Investors Pay The Price As Musk-Trump War Of Words Escalates: Once Allies, Now Foes, Their Linked Stocks, Crypto And Funds Wipe Out $155 Billion In A Single Day

The ongoing public dispute between the CEO of Tesla Inc. (NASDAQ:TSLA), Elon Musk, and President Donald Trump has caused a stir in the financial markets, wiping nearly $155 billion of investor wealth in a single day.

What Happened: The Musk-Trump dynamic took a sharp turn after the former began criticizing the government’s new tax bill, terming it a “spending bill” and calling it a “disgusting abomination” earlier this week.

This comes after Musk’s late May exit from the Department of Government Efficiency, or DOGE, which was directed to reducing the “wasteful spending” by the administration. –

On Thursday, Musk and Trump engaged in a very public spat on social media, and both were seen allaying accusations against each other.

These developments dragged the stocks linked to their businesses lower in trade. While Tesla’s market capitalization dropped from $1,069 billion to $916.7 billion, the firm erased $152.3 billion of investor wealth.

Similarly, the market cap of Destiny Tech100 Inc. (NYSE:DXYZ) fund, which owns 34.6% of Musk’s SpaceX, tumbled from $466 million to $408 million, destroying $58 million of the wealth.

On the other hand, Trump Media & Technology Group Corp. (NASDAQ:DJT) wiped $490 million of the investor wealth, which is held by the Donald J. Trump Revocable Trust, with Trump being the sole beneficiary of the trust.

| Stocks | M-Cap On Wed, June 4 | M-Cap On Thurs, June 5 | Change |

| Tesla Inc. (NASDAQ:TSLA) | $1069 billion | $916.7 billion | $152.3 billion |

| Trump Media & Technology Group Corp. (NASDAQ:DJT) | $6.05 billion | $5.56 billion | $0.49 billion |

| Destiny Tech100 Inc. (NYSE:DXYZ) | $0.466 billion | $0.408 billion | $0.058 billion |

Meanwhile, the cryptocurrencies linked to both Musk and Trump also tumbled.

| Cryptocurrencies | M-Cap On Wed, June 4 | M-Cap On Thurs, June 5 | Change |

| Dogecoin (CRYPTO: DOGE) | $28.61 billion | $26.90 billion | $1.71 billion |

| Official Trump (CRYPTO: TRUMP) | $2.196 billion | $2.023 billion | $0.173 billion |

Cumulatively, the three securities erased $154.731 billion in investor wealth in just a single day.

Why It Matters: Despite the apparent tension, Trump seemed unfazed, in an interview with Politico on Thursday, stating, “Oh, it’s okay.”

"It's going very well, never done better." He also mentioned his high favorability ratings, indicating a possible shift in his stance towards Musk.

President's aides have even scheduled a call with Musk to potentially resolve the conflict.

However, the shares of these companies witnessed a sharp drop on Thursday.

| Stocks | Thursday Close | YTD Performance |

| Tesla Inc. (NASDAQ:TSLA) | -14.26% | -24.94% |

| Trump Media & Technology Group Corp. (NASDAQ:DJT) | -8.04% | -40.86% |

| Destiny Tech100 Inc. (NYSE:DXYZ) | -12.42% | -34.39% |

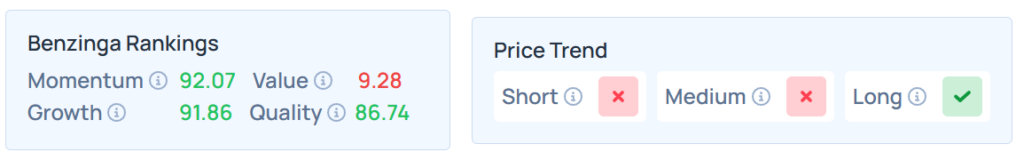

Benzinga Edge Stock Rankings show that Tesla had a weaker price trend over the short and medium terms but a strong trend over the long term. Its momentum ranking was solid, and its value ranking was poor at the 9.28th percentile. The details of other metrics are available here.

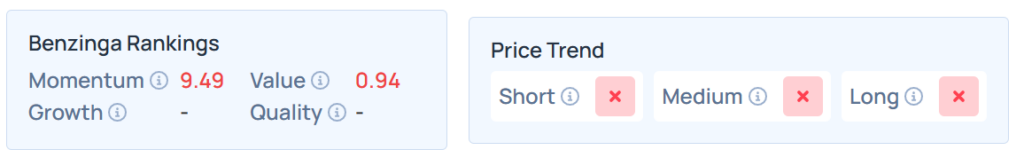

Benzinga Edge Stock Rankings show that DJT had a weaker price trend over the short, medium, and long term. Its momentum ranking was poor, and its value ranking was also poor at the 0.94th percentile. The details of other metrics are available here.

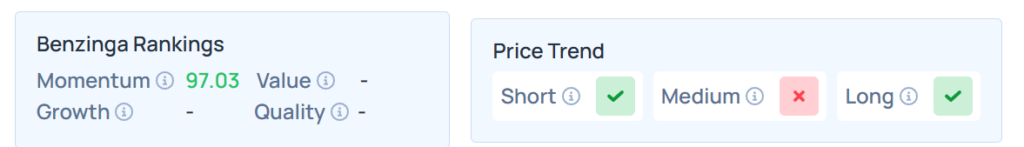

Benzinga Edge Stock Rankings show that DXYZ had a weaker price trend over the medium term but a strong trend over the short and long term. Its momentum ranking was solid at the 97.03th percentile. The details of other metrics are available here.

Read Next:

Photo courtesy: Joey Sussman / Shutterstock.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English