Gold's At $3,500, But These Miners Still Trade Like It's $1,500: Investor Sees 10x Upside In These Under-The-Radar Stocks

As gold hovers around $3,500, Michael Gentile, the co-founder of Bastion Asset Management, believes large swathes of the sector have barely budged in recent weeks.

What Happened: On Thursday, appearing on Kitco News, Gentile said that the stocks of most junior miners, or small, early-stage mining companies, continue to trade as if prices were stuck at $1,500.

This disconnect, Gentile says, represents one of the most overlooked opportunities in today's markets. He says the sector's smallest companies, those with sub-$100 million market caps, have been left behind despite historic highs in the spot price of the yellow metal.

“Normally, when gold hits new all-time highs, the juniors rally the hardest,” he says; however, this time around, “they're still trading at crisis-level valuations.”

While senior producers are “spewing cash right now, buying back stock, paying dividends [with] pristine balance sheets,” capital remains scarce for junior miners.

Gentile, who serves on the board of several leading mining firms, believes the sector is still reeling from a post-COVID hangover, when inflation wiped out expected margin gains.

“In 2020, everyone was excited about margin expansion, but then inflation hit, and that got all eroded away,” he says. “Today, costs are much more under control. We're seeing record margins in both absolute and percentage terms.”

“Today, the majors are printing cash, that will eventually flow downstream,” he notes, predicting an M&A wave and a re-rating of undervalued developers and explorers. Gentile believes there are already some signs of life, with generalist funds beginning to revisit the sector.

For risk-tolerant investors, he sees potential for “three, four, even 10 times your money” among select junior names. Still, he urges discipline, with a focus on tight cost controls, a well-aligned management team, and a clear path to profitable production.

| Stock / ETF | YTD Performance |

|---|---|

| New Found Gold Corp. (NYSEAMERICAN: NFGC) | -22.80% |

| Capitan Silver Corp. (OTC:CAPTF) | +141.09% |

| Artemis Gold Inc. (OTC:ARGTF) | +93.29% |

| Osisko Metals Inc. (OTC:OMZNF) | +34.54% |

| VanEck Gold Miners ETF (NYSE:GDX) | +50.40% |

| SPDR Gold Trust (NYSE:GLD) | +26.04% |

Why It Matters: Other analysts have echoed similar views on gold miner profitability, with Oktay Kavrak of LeverageShares saying that “A gold rally can supercharge miner profits if costs are controlled. But that’s a big ‘if.'”

“If it costs $1,500 to produce an ounce and gold rises from $2,000 to $2,100, that’s a 20% boost in profits on just a 5% move in gold,” he says, but adds that the reverse is also true.

Price Action: The spot price of Gold now trades at $3,366.42, up 0.37% for the day, 1.51% over the past 30 days, and an impressive 46.37% over the past 12 months.

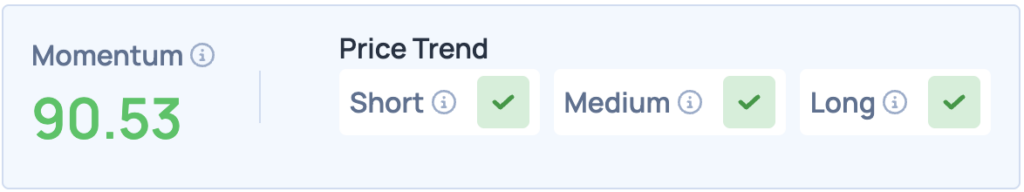

The SPDR Gold Trust scores high on Momentum according to Benzinga’s Edge Stock Rankings, and has a favorable price trend in the short, medium, and long terms. Click here for deeper insights into the ETF.

Read More:

Photo courtesy: Shutterstock

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English