High Growth Tech Stocks in Asia Featuring Three Prominent Companies

As global markets navigate the complexities of trade policies, with smaller-cap indexes showing positive returns despite lagging behind major counterparts, Asia's tech sector continues to capture attention amid evolving economic landscapes. In this context, identifying high-growth tech stocks requires a keen understanding of market dynamics and potential resilience to external pressures, making it essential to focus on companies that demonstrate robust innovation and adaptability.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.68% | 30.37% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.40% | 23.42% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| ALTEOGEN | 54.36% | 69.84% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| PharmaResearch | 24.38% | 25.85% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

SUNeVision Holdings (SEHK:1686)

Simply Wall St Growth Rating: ★★★★☆☆

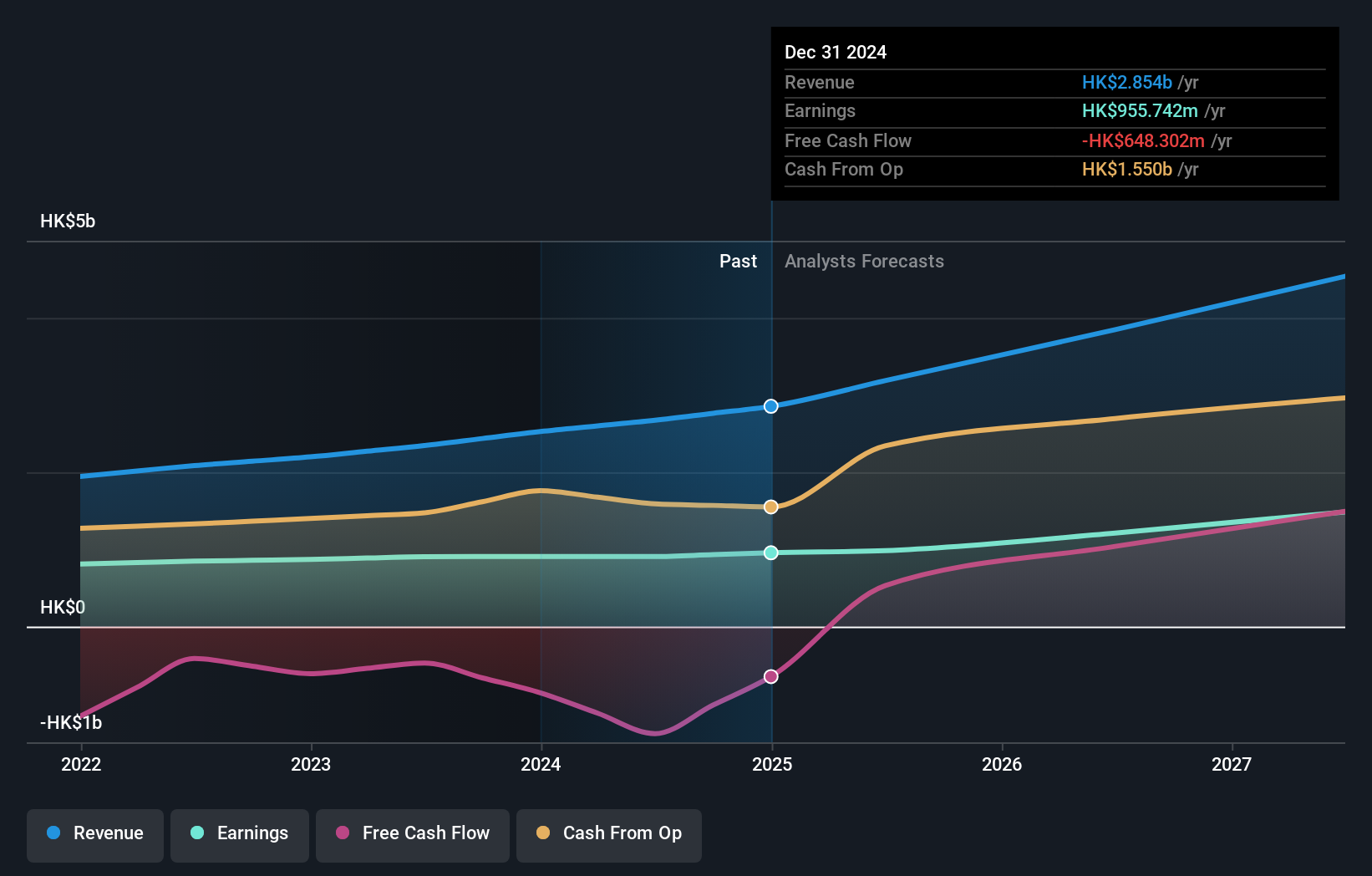

Overview: SUNeVision Holdings Ltd. is an investment holding company that offers data centre and IT facility services in Hong Kong, with a market capitalization of approximately HK$27.77 billion.

Operations: SUNeVision Holdings generates revenue primarily from its data centre and IT facilities services, totaling HK$2.64 billion, along with additional income from Extra-Low Voltage (ELV) and IT systems amounting to HK$217.70 million.

SUNeVision Holdings, with a robust 19.1% annual revenue growth, outpaces the Hong Kong market average of 8.1%. The company's earnings have also seen a commendable increase, growing by 18.3% annually, which is significantly higher than the local market's 10.3%. Notably, their R&D investment strategy reflects a commitment to innovation; however, specific expenditure figures are crucial for evaluating its impact on future capabilities and market position. Despite challenges in covering debt through operating cash flow, SUNeVision maintains a promising trajectory in the tech sector with an anticipated high return on equity at 23.2% in three years' time.

- Click here to discover the nuances of SUNeVision Holdings with our detailed analytical health report.

Explore historical data to track SUNeVision Holdings' performance over time in our Past section.

Kingboard Laminates Holdings (SEHK:1888)

