Insider Buying Highlights 3 Undervalued Small Caps For Your Portfolio

The United States market has shown a positive trend, climbing 1.4% in the last week and 12% over the past year, with earnings anticipated to grow by 15% annually in the coming years. In such a dynamic environment, identifying stocks that are perceived as undervalued can be beneficial for investors seeking opportunities for potential growth, especially when insider buying signals confidence from those closest to the company.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 0.9x | 35.66% | ★★★★★★ |

| Columbus McKinnon | NA | 0.4x | 40.71% | ★★★★★☆ |

| Barrett Business Services | 20.6x | 0.9x | 47.29% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.8x | 25.49% | ★★★★☆☆ |

| Titan Machinery | NA | 0.2x | -336.78% | ★★★★☆☆ |

| Farmland Partners | 9.1x | 9.2x | -19.77% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -51.12% | ★★★☆☆☆ |

| BlueLinx Holdings | 14.1x | 0.2x | -74.42% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.4x | -2686.53% | ★★★☆☆☆ |

| Montrose Environmental Group | NA | 1.0x | 6.95% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

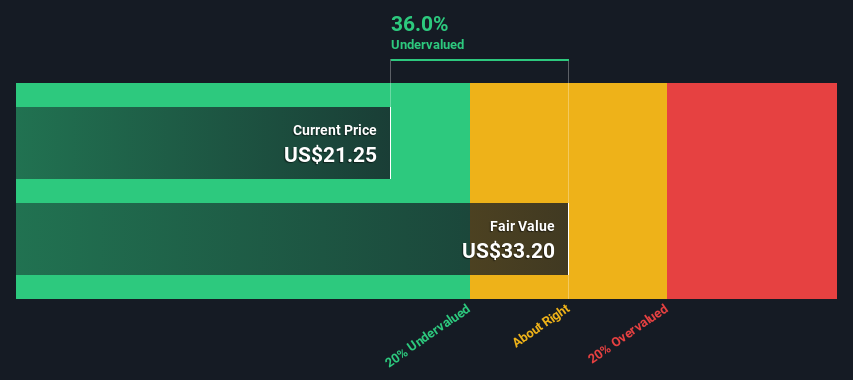

Saul Centers (BFS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Saul Centers operates primarily in the real estate sector, focusing on shopping centers and mixed-use properties, with a market capitalization of approximately $1.21 billion.

Operations: The company's revenue streams are primarily derived from Shopping Centers and Mixed-Use Properties, totaling $278.89 million. Over recent periods, the net income margin has shown fluctuations, reaching 16.65% in September 2024 before declining to 13.00% by March 2025. The cost of goods sold (COGS) and operating expenses have generally increased over time, impacting profitability metrics like the gross profit margin which was at its lowest at 72.40% in March 2025.

PE: 23.5x

Saul Centers, a smaller company in the U.S., recently showed insider confidence with Bernard Saul purchasing 10,000 shares for approximately US$334,885. Despite a decline in net income to US$9.8 million for Q1 2025 from US$13.63 million the previous year, sales increased to US$70.55 million from US$65.3 million. The company maintains its dividend at $0.59 per share amidst forecasts of declining earnings over the next three years by an average of 6.8% annually due to reliance on external borrowing for funding and insufficient earnings coverage for interest payments.

- Get an in-depth perspective on Saul Centers' performance by reading our valuation report here.

Examine Saul Centers' past performance report to understand how it has performed in the past.

