Asian Growth Companies With High Insider Ownership

Amid ongoing trade tensions and fluctuating economic indicators, Asian markets have been navigating a complex landscape, with investors keenly observing the impact of global tariff policies on regional growth prospects. In this environment, companies that exhibit strong growth potential and high insider ownership can offer unique insights into market confidence and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.5% | 23.4% |

| Fulin Precision (SZSE:300432) | 9.7% | 44.2% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.9% |

| Schooinc (TSE:264A) | 30.6% | 68.9% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11% | 63.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 40.6% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

Let's dive into some prime choices out of the screener.

Zhejiang Leapmotor Technology (SEHK:9863)

Simply Wall St Growth Rating: ★★★★★★

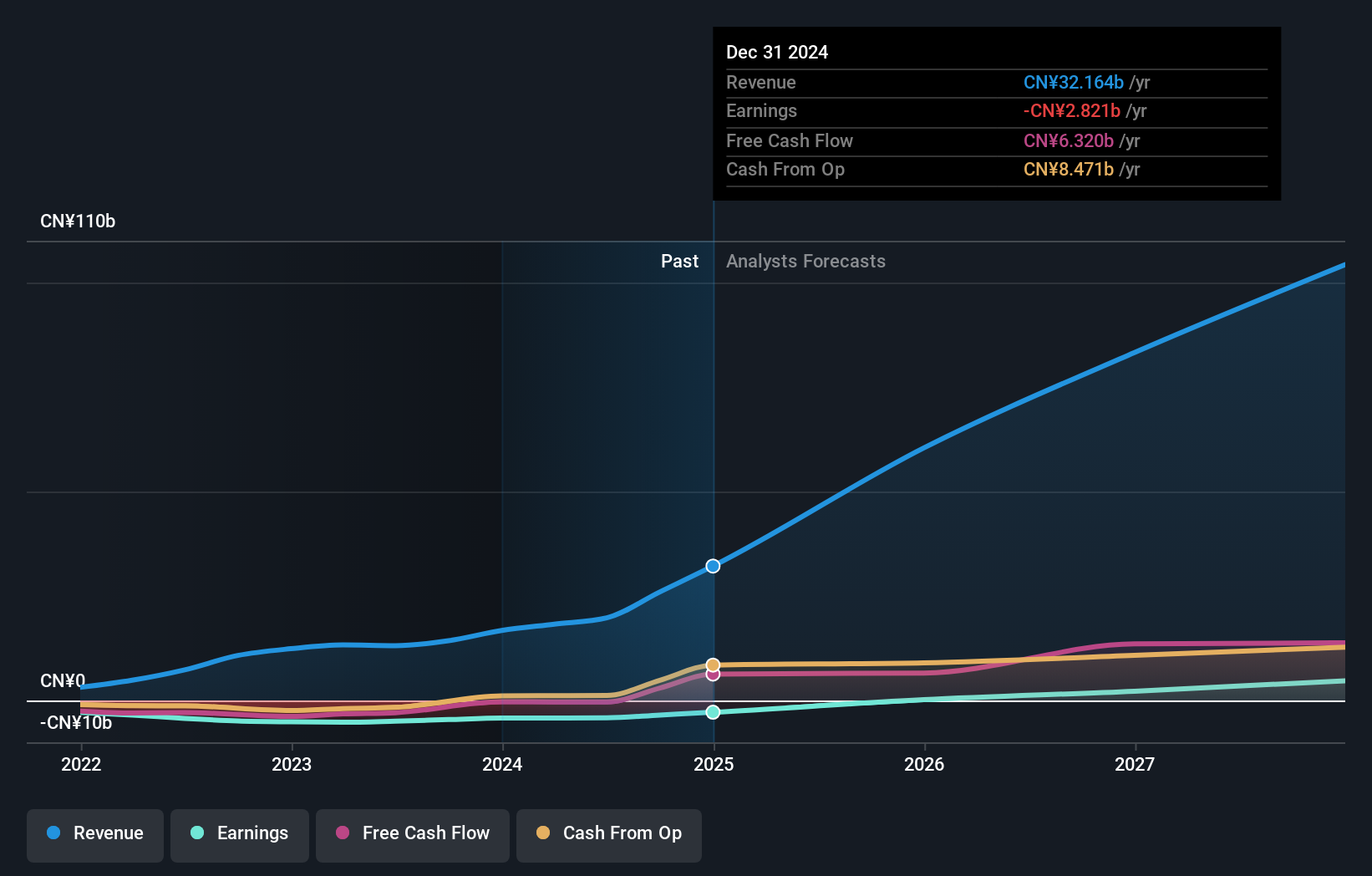

Overview: Zhejiang Leapmotor Technology Co., Ltd. focuses on the research, development, production, and sale of new energy vehicles both in Mainland China and internationally, with a market cap of HK$77.14 billion.

Operations: The company generates revenue of CN¥32.16 billion from its activities in the production, research and development, and sales of new energy vehicles.

