Sarepta Therapeutics (NasdaqGS:SRPT) Gains 19% Over Past Month Following Japan Approval

Sarepta Therapeutics (NasdaqGS:SRPT) saw its share price rise by 19% over the past month, a move that notably outpaced the broader market's 1% increase for the week and the 13% gain over the year. This significant increase can be partially attributed to several key announcements, including the FDA's platform technology designation for their rAAVrh74 viral vector, pivotal updates from ongoing studies related to their ELEVIDYS treatment for Duchenne Muscular Dystrophy, and new approval in Japan. These developments highlight the company's continued progress and innovation in gene therapy, reinforcing investor confidence amidst market growth.

Recent developments for Sarepta Therapeutics have sparked a positive response in short-term share price, primarily driven by advancements in their gene therapy programs. These innovations, particularly the FDA's designation and updates on the ELEVIDYS program, are poised to bolster investor confidence. However, despite this optimism, it's essential to acknowledge that Sarepta's shares have experienced a 37.80% decline over the past three years, highlighting challenges the company has faced. Relative to the biotechnology industry, Sarepta has underperformed in the past year compared to the US Biotechs market, which returned -9.3%.

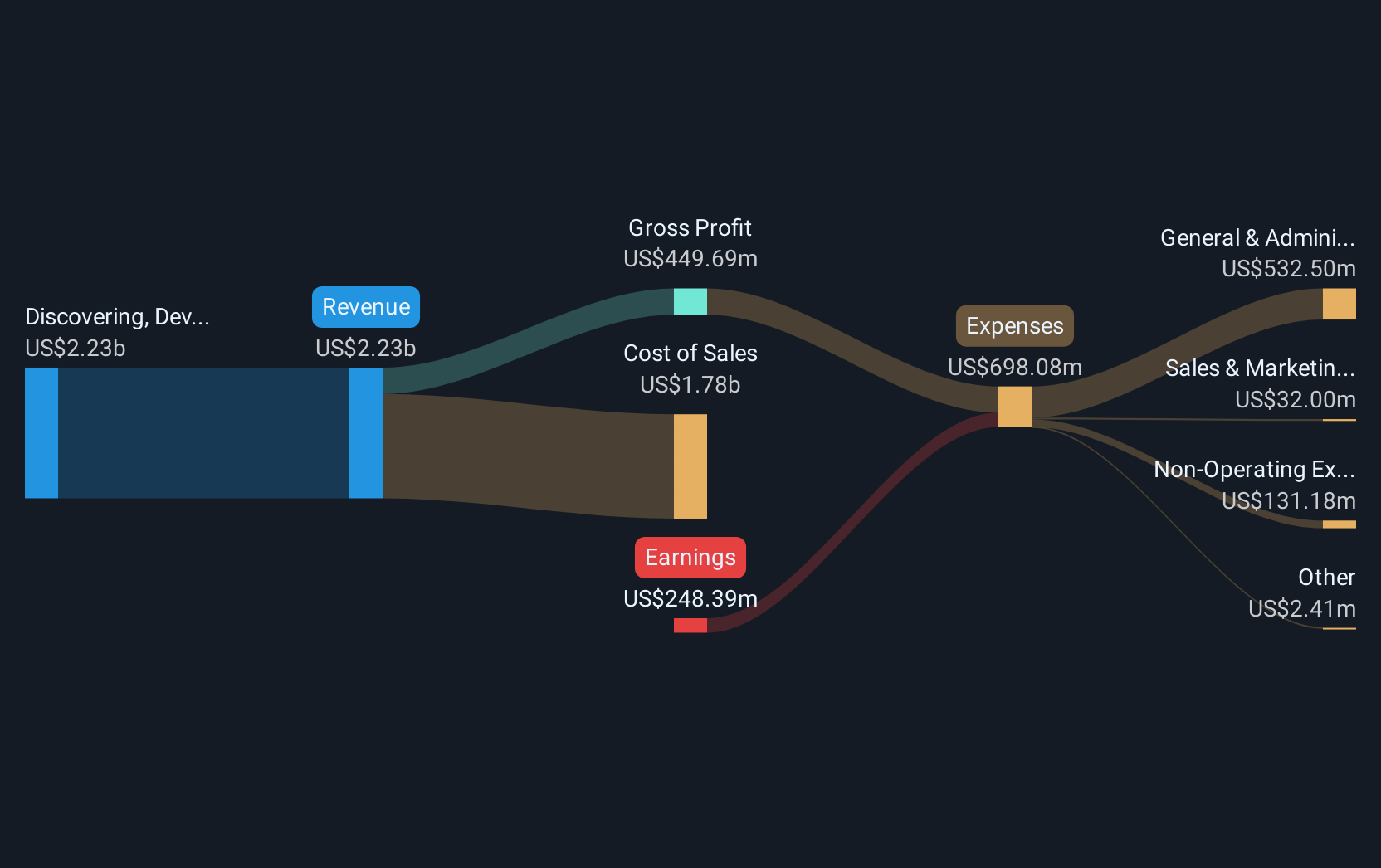

The recent announcements could potentially impact Sarepta's revenue and earnings forecasts considerably. Analysts project a significant annual revenue increase over the next three years, with expectations that profit margins will improve. Crucially, these updates could address operational delays and safety concerns surrounding ELEVIDYS, enhancing the therapy's credibility and market uptake. In terms of valuation, Sarepta's recent share price movements are in the context of an analyst price target of US$89.96, indicating further room for growth if the company's strategic objectives translate into financial success. These factors collectively shape a complex but promising outlook for Sarepta as it navigates both opportunities and challenges in its field.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English