These Analysts Increase Their Forecasts On Signet Jewelers After Better-Than-Expected Q1 Earnings

Signet Jewelers Limited (NYSE:SIG) reported better-than-expected first-quarter financial results and raised its FY26 guidance on Tuesday.

The company posted revenue of $1.54 billion, a 2% increase from the prior year, surpassing analysts’ consensus estimate of $1.49 billion. Adjusted EPS of $1.18 beat the consensus estimate of $1.07.

"We delivered positive same-store sales growth each month of the quarter, and into May, by bolstering our offerings at key price points and continuing the evolution of our assortment. Our three largest brands – Kay, Zales, and Jared – all saw sequential comp sales improvement from the fourth quarter on higher margins, highlighting the impact of our outsized focus on our larger brands," stated J.K. Symancyk, Chief Executive Officer.

Signet raised its 2026 revenue guidance to a range of $6.57 billion to $6.80 billion, up from $6.53 billion to $6.80 billion, compared with the consensus estimate of $6.69 billion.

The company increased its adjusted EPS forecast to $7.70 to $9.38, up from $7.31 to $9.10, versus the consensus of $8.45. It expects adjusted EBITDA between $615 million and $695 million, slightly higher than the prior range of $605 million to $695 million.

For the second quarter, Signet projects revenue of $1.47 billion to $1.51 billion, above the $1.34 billion estimate, and adjusted EBITDA of $53 million to $73 million.

Signet Jewelers shares fell 1.1% to close at $74.40 on Wednesday.

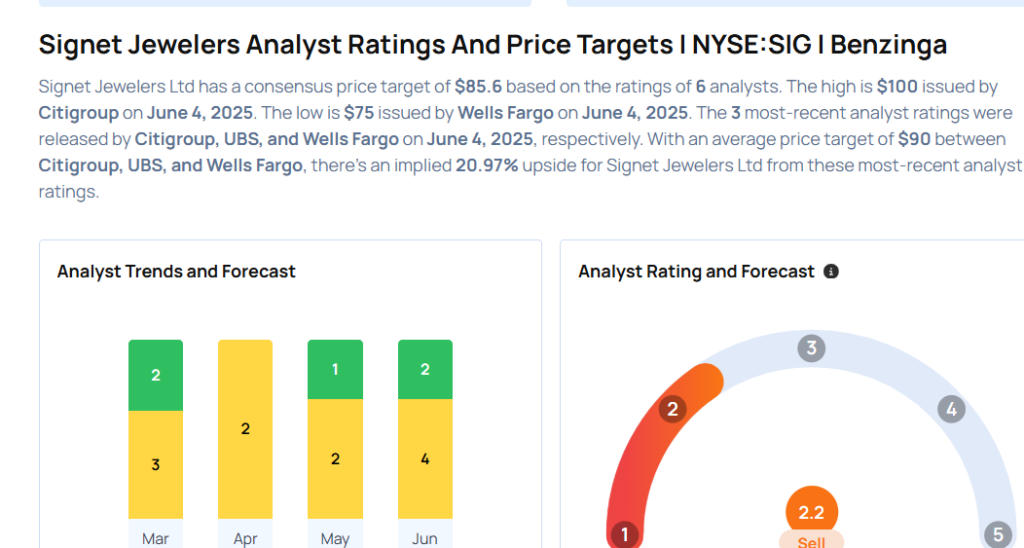

These analysts made changes to their price targets on Signet following earnings announcement.

- Telsey Advisory Group analyst Dana Telsey maintained Signet Jewelers with a Market Perform and raised the price target from $62 to $80.

- B of A Securities analyst Lorraine Hutchinson maintained the stock with a Neutral and raised the price target from $65 to $78.

- Wells Fargo analyst Ike Boruchow maintained Signet Jewelers with an Equal-Weight and raised the price target from $70 to $75.

- UBS analyst Mauricio Serna maintained the stock with a Buy and raised the price target from $84 to $95.

- Citigroup analyst Paul Lejuez maintained Signet Jewelers with a Buy and raised the price target from $85 to $100.

Considering buying SIG stock? Here’s what analysts think:

Read This Next:

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English