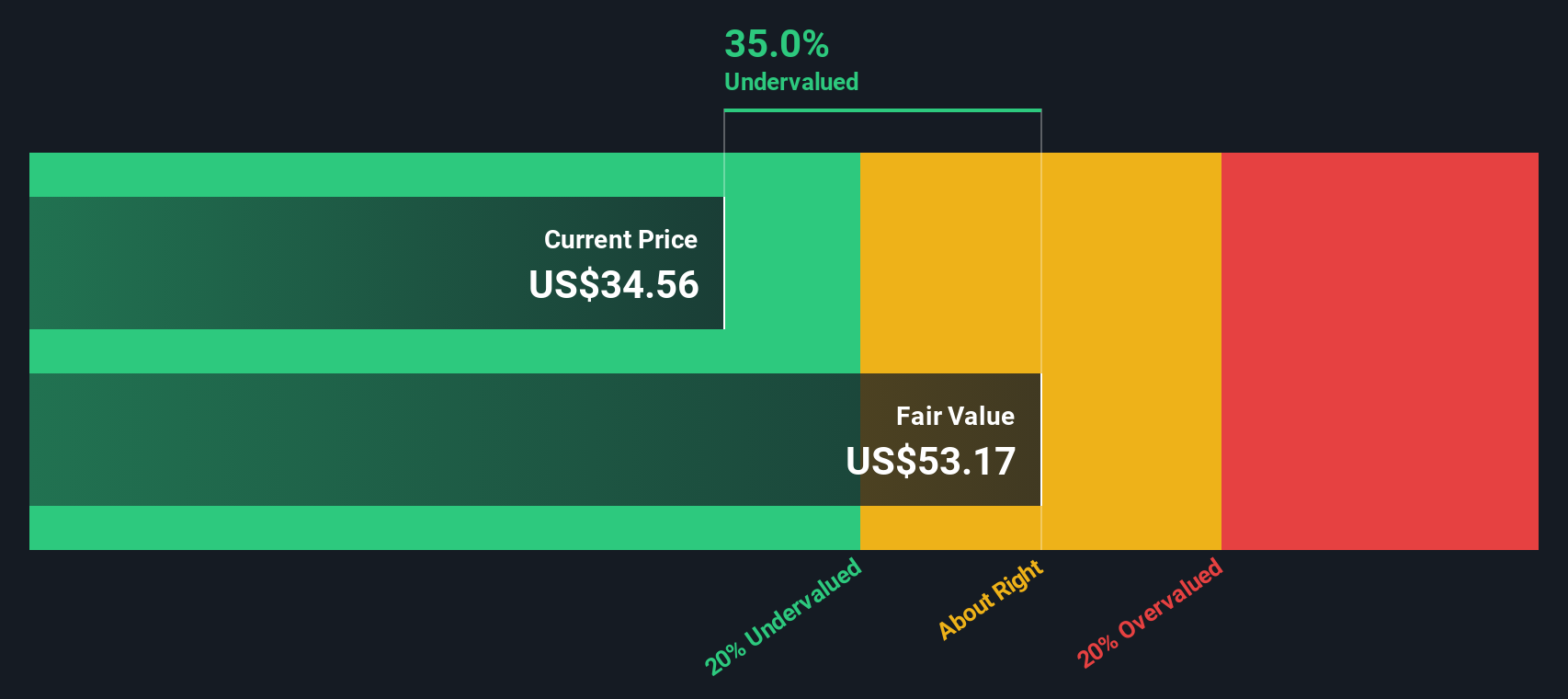

Beazer Homes USA (BZH)

Simply Wall St Value Rating: ★★★★★★

Overview: Beazer Homes USA is a home construction company that focuses on building single-family homes across the East, West, and Southeast regions of the United States with a market capitalization of approximately $0.84 billion.

Operations: The company generates revenue primarily from its homebuilding operations across the East, West, and Southeast regions. The gross profit margin has shown variability, with a high of 23.33% in September 2022 and a low of 13.75% in June 2016. Operating expenses are significant, consistently comprising costs such as sales and marketing along with general and administrative expenses.

PE: 6.8x

Beazer Homes USA, a smaller player in the housing market, has caught attention due to its potential value proposition. Despite a dip in net income and profit margins compared to last year, insider confidence is evident with Lloyd Johnson acquiring 22,500 shares worth US$510,379. The company reported sales of US$1.03 billion for the first half of 2025 and completed a share buyback program repurchasing over 6% of its shares for US$41.67 million by March 2025. With earnings forecasted to grow annually by about 10%, Beazer's strategic expansion into home insurance underscores its commitment to diversifying revenue streams while supporting charitable causes through its new venture.

- Click to explore a detailed breakdown of our findings in Beazer Homes USA's valuation report.

Understand Beazer Homes USA's track record by examining our Past report.

Hillenbrand (HI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hillenbrand is a diversified industrial company operating primarily in advanced process solutions and molding technology solutions, with a market cap of approximately $3.54 billion.

Operations: The company's revenue primarily stems from Advanced Process Solutions and Molding Technology Solutions, with the former contributing significantly more to overall revenue. Over recent periods, the gross profit margin has shown a slight upward trend, reaching 34.09% in September 2023. Operating expenses have been increasing alongside non-operating expenses, impacting net income figures negatively in recent quarters.

PE: -5.2x

Hillenbrand, a smaller U.S. company, is drawing attention for its potential value despite recent challenges. They reported a net loss of US$40.9 million in Q2 2025, contrasting with last year's profit of US$6.1 million, and earnings have declined by 33% annually over five years. However, insider confidence is evident with recent share purchases between January and March 2025. The company's revenue guidance for the year ranges from US$2.56 billion to US$2.62 billion amidst ongoing financial adjustments and external borrowing reliance.

- Click here and access our complete valuation analysis report to understand the dynamics of Hillenbrand.

Gain insights into Hillenbrand's past trends and performance with our Past report.

Where To Now?

- Unlock more gems! Our Undervalued US Small Caps With Insider Buying screener has unearthed 99 more companies for you to explore.Click here to unveil our expertly curated list of 102 Undervalued US Small Caps With Insider Buying.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English