Simply Wall St Growth Rating: ★★★★☆☆

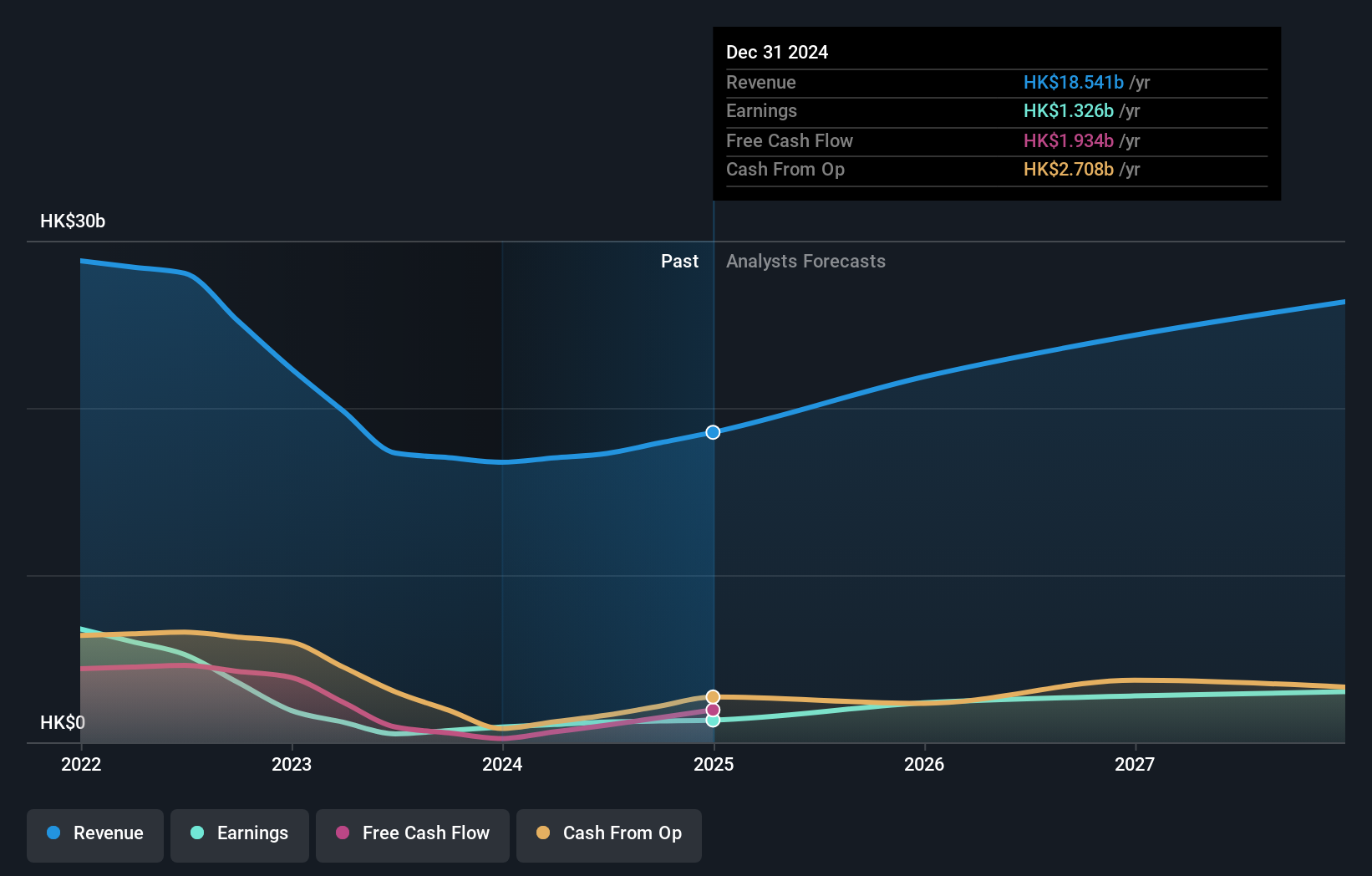

Overview: Kingboard Laminates Holdings Limited is an investment holding company that manufactures and sells laminates across the People's Republic of China, Europe, other Asian countries, and the United States, with a market cap of HK$28.17 billion.

Operations: The company primarily generates revenue from its laminates segment, contributing HK$18.30 billion, with additional income from properties and investments at HK$126.67 million and HK$109.81 million, respectively.

Kingboard Laminates Holdings has demonstrated a robust financial performance with earnings soaring by 46.1% over the past year, significantly outpacing the electronics industry's average growth of 17.1%. This surge is supported by an aggressive R&D investment strategy, crucial for maintaining its competitive edge in a rapidly evolving tech landscape. The company also announced a special dividend of HKD 0.3 per share, reflecting confidence in its financial health and commitment to shareholder returns. With annual earnings expected to grow by 23.2%, Kingboard is strategically positioned to leverage market opportunities, particularly as it continues expanding its product offerings in high-demand sectors.

Dmall (SEHK:2586)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dmall Inc. is an investment holding company that offers retail digitalization solutions to retailers across various regions including China, Hong Kong, Macau, the Philippines, Malaysia, Singapore, and Poland with a market capitalization of approximately HK$9.26 billion.

Operations: Dmall Inc. generates revenue primarily from its Retail Core Service Cloud, contributing CN¥1.81 billion, while its E-Commerce Service Cloud adds CN¥4.28 million to the total revenue stream.

Dmall, despite a challenging fiscal year with a net loss widening to CNY 2.20 billion from CNY 592.36 million, shows promising signs of recovery with revenue up by 17.3% to CNY 1.86 billion. This growth is underpinned by significant R&D investments aimed at innovation and market expansion in the competitive tech landscape of Asia. Looking ahead, Dmall is expected to turn profitable within three years, bolstered by an anticipated annual earnings growth rate of 108.17%, reflecting its potential resilience and adaptability in the high-growth tech sector.

Seize The Opportunity

- Unlock our comprehensive list of 493 Asian High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English