Insider Ownership: 15.6%

Earnings Growth Forecast: 60.1% p.a.

Zhejiang Leapmotor Technology shows potential as a growth company with substantial insider ownership. The stock has seen more insider buying than selling in the past three months, indicating confidence from within. Despite recent volatility, it's trading at 44.1% below its estimated fair value, suggesting potential upside. Revenue is forecast to grow at 27.9% annually, outpacing the Hong Kong market average of 8.1%, with earnings expected to increase by 60.1% per year while becoming profitable within three years.

- Get an in-depth perspective on Zhejiang Leapmotor Technology's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Zhejiang Leapmotor Technology implies its share price may be too high.

Quzhou Xin'an Development (SHSE:600208)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Quzhou Xin'an Development Co., Ltd. operates in real estate development, technology manufacturing, and financial services in China with a market cap of CN¥22.46 billion.

Operations: The company generates revenue from real estate development, technology manufacturing, and financial services within China.

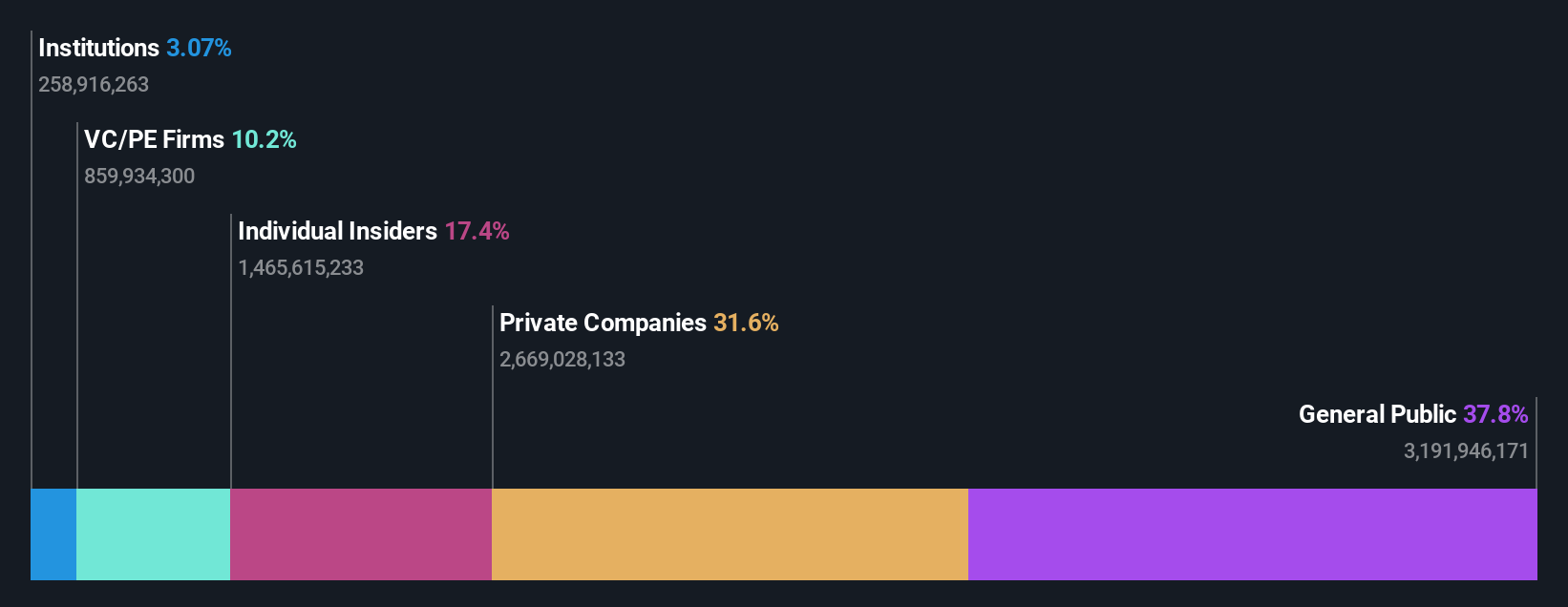

Insider Ownership: 17.4%

Earnings Growth Forecast: 46.7% p.a.

Quzhou Xin'an Development is poised for significant growth, with earnings expected to rise by 46.7% annually, surpassing the Chinese market's average growth rate. Despite a recent decline in quarterly sales to CNY 344.89 million from CNY 2.24 billion, net income increased to CNY 423.95 million, reflecting strong profitability potential. The stock is attractively valued with a price-to-earnings ratio of 21x compared to the market's 37.6x, though its debt coverage by operating cash flow remains a concern.

- Dive into the specifics of Quzhou Xin'an Development here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Quzhou Xin'an Development's share price might be too pessimistic.

iSoftStone Information Technology (Group) (SZSE:301236)

Simply Wall St Growth Rating: ★★★★☆☆

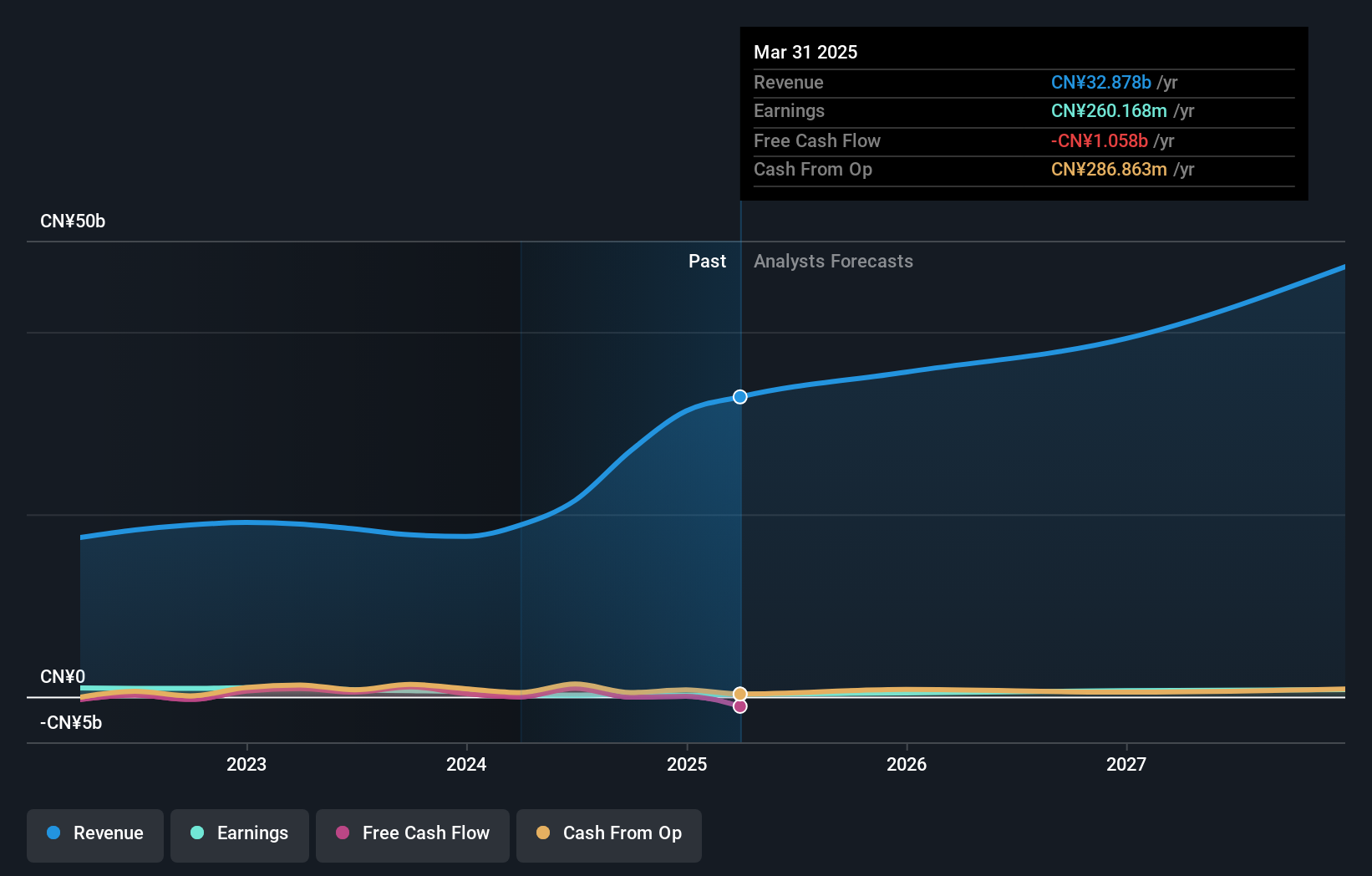

Overview: iSoftStone Information Technology (Group) Co., Ltd. operates as an IT services provider, offering digital transformation solutions and consulting services, with a market cap of CN¥51.24 billion.

Operations: iSoftStone's revenue is derived from its IT services and digital transformation solutions, with a market cap of CN¥51.24 billion.

Insider Ownership: 23.8%

Earnings Growth Forecast: 37.2% p.a.

iSoftStone Information Technology is experiencing robust growth, with earnings projected to increase significantly by 37.2% annually, outpacing the Chinese market's average. Recent initiatives include a private placement aiming to raise up to CNY 3.38 billion, reflecting strategic expansion efforts. Despite a net loss of CNY 197.69 million in Q1 2025, revenue surged from CNY 5.45 billion to CNY 7.01 billion year-on-year, indicating strong sales momentum amidst evolving financial strategies and corporate governance changes.

- Click here and access our complete growth analysis report to understand the dynamics of iSoftStone Information Technology (Group).

- According our valuation report, there's an indication that iSoftStone Information Technology (Group)'s share price might be on the cheaper side.

Turning Ideas Into Actions

- Explore the 618 names from our Fast Growing Asian Companies With High Insider Ownership screener here.

- Want To Explore Some Alternatives? We've found 21 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English