy services and products to customers, with a market capitalization of approximately $3.79 billion.

Operations: Sunrun's revenue primarily comes from providing solar energy services and products, with recent figures showing $2.08 billion. The company's gross profit margin has shown variability, reaching 18.95% in the latest period analyzed. Costs of goods sold (COGS) have been significant, impacting overall profitability alongside substantial operating expenses such as sales and marketing, research and development, and general administrative costs.

PE: -0.6x

Sunrun, a notable player in the renewable energy sector, has seen insider confidence with Edward Fenster purchasing 150,000 shares for US$1.02 million. Despite recent share price volatility and reliance on external borrowing, Sunrun's innovative offerings like Sunrun Flex™ and expansion of its CalReady power plant underscore its potential for growth. The company reported first-quarter revenue of US$504 million and a net income of US$50 million, marking a turnaround from last year's loss.

- Click to explore a detailed breakdown of our findings in Sunrun's valuation report.

Review our historical performance report to gain insights into Sunrun's's past performance.

Centuri Holdings (NYSE:CTRI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Centuri Holdings operates in the energy sector, providing services in U.S. and Canadian gas, as well as union and non-union electric segments, with a market capitalization of approximately $1.5 billion.

Operations: Centuri Holdings generates revenue primarily from U.S. Gas, Canadian Gas, Union Electric, and Non-Union Electric segments. The company's gross profit margin has shown fluctuations over recent periods, with a notable decrease to 7.87% in late 2024 before rising to 8.56% by early 2025. Operating expenses have remained a significant portion of costs, with general and administrative expenses consistently around $90 million to $103 million during the same timeframe.

PE: 4510.6x

Centuri Holdings, a small company in the U.S., recently secured $350 million in new customer awards, highlighting demand for its infrastructure solutions. Despite a net loss of US$17.94 million in Q1 2025, losses narrowed from the previous year. The company's revenue outlook for 2025 is between US$2.60 billion and US$2.80 billion, indicating potential growth. Insider confidence is evident with recent share purchases by executives, suggesting belief in Centuri's future prospects amidst ongoing expansion efforts across North America.

- Click here and access our complete valuation analysis report to understand the dynamics of Centuri Holdings.

Gain insights into Centuri Holdings' past trends and performance with our Past report.

Piedmont Office Realty Trust (NYSE:PDM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Piedmont Office Realty Trust is a real estate investment trust specializing in the ownership and management of high-quality office properties, with a market cap of approximately $1.03 billion.

Operations: Piedmont Office Realty Trust generates its revenue primarily from its commercial real estate investment trust (REIT) operations, with a recent revenue figure of $568.47 million. The company's cost of goods sold (COGS) is $232.59 million, contributing to a gross profit margin of 59.08%. Operating expenses include significant depreciation and amortization costs, which impact net income margins that have shown variability over the periods analyzed.

PE: -14.9x

Piedmont Office Realty Trust's recent financials reveal a mixed picture, with first-quarter 2025 revenue at US$142.69 million, slightly down from US$144.54 million the previous year, yet net loss improved to US$10.1 million from US$27.76 million. Insider confidence is evident as Executive VP Sherry Rexroad acquired 16,850 shares for approximately US$100,258 in early 2025. Despite external borrowing risks and interest coverage concerns, such insider activity suggests potential undervalued appeal amidst market challenges.

Seize The Opportunity

- Gain an insight into the universe of 107 Undervalued US Small Caps With Insider Buying